ECB President Mario Draghi’s challenge at today’s Council Meeting is to broker a deal whereby he doesn’t disappoint market expectations of an extension of the current (EUR80bn per month) asset purchase programme, while satisfying the demands of the more hawkish elements in the Council who want the pace of asset purchases to slow given the prospect of rising (but still low) core inflation and steady growth. It’s a fine balancing-act which may be achieved by extending the programme without specifying the pace of buying, or maybe could see an extension with a shorter period of commitment to EUR 80bn/month.

ECB President Mario Draghi’s challenge at today’s Council Meeting is to broker a deal whereby he doesn’t disappoint market expectations of an extension of the current (EUR80bn per month) asset purchase programme, while satisfying the demands of the more hawkish elements in the Council who want the pace of asset purchases to slow given the prospect of rising (but still low) core inflation and steady growth. It’s a fine balancing-act which may be achieved by extending the programme without specifying the pace of buying, or maybe could see an extension with a shorter period of commitment to EUR 80bn/month.

EUR/USD

After repeatedly probing the lower bound of the broad consolidation zone at 1.0540/1.0465, EUR/USD appears to have successfully defended it and this level will remain a decisive support near term. On daily chart, the pair tested lower bound of a multi month descending channel (also at 1.0540).

Recent weekly candlesticks in the form of doji and bullish engulfing denote an initial recovery is under way and the pair is likely to head towards median of the range at 1.0810/60 which is also the 38.2% retracement from November highs. However a break above remains needed to confirm a larger pullback.1.0620 will be an immediate support. Only a move below 1.0540/1.0465 will lead to a deeper downtrend.

Recent weekly candlesticks in the form of doji and bullish engulfing denote an initial recovery is under way and the pair is likely to head towards median of the range at 1.0810/60 which is also the 38.2% retracement from November highs. However a break above remains needed to confirm a larger pullback.1.0620 will be an immediate support. Only a move below 1.0540/1.0465 will lead to a deeper downtrend.

Commentaries, trading setups and many more are provided by FxWatcher. Try out FxWatcher service for 5 days for free!

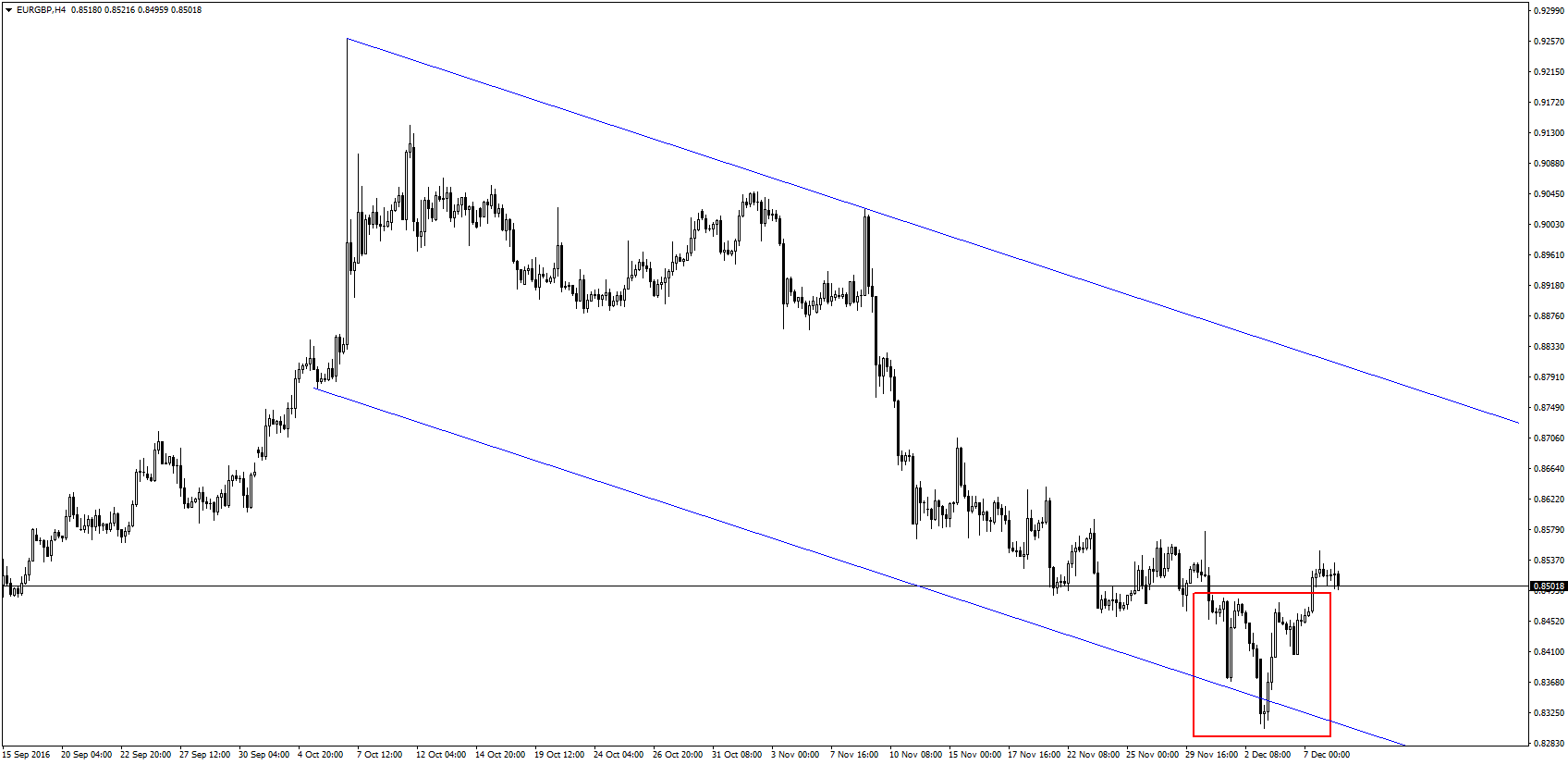

EUR/GBP

EUR/GBP spiked towards 0.9298 recently but has reversed forming monthly shooting star and a bearish engulfing. Also, on hourly chart we can see a small reverse head and shoulders formation. Pair is evolving within a descending channel and achieved our downside target of 0.8330/0.8260, lows of September. Short term, a rebound looks likely. It should be capped at 0.87.

EUR/GBP spiked towards 0.9298 recently but has reversed forming monthly shooting star and a bearish engulfing. Also, on hourly chart we can see a small reverse head and shoulders formation. Pair is evolving within a descending channel and achieved our downside target of 0.8330/0.8260, lows of September. Short term, a rebound looks likely. It should be capped at 0.87.

USD/JPY

USD/JPY has accelerated the up move after confirming a double bottom formed at key graphical levels of 100. The pair looks poised to head towards projected potential of the pattern and graphical levels at 116. Short term retracement, if any, should be cushioned at daily channel drawn since June near 109.

USD/JPY has accelerated the up move after confirming a double bottom formed at key graphical levels of 100. The pair looks poised to head towards projected potential of the pattern and graphical levels at 116. Short term retracement, if any, should be cushioned at daily channel drawn since June near 109.