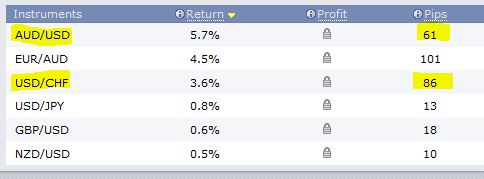

This week (19-25.05.2019) I analysed two currencies of countries on opposite sides of the globe and predicted their exchange rate against the US dollar. It was the Australian dollar (AUD) and Swiss franc (CHF). Let us check how accurate were my predictions.

AUDUSD 19-25.05.2019

The first pair – AUDUSD – after quite a long period of drops reached the support of the downward channel in which the quotations have been moving since the beginning of the year. Despite the fact that this support was slightly defeated, I was focused on growths, and I justified it in Monday’s analysis: “The results of the (Sunday) elections show that Prime Minister Scott Morrison and his party won the elections and will have a majority in the Australian parliament, which may improve moods in pairs with AUD.

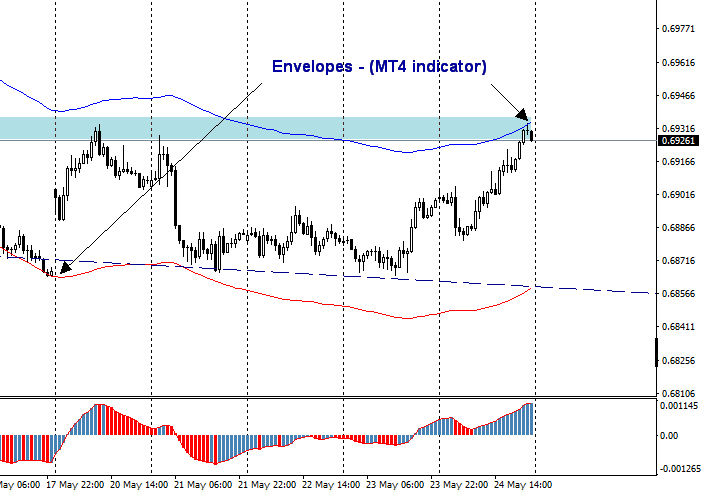

In addition, I used the envelopes indicator, according to which it was also possible to anticipate increases because the price was at its lower edge.

In addition, I used the envelopes indicator, according to which it was also possible to anticipate increases because the price was at its lower edge.

The market confirmed my assumptions and after two days of indecision, the market moved upwards at the end of the week. The long-awaited growth on MACD appeared and the quotations on Friday reached the upper edge of envelopes.

USDCHF 20-25.05.2019

I analyzed this pair on Tuesday: “USDCHF – in an Inside Bar” – and according to the information in the title, I was considering the possibility of a breakout from that IB in the south direction. I wrote this:- “Currently the price after negating (twice) of the upper IB limit is heading south and if it overcomes the lower IB limit it will be a classic pattern of continuation of declines according to Price Action rules. If such a breakout occurs, the target may be the nearest demand zone starting at 1.0012.

One look at the graph above showing the situation on Tuesday and Friday, and we can see that the analysis has proved its worth quite well, because the price on Friday stopped at the indicated level of 1.0012. The only thing that could have kept the sellers a little uncertain was the next two re-tests of the upper limit (1.0120) of Inside Bar, which also ended with the rejection of this level, as well as the two previous ones, and eventually directed the quotations downwards.

The week can be considered a success, the trades based on these two analyses gave nearly 150p.

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities