The next week marked by political events affecting the financial markets. In the USA, government institutions were temporarily opened for 3 weeks, so there was a backlog of outstanding macro data. The FED meeting and abstention from raising interest rates – the dollar weakens. The vote on the EU-UK divorce agreement, less and less concrete but greater confusion, seems to us we know less than a few months ago how, when and whether the UK will leave the EU. Friday’s payrolls – strong (304,000) and initially the dollar has strengthened, especially in the case of Yen and Gold. In the afternoon the euphoria faded a little. The trader’s life today is not easy….

EURUSD 27.01-02.02.2019

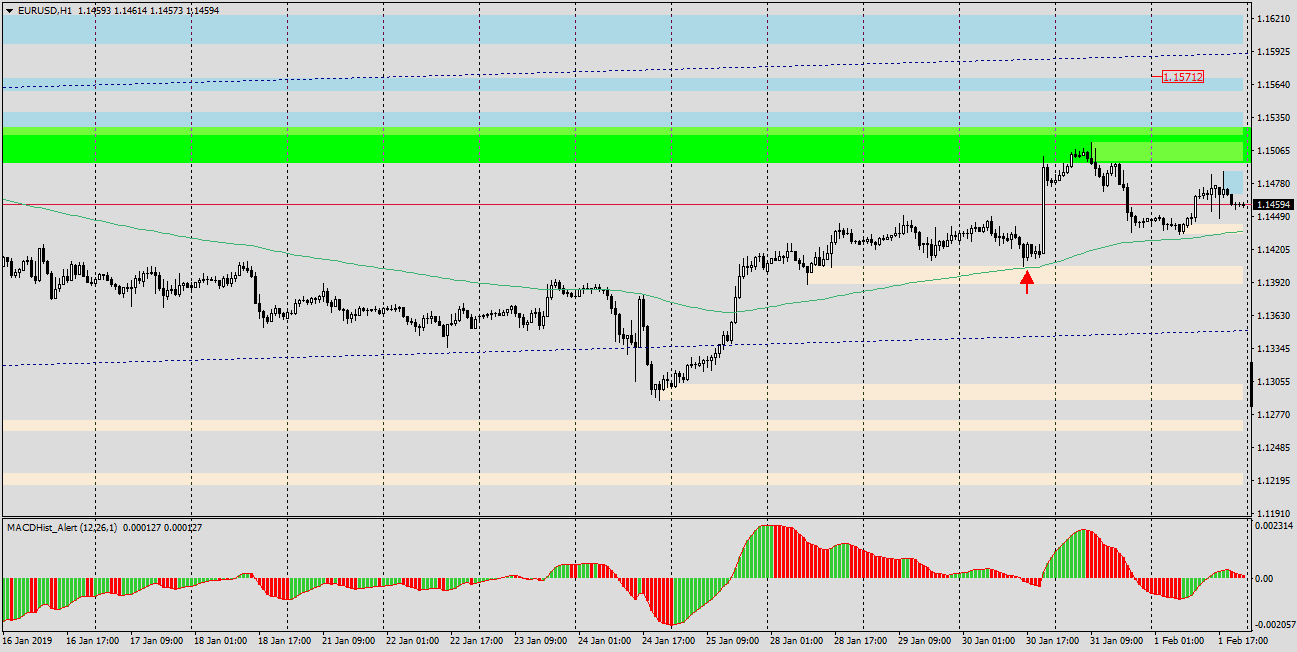

Last week, on Monday, I wrote a study on this pair – “EURUSD – Back to consolidation’: “Graph H4 shows that the demand response at 1.13 was strong and the price broke the previous maximum without any problems. In addition, the growth option is supported by bullish divergence triggered by this increased demand”. The increases became a fact, and the pair gained in a maximum slope of 110p.

Expecting growths, I advised to look for opportunities for a long around the average EMA144, cited above: “To find a good place to join increases, it is worth looking at chart H1, where the average EMA144, which has recently acted as a strong dynamic resistance, can determine our entry level, becoming a support for the price returning to it.” The graph below illustrates how the market has met my expectations, additionally launching a local demand zone.

This week’s prey: