The greenback managed to hold on to the gains made from Friday on Monday’s session. Price action was however rather subdued with the lack of any clear economic data on Monday.

The greenback managed to hold on to the gains made from Friday on Monday’s session. Price action was however rather subdued with the lack of any clear economic data on Monday.

Fed speeches included that from Neel Kashkari and Bullard. Bullard said that the Fed does not need to raise interest rates in the near term amid a surprisingly stubborn low inflation. The US consumer prices data will be released this Friday. Expectations are high that inflation has managed to increase in July.

Looking ahead, the economic data today will include the German trade balance followed by the NFIB small business index in the US Later in the evening, RBA assistant governor Kent will be speaking.

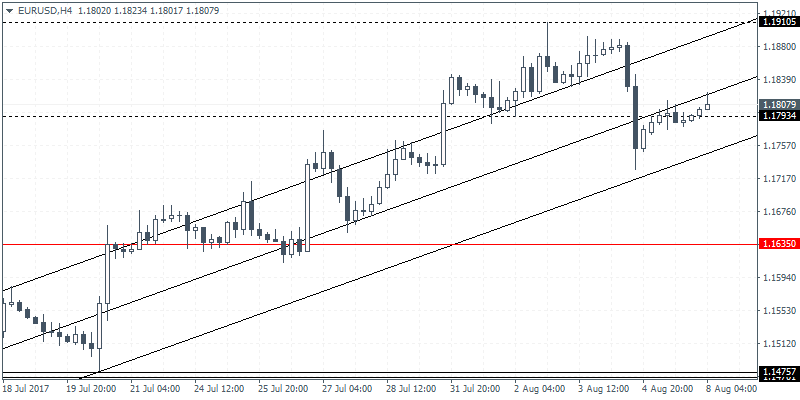

EURUSD intraday analysis

EURUSD (1.1807): Following the brief retracement to 1.7934 resistance level, EURUSD has turned lower. This could potentially suggest a near-term decline in prices in the short term. There is also scope for a bearish flag pattern that could be forming as a result of this reversal. If EURUSD manages to break down below the previous low on Friday at 1.1728, then expect to see further declines. A measured move of this potential bearish flag pattern will see EURUSD targeting 1.1635. This also coincides with the support level that is formed here.

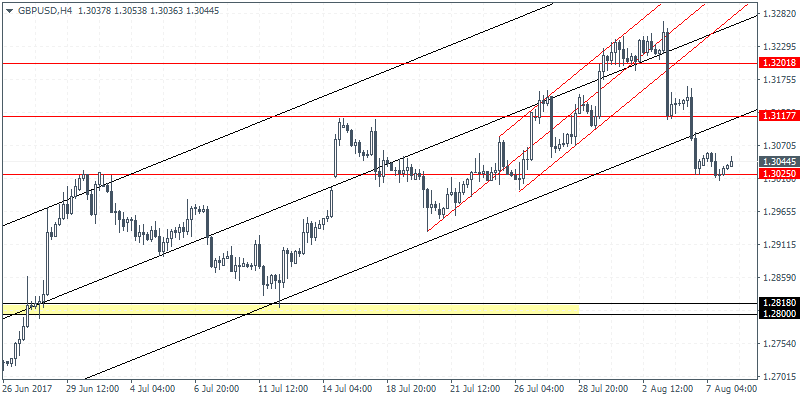

GBPUSD intraday analysis

GBPUSD (1.3044): The British pound was seen trading rather subdued yesterday about price action was seen hitting the support at 1.3025. A confirmed break down below this level could suggest further downside in prices. The next main technical support in GBPUSD is at 1.2818 – 1.2800. However, watch for any potential reversal above this support. Unless resistance is clearly formed at 1.3025, further gains cannot be ruled out in GBPUSD.

Above article was provided by Orbex – Serving Traders Responsibly. Check the trading conditions and open your own account.

The Latest News covering forex, commodities, and indices in addition to exclusive CFD and forex trading opportunities identified by the Orbex research team

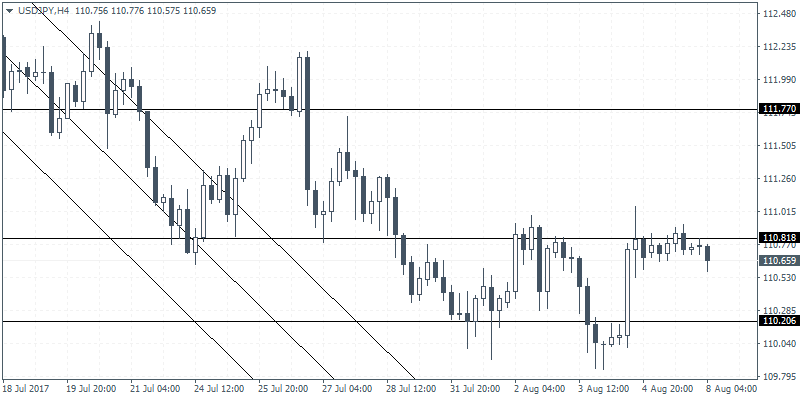

USDJPY intraday analysis

USDJPY (110.65): The US dollar continues to struggle to break out above 110.80 resistance level. Price action has once again failed to make any inroads above this resistance level. In the near term, any reversals could be limited within the inside bar range that was formed on Friday. The breakout from Friday’s high or low of 111.05 an 110.67 will signal further direction in the near term. To the upside, 111.77 will be the next target where resistance sits, while to the downside, below 110.67 low, the support at 109.58 will be tested for support.