Another trading week behind us. It is worth mentioning that it was first week after last week’s swearing-in of the new President of the United States. Donald Trump from the very beginning of his term in office hard worked and it would seem that if he continues the nature and specifics of his work like he does now we can expect on the market quite high and not necessarily easy to predict volatility.

Another trading week behind us. It is worth mentioning that it was first week after last week’s swearing-in of the new President of the United States. Donald Trump from the very beginning of his term in office hard worked and it would seem that if he continues the nature and specifics of his work like he does now we can expect on the market quite high and not necessarily easy to predict volatility.

The first significant macroeconomic publication having an influence on the exchange rate of the US currency were this week Tuesday’s readings on PMI for industry and December sales of existing real estate.

According to the preliminary report IHS Markit, new industrial orders recorded in the current month best market conditions since September 2014. The main index at 55.1 was much better from both forecasts at 54.5 as well as the results of the December (54.3).

Data from the real estate market turned out to be not so good. It is true that result of the December was revised slightly upwards, but the decline was much stronger than assumed analysts (-2.8% vs. -1.1% expected). The final value of sale of existing property last month was recognized on level of 5,49mln.

As reported on Thursday, the US Census Bureau foreign trade deficit in December last year increased to 65 billion USD. The published value did not meet the expectations expressed in market forecasts of 64.5 billion USD, however, is still lower than that published in November (65.3 billion USD).

The value of exports in December totaled in 125.5 billion dollars (up to $ 3.7 billion more than in November). The increase was also recorded in volume of imports – the value of imported goods amounted to 190.5 billion USD (to about $ 3.4 billion more than in November).

Inventories of wholesalers increased by 1% compared to November 2016 and is estimated that in December amounted to 601.1 billion USD. The December value is still about 2.6% higher than that reported in the corresponding period of 2015.

In case of data reported by the US Department of Labour we also cannot find a positive surprise. Despite the forecast of an increase in the number of applications submitted to the level of 247,000, the number of new applications for unemployment benefits (initial jobless Claims) increased in the third week of January about 22 thousand. to the level of 259 thousand. Also, data for the previous reading was revised upward by three thousand to the level of 237 thousand.

On the same day (Thursday) we also met readings for PMI services and those concerning the sale of new homes and real estate.

Like the PMI for the industry as well as in the case of services we recorded an upturn. Reading of 55.1 was better than the already optimistic expectations at 54.4 (previous reading was 53.9).

In the case of sales of new real estate results were not so optimistic and quite significantly missed forecasts. Despite the expected change of -1%, in December it amounted to -10.4%. Thus, despite the expected new home sales at the level of 588 thousand., sales in December amounted to only 536 thousand., Where last month it was up to 598 thousand.

On Friday we met the latest data on durable goods orders of US companies and the estimated change in the level of GDP.

Dynamics of changes in the value of orders for durable goods rose in December, but this increase did not match market forecasts. Durable goods orders index stood at -0.4% m / m against the forecasted growth of 2.6%. The situation is still better than a month ago, when orders plunged by nearly 5%.

Much more important indicator for investors, of course, was estimated change in GDP. The latest estimate shows an increase in US gross domestic product in the fourth quarter of last year by only 1.9%. This value is noticeably lower than forecast, at 2.2%, and dramatically lower than the change in GDP in the third quarter. Then the US economy expanded by 3.5%.

As the report says the Bureau of Economic Analysis growth in the gross domestic product reflects the positive impact of private consumption on the economy. The negative impact of exports and government spending was partially offset by a higher level of housing investment and an increase in inventory levels.

The GDP deflator, in line with earlier forecasts, amounted to 2.1%. Higher than reported in the previous quarter growth of 1.4%, although it should be remembered that these are only preliminary estimates.

Much more optimistic proved to be data on US consumer confidence. Index of consumer sentiment University of Michigan was in January, higher than expected. Market analysts had expected a result of maintaining the current level of 98.1. Readings was better than expected and amounted to 98.5 which was the best result since March 2004.

Let’s get to the charts …

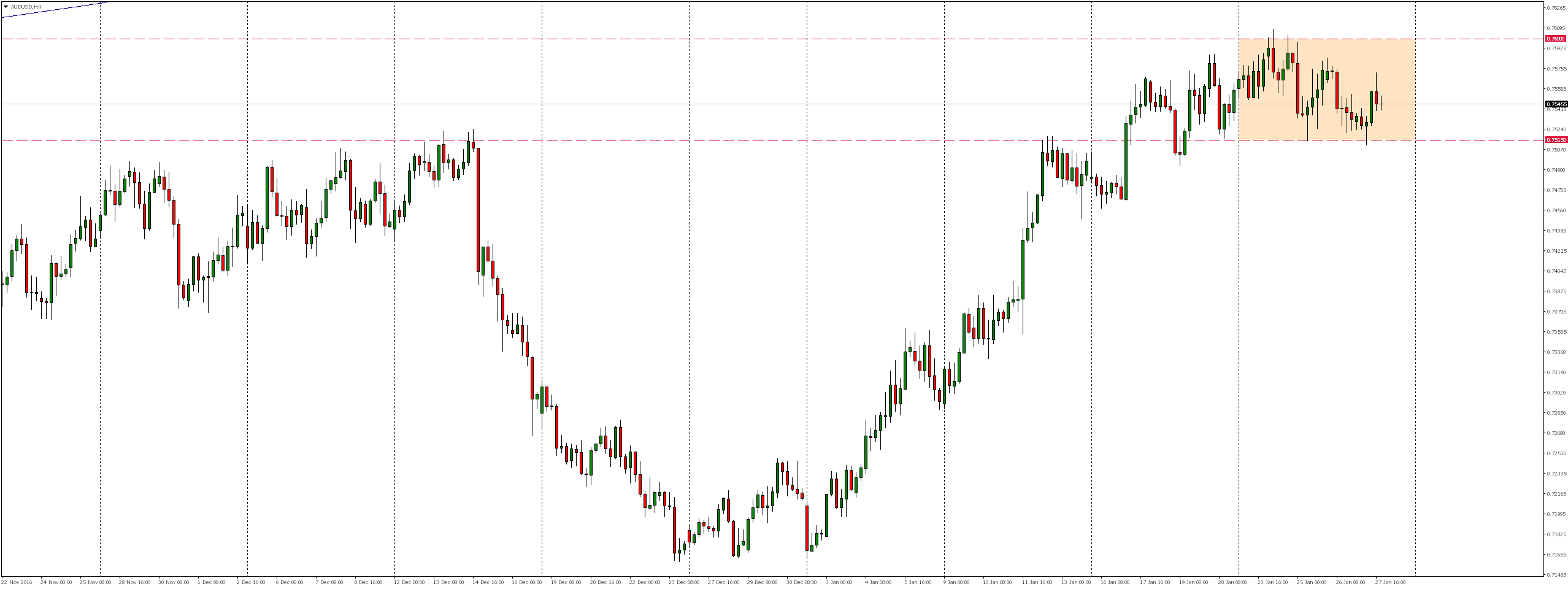

AUDUSD

Throughout the week the market moved within the previous consolidation. Weakening strength of demand may indicate impending change in market sentiment, but this to happen we would have to overcome first the support level around 0.7515.

The most important publications affecting the exchange rate of the Australian dollar were published on Wednesday, readings consumer inflation (CPI), which in the last quarter of 2016 in comparison to the previous quarter decreased from 0.7% to 0.5% in Q4 compared to the year increased from the previous 1.3% to 1.5% while analysts had expected an increase to 1.6%.

Far better presented Friday readings of producer inflation (PPI), which in the last quarter of 2016iIn comparison to the previous quarter increased from 0.3% to 0.5% (the forecast assumed a decline to 0.2%). In relation to the previous Q4 PPI grew from 0.5% to 0.7%.

EURUSD

For most of the week the market was moving inside a consolidation, which in a result of Thursday’s market decline was broken down. As a result of these declines we overcame the growth trend line , which together with the lower bound of earlier consolidation and measuring the 50% Fibonacci correction was re-tested on Friday. In the area of this zone appeared response from supply side and if this level would be permanently rejected, we expect a continuation of the declines in the coming week.

GBPUSD

Since the beginning of the week market continued its dynamic growth, which on Thursday carrying out proportions of AB = CD arrived in the vicinity of levels of 161.8% external measuring of former bullish impulse and 261.8% external measure of last week’s downward correction.

Undoubtedly, the most important news from the UK was Tuesday’s decision of the Supreme Court of the UK as to whether the government will have to be granted permission from parliament to start the procedure exiting from European Union. The Supreme Court upheld the judgment of the lower court, which assumed the requirement of parliamentary approval for Brexit. According to the guidelines judges prime minister Theresa May cannot start talks with EU officials, unless both houses of parliament will not support the decision.

The decision of the Supreme Court covered with the expectations of investors – in accordance with generally accepted consensus of both houses of parliament should promote the introduction into force of Article 50 of the Treaty of the European Union (TEU), the deadline for a vote on the matter is March 3 this year.

In addition, the Supreme Court announced that the Scottish, Welsh and Northern Irish parliament mustn’t speak out on this issue. The order went “under the hammer” of the judges because of the fact that the government saw no need to negotiate the implementation of article with parliamentarians. Ministers request was rejected by a majority of 8 to 3.

According to the President of the London Stock Exchange, Brexit could cost Britain up to 230 thousand jobs. According to Reuters their bit to this large number will add Morgan Stanley and Citi – both investment banks allegedly planning to transfer at least a thousand employees currently at the heart of the City of London.

On Thursday, we met preliminary data on changes in the size of UK GDP in the fourth quarter of 2016 yea which positively surprised investors. The British economy continued to maintain the pace of development.

Forecasts for described publication were not exceedingly pessimistic, but the market is expected to decline in the growth rate of gross domestic product. Preliminary data for the fourth quarter of last year, however, indicate that the British economy has maintained its previous growth rate of 2.2% (0.6%) on an annual basis (quarterly).

For growth in last quarter were primarily responsible services, with – as it recognizes the Office of National Statistics – strong contribution of industries that are consumer oriented – retailers and travel agencies.

Good news may be the fact that the sector of industrial production and construction – unlike in the third quarter of 2016 years – had positive impact on the British GDP.

Recent estimates for full-year change in gross domestic product speak of growth at 2.0%. This means that the UK economy is slowing down somewhat after 2015 (GDP growth of 2.2%).

CentroFX is a fully licensed and authorized by the CySEC (license 246/14) broker that is part of the group R Capital Solutions Limited operating from 2014.

CentroFX is a fully licensed and authorized by the CySEC (license 246/14) broker that is part of the group R Capital Solutions Limited operating from 2014.

CentroFX offers trading without intervention the so-called. non-dealing desk, over 170 trading instruments including currencies, stocks, commodities, indices, fully transparent and advanced trading system with instant execution of orders and guarantee a fixed spread on all instruments (fix), Compensation Fund Investment up to 20 000 euro and protection against negative account balance –check our offer.