Undoubtedly, of all macroeconomic events that have taken place in the past week, two deserve for our special attention. First is of course Wednesday’s FOMC decision on leaving US interest rates at current levels in the range of 0.5-0.75%. There is a noticeable but subtle change in the FOMC statement accompanying the decision, which was slightly more hawkish. The Committee notes positive changes in the economy that occurred between December and points to improvement in the US labor market and general improvement in business sentiment and consumers in recent times. In the latest statement, we will not find, however, part of the temporary effects of energy prices on inflation. In the latest statement, once again provided the relative balancing of possible risk factors and highlights the modest level of investment in US companies. The entire FOMC statement (in English) is available on the website of the Federal Reserve.

The second most important (though perhaps even more important than the previous one) event of the week was, of course, Friday’s release of report from the US labor market for January by the BLS. While reading of the main employment in the non-agricultural sector was much higher than forecast, the remaining components fared worse than assumed markets.

Below the most important data presented in the report:

- NFP – 227,000, the forecast 175,000, previously 156,000

- The unemployment rate – 4.8% vs. 4.7% previously and

- Average Hourly Earnings m / m – + 0.1% vs. + 0.3% previously + 0.4%

- Average hourly earnings y / y – + 2.5% vs. + 2.8% previously + 2.9%

- The rate of participation – 62.9%, previously 62.7%

Increase in the rate of participation reflected in jump in the unemployment rate, the worst looks, however, the dynamics of wages inflation , which slowed compared to December decidedly harder than anticipated by investors.

On Monday we met index of signed home buy contracts in the United States, which after November the lower the index by -2.5% in December expected increase of 1.1%. The final results were even better and indicator of signed contracts to buy homes rose by 1.6% from 107.3 in November to 109.0 in December. On an annual basis the index is 0.3% above the result of December 2015. when it stood at 108.7%).

On Tuesday we met readings of the index of consumer confidence in the United States, which was prepared by a research non-profit organization called Conference Board. Despite slightly worse forecast at 113.0 compared to the previous reading 113.7 (adjusted eventually to 113.3), the current reading was only 111.8.

Despite this decline in the reading still it ranks at a high level even though you can see that respondents who took part in the survey assess slightly worse current situations and have different expectations of future economic conditions in the United States.

In addition to the aforementioned decision on interest rates on Wednesday we met also published by ADP January report on the US labor market, which many investors treat as an important sign ahead having place two days after the publication of NFP and the jobs report by the BLS (I mentioned above) .

While the results of the ADP and NFP are often not identical a dynamic change in the non-agricultural employment on Wednesday’s publication indicates that in the case of NFP also we could expect to be a stronger When the analysts assumed increase in jobs in January by 165,000, and the final reading was ranked at a level of 246,000, the appetite for strong NFP on Friday certainly increased. So it happened, and as I mentioned earlier – despite Friday’s NFP forecast at 175 thousand. It amounted to 227 thousand.

To summarize the most important publications and readings from the United States should also mention Wednesday’s publication of the ISM Index for industry and Friday ISM services.

In the first case in spite of better forecast at 55.0 from the previous reading of 54.5, the index stood at 56.0. In case of services, the forecast also assumed subtle improvement from 56.6 to 57.0, however, the final reading was 56.5.

Lets take a look on charts

AUDUSD

As a result of dynamic growth market broke top of lasting for more than two weeks consolidation. From a technical point of view, it is worth noting that still wasn’t made a re-test of broken level of 0.7600, which is currently located in an area measuring 38.2% Fibonacci correction. According to the principle changes polarity a re-test should take place, however, given the dynamic growth on Friday there is an increasing probability that the market will continue to further increases without descent decline.

EURUSD

The next week the market was moving slowly to the north. These increases has been ongoing since mid-December and it seems increasingly likely that in near future the market will reach and re-test the level of 1.0850 and the trend line of bearish trend.

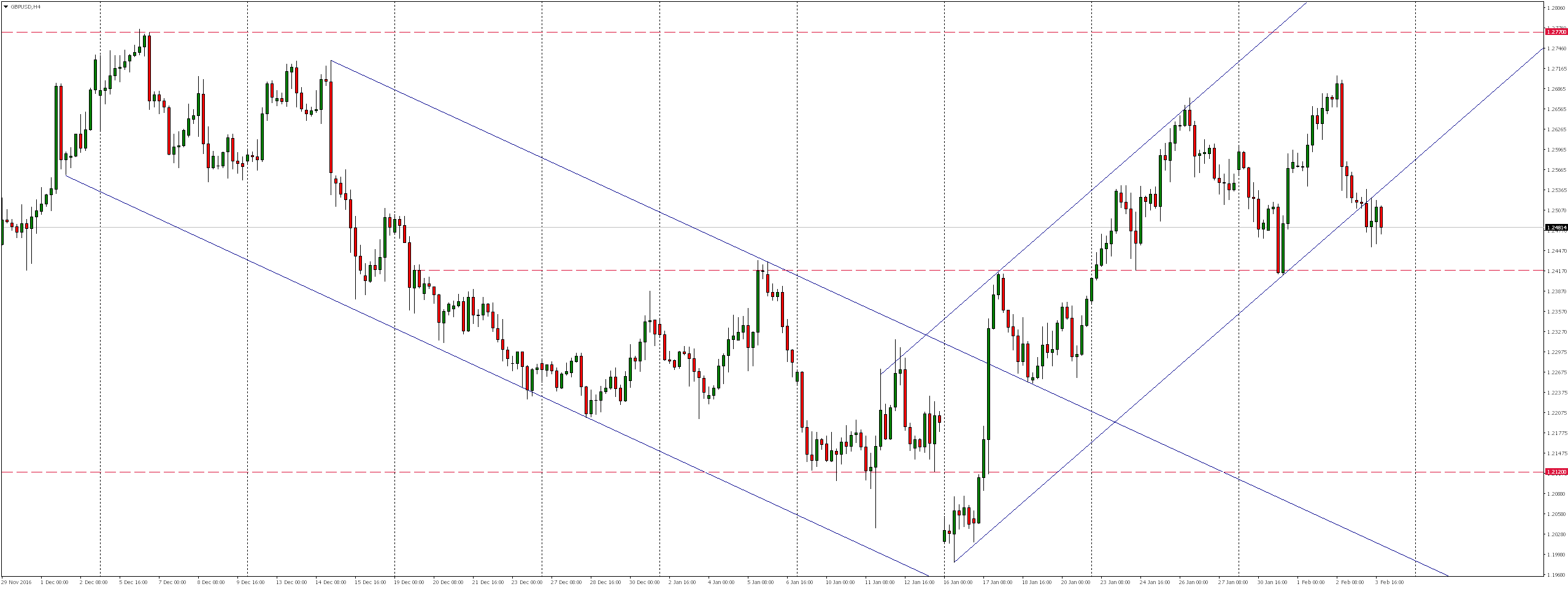

GBPUSD

Since the beginning of the week we saw a continuation of declines that reached the vicinity of local support 1.2420, where on Tuesday there was a strong reaction of bulls. These increases were continued until Thursday afternoon, and even though they have established a new, higher top, as a result of decision of BoE to leave interest rates and asset purchase program unchanged, there has been a drastic weakening of the pound sterling. As a result of these market declines price broke the bottom of lasting three weeks growth channel and if declines will continue in the near future we expect to retest the previously mentioned 1.2420 level.

What had an effect on the exchange rate of GBP was the above mentioned BoE decision to leave interest rates unchanged at the current level of 0.25%. This was undoubtedly one of the three most important events of the passing week, however, because it does not apply to all Majors but only GBPUSD (and other pairs with GBP) I mention it only now. At the same time the central bank published updated economic forecasts and the minutes of the meeting.

Monetary Policy Committee unanimously (9-0) decided to keep its key rate at 0.25%, and continuing QE at an altitude of 435 billion pounds.

Full content of the summary meeting of the monetary policy, together with the MPC minutes are available directly on the bank. The most significant headlines and inflation forecasts,can be foud here:

Half an hour after the publication of the official decision of the bank was held press conference and Q & A session with BoE governor, Mark Carney, who without bigger problems clogs popular cable below the round level of 1.2600.

When reading a statement introducing Carney said that the most important factor for the future prosperity of the UK will be relations with the European Union after Brexit.

USDCAD

Almost from the beginning of the week, when around local resistance around 1.3165 appeared bearish response, the market moved south. Although the drop on Tuesday arrived at around the level of 1.2980 and to the end of week this support remained unbeaten.

On the strengthening of the Canadian dollar affected this week, among others, Tuesday’s publication of the results of the November GDP of Canada, the dynamics of growth rose to 0.4%.

The exchange rate of Canadian dollar was also affected by Wednesday’s publication of the report concerning the US EIA oil stocks. After increasing by nearly 2.84 million barrels last week, a consensus prior to publication founded another increase, this time heals of 3,829 million barrels. As reported by EIA crude oil stocks rose while about 6.466 million barrels which gives gain more than twice the size of the previous one.

CentroFX offers trading without intervention the so-called. non-dealing desk, over 170 trading instruments including currencies, stocks, commodities, indices, fully transparent and advanced trading system with instant execution of orders and guarantee a fixed spread on all instruments (fix), Compensation Fund Investment up to 20 000 euro and protection against negative account balance –check our offer.

CentroFX offers trading without intervention the so-called. non-dealing desk, over 170 trading instruments including currencies, stocks, commodities, indices, fully transparent and advanced trading system with instant execution of orders and guarantee a fixed spread on all instruments (fix), Compensation Fund Investment up to 20 000 euro and protection against negative account balance –check our offer.