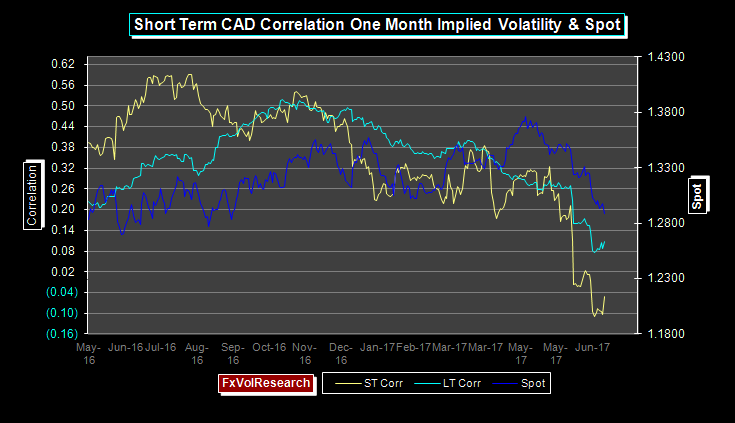

Both the short and long term correlations of spot CAD and one month implied vol is turning back up again from a local extreme reading and this suggests the rally in the CAD is getting a bit long in the tooth.

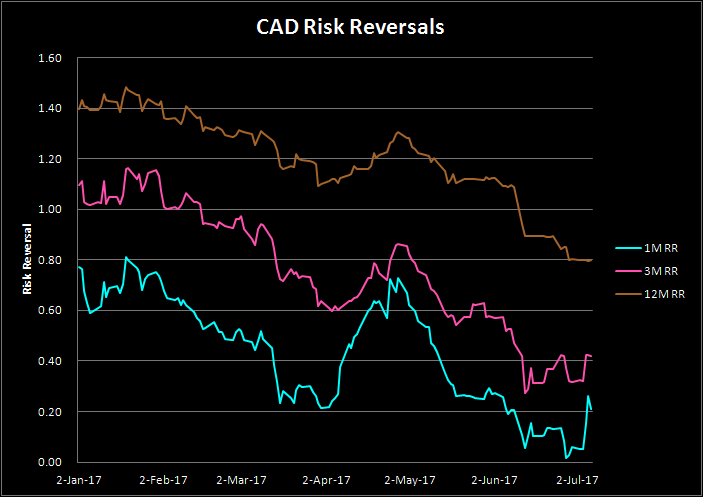

A week in which the CAD rallied and the front month risk reversals moved better bid for Dollar Calls (CAD puts). What does this tell us? It tells us the market is not short of inventory in out of the money CAD calls and we are probably getting into a region where the market makers are naturally long gamma. This will act as a dampener on short-term volatility.

While one week CAD realized volatility traded over 10% and so too did the one-week implieds vols (before the NFP) and body of the curve remain well bid around 7%. This should set up a good opportunity to implement an option traded that is short vol but retains limited loss downside and gains value with a slow US$ correction and falling vol…

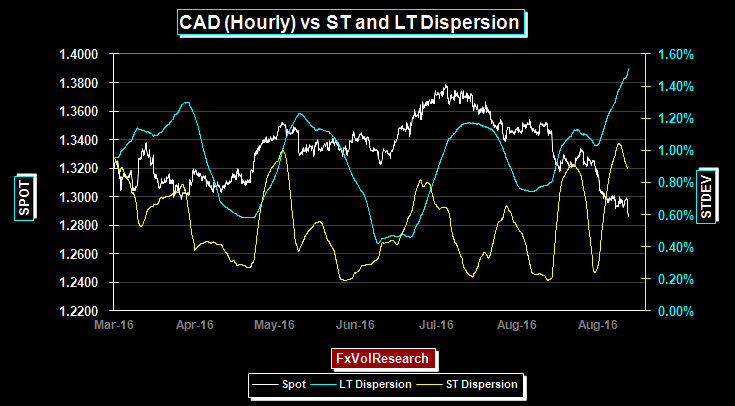

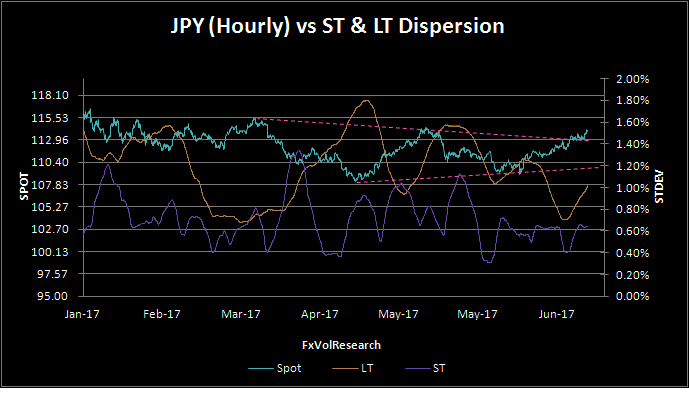

With six-week dispersion indicators making new local highs suggests that the move is not yet done but nearing exhaustion. The decline in the short term dispersion indicators further suggests a loss of downside momentum.

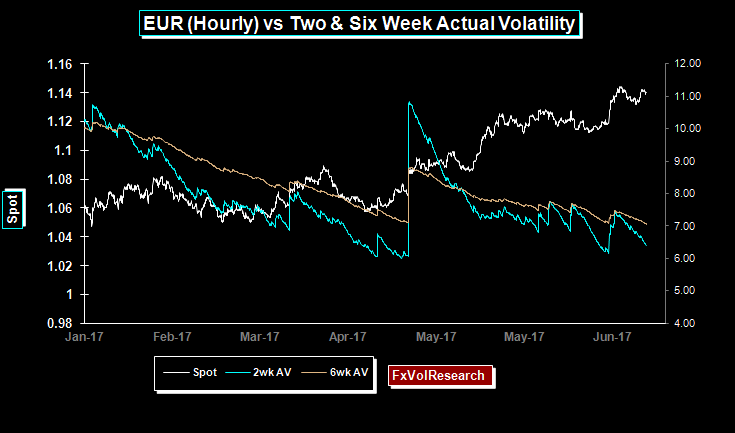

As we pointed out last week the CHF is threatening to break out of a longer term trend line, however, the market, for now, remains non-plussed. Actual vols are trending lower again and look to retest recent cyclical lows. The same can be seen in the EUR chart below. If this trend continues it will set up another batch of short term buy signals to own one and two-week gamma style options.

Here is the updated EUR chart. As you can see two-week actuals look like they will retest 6%. If the short term premiums get oversold again, trading under the actuals, it will set us up for another buying opportunity.

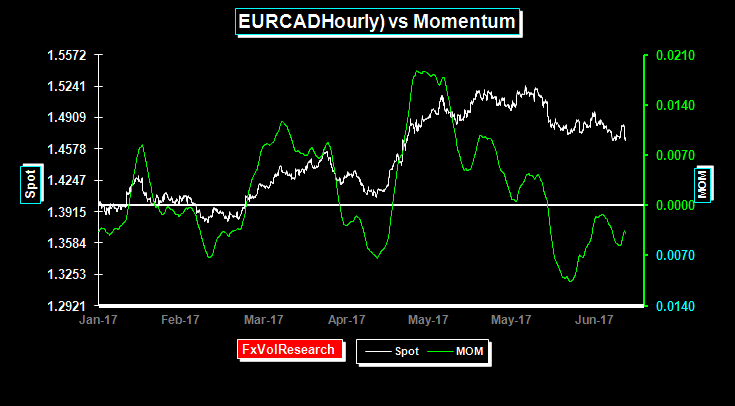

The divergence in the EURCAD chart has gone with momentum back under par.

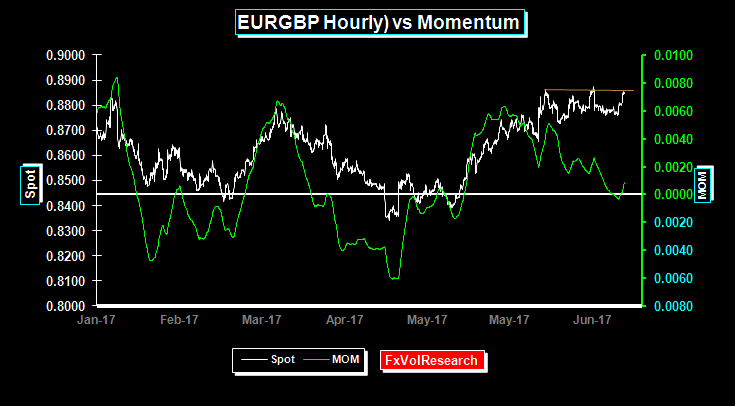

EUR-GBP risk reversals remain solidly bid for EUR calls over GBP, particularly so in the one year. As I mentioned last week the market is likely long EUR and heavy. We need to clear the topside congestion to get the EUR motoring higher. The divergence we noted in the momentum indicators has now been cleared and has turned back up.

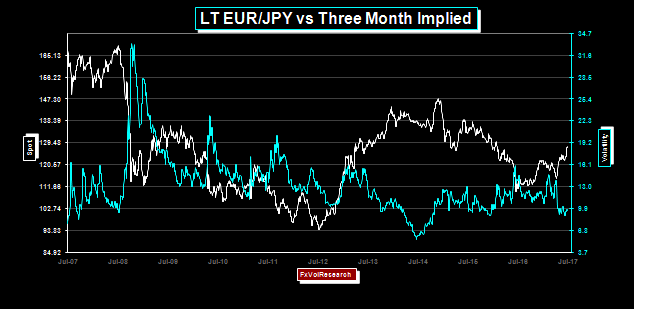

Three-month EURJPY vols are finding support just under 10% level while the spot is trending higher. Near-term resistance is around 130. The dispersion as we noted last week moved higher off of a local extreme implying more trending price action. With the move up in spot dispersion has followed suit but is still well below recent cyclical highs, suggesting more trending price action to follow.

With the yen breaking out of its triangle formation (see below) and the EUR looking set to test its local highs more EURJPY strength looks likely. From a longer-term perspective, it is not hard to see the EUR at 1.2000 and Dollar-yen back to 120 implying EURJPY cross around 144.

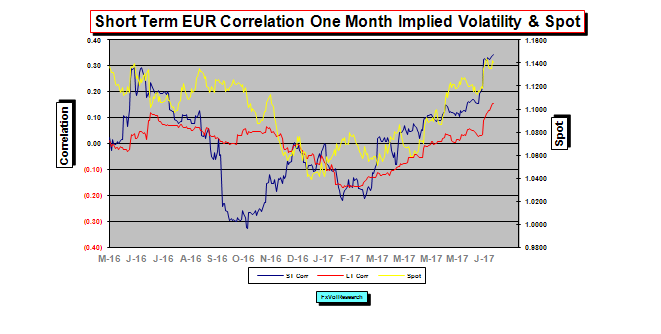

The one-month correlation of EUR and one month IV is still well into positive territory and this increases the odds of a renewed EUR test higher. When the spot vol correlations do turn it will be one sign that we are getting close either to a near-term top or a period of price consolidation. European bond markets are still out of line in relation to nominal GDP growth.

Last weeks EUR bond sell off still does not take into account the full realities of how fast the Eurozone fundamentals are turning. 10Y German bond yields rose from .4740 to .5720, a large move for sure in % terms, however, EU GDP growth has accelerated in the second quarter to an annualized rate of 1.9%. US growth is last reported at 1.4% with 10Y yields at 2.38. Of these two, which one seems more out of line?

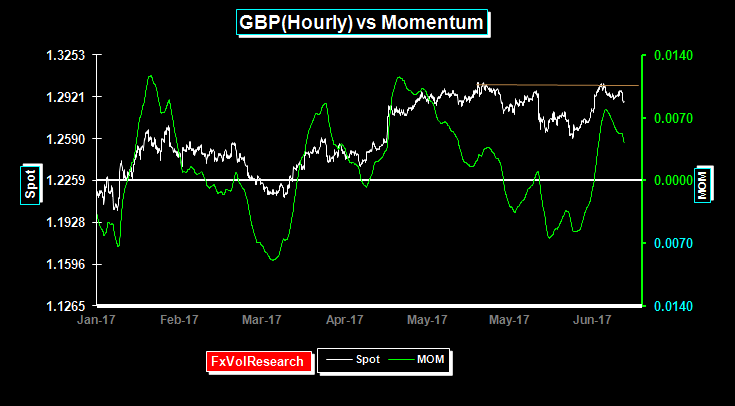

GBP fails to take out the 1.3050 area and momentum turns lower. This should help EURGBP clear the 88.50 hurdle. Just about every fundamental UK release last week was uninspiring. The realities of Brexit are coming home to roost and in the on-going Brexit negotiations, it is the EU-27 who hold all the cards. Three months GBP vol remains a buy on dips and should be re-balanced selectively.

Last week we pointed out that the Yen, as well as the AUD, were threatening to break out of their triangle formations. The AUD failed to break following a more dovish RBA comments and remains range bound. The JPY, on the other hand, has broken out.

Dollar-yen has been tracking 10 US bond yields and while the move in the ten years may look stretched in the short term, long term it is clear at some point not only that FED will adhere to their dot plot rate high schedule, but more importantly, they will start the process of reducing the balance sheet.

Get more reports on FxVolResearch.com!

Of these two the latter is far more important than the former in terms of its tightening implications. Mrs. Yellen may well be trying to formalize a process now for reducing the balance sheet well before her term at the Fed comes expires.

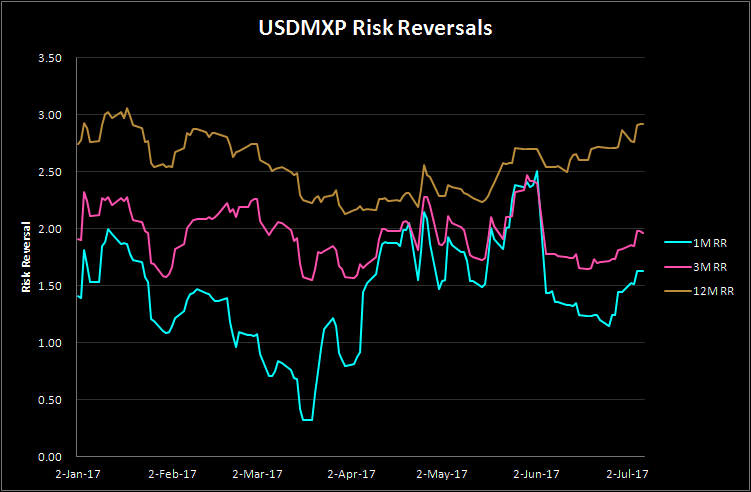

The MXP rally looks to be running out of gas in the near term. The spot has traded through the hourly trend line and momentum has shifted back in favour of the dollar.

MXP risk reversal has moved better bid for US$ calls over puts in all periods from one month out to one year. This is another sign that in the near term at least the MXP rally is due for a pause. The move may well reflect genuine concerns over forthcoming NAFTA renegotiations.

Best Regards,

James Rider

Director,

FxVolResearch Ltd.