Hi Everybody,

You may have heard a similar story before but I assure you this is something completely different.

There once was a young millennial named Goldilocks. One day she looked at her bank account and realized that the money sitting there was not earning her any interest and that due to inflation she was actually losing money every year.

So she naively wandered into the world of investments. A world that is full of hungry wolves who would just as soon eat Goldy than help her.

Finally, after a ton of research, she spotted a broker that she felt she could trust. But the broker had so many assets to trade that Goldy’s head started spinning as soon as she walked in the door.

First, she tried the cryptocurrencies. But this market was too young and way too volatile.

Next, she tried the stock markets. But the markets were way too high and Goldy had no way of getting into this market without grossly overpaying for the shares she wanted to buy.

Finally, she tried the bond markets. But the Fed had already bought all of the good bonds and there was nothing left at a reasonable price for poor Goldilocks.

I forget how the story ends but I hope it’ something along the lines of all the investors coming back to their senses, valuations slowly returning to normal, and Goldilocks living happily ever in peace and harmony with the financial markets.

–Mati Greenspan

eToro, Senior Market Analyst

Today’s Highlights

- Goldilocks Jobs?

- Gold Locked

- Digital Gold

Please note: All data, figures, and graphs below are valid as of July 10th. All trading carries risk. Only risk capital you can afford to lose.

Market Overview

Pheww. The G20 meetings are over without any drastic headlines. In fact, the leaders of the world seem to be surprisingly on the same page. They were even able to put out a unified statement.

The G20 reaffirmed their commitment to the Paris Climate Accords, even while noting the US’s planned departure from the deal. The statement contained no mention of North Korea. So it seems that issue is safely under the rug for now.

The Trump-Putin meeting produced some interesting headlines as well. Most notable, that Trump asked Putin if Russia interfered in the US elections. Putin said no. Some are now considering this issue as a closed case as well. Of course, we’ll wait until special investigator Robert Mueller gives the final word.

The Jobs Report last Friday was also quite eventful. The US economy managed to add an astonishing 222,000 jobs. The job market is certainly running hot at this point, some might say it’s running too hot.

The only issue is that despite the diminishing labor force wages don’t seem to be rising. Over the past year, average hourly wages grew by just 0.2%.

The market did much of nothing. First it went too high, then too low and ended up finding something that was just right… where it started.

The stocks on the other hand, were very happy about this report and we can see the Dow Jones rose sharply on the news.

Of course. it doesn’t take much to please the stock markets these days.

Gold reversal

According to an article on Bloomberg this morning, over the past month investors have gone from extremely bullish to extremely bearish.

The reason seems to be the expectations of rising rates in the United States. However, this doesn’t make much sense. The expectation of rising rates has been happening for months. It’s not some new piece of information that now needs to be priced in.

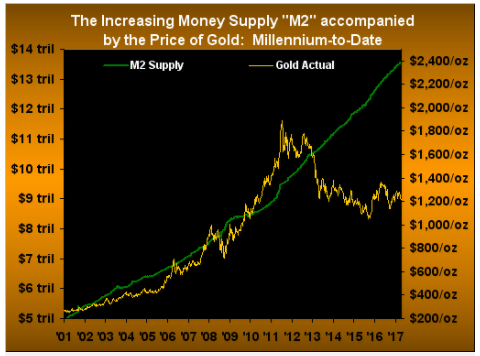

The following chart was posted by a guy named Mark Baillie and shows the price of gold over the last hundred years compared to the supply of US Dollars in the market.

So, it does appear that we’re seeing some sort of long-term divergence in the market over the past 4 years.

Less than $100B

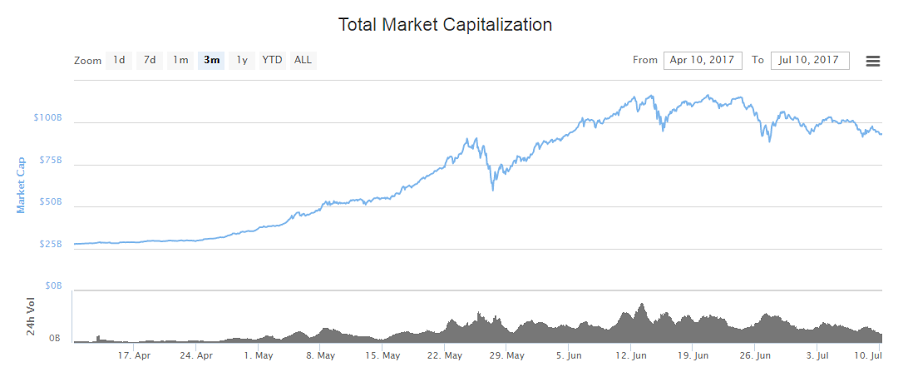

The Crypto market is currently seeing the most pressure it’s seen since 2013, and arguably the most pressure ever as we see yet another completely red day for this industry.

Of the top 30 most valuable cryptos only 3 are currently in the green. This as the total market cap of all cryptocurrencies has dropped significantly below $100 Billion.

Still, if we look at the last three months it’s quite clear that we’re still up exponentially since April.

As with gold, one of the best strategies I’ve seen for the crypto markets is to think long term. Don’t be surprised or startled by short-term movements.

Buy low sell high, and always have sufficient diversity in your account.

Have an amazing week ahead!

![Reltex Group Reviews: Explore business opportunities by Trading [reltexg.com]](https://comparic.com/wp-content/uploads/2023/12/image001-218x150.jpg)

![Mayrsson TG Reviews: Why Choose Crypto-Trading with Them? [mayrssontg.com]](https://comparic.com/wp-content/uploads/2023/12/image1-218x150.jpg)