EURUSD

According to my previous projections for almost the entire week the market was moving quietly up to form what seemed like a correction of trend. Despite expected strong bearish response in the area of resistance 1.0960 as an effect of the new information from Friday evening, that FBI officially resumes investigation related to emails of Hillary Clinton was a strong depreciation of the US dollar against the euro and price beat this level without any problem. If in the near future supply does not negate this breakout, then we can expect continuation of growth at around 1.1057 or even 1.1100.

If we look at the chart H4 notice that these resistances are also located in the vicinity of levels of 38.2% and momentum 50% Fibonacci correction of the entire previous downward movement.

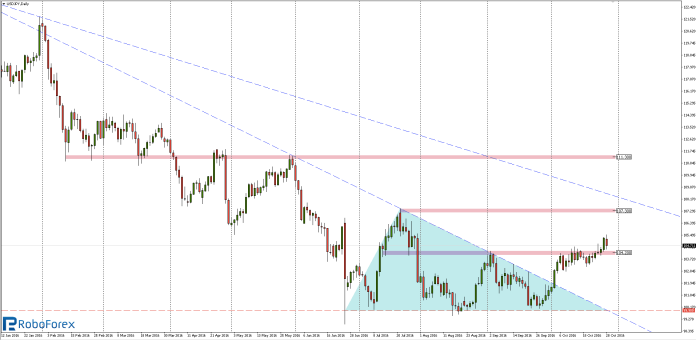

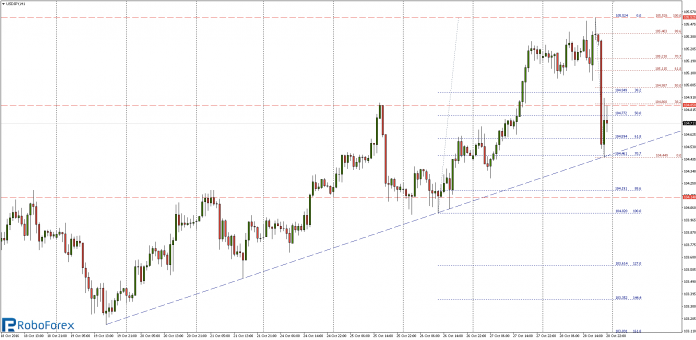

USDJPY

For the majority of the week the market was moving quietly up to break dynamically on Thursday zone of resistance around which oscilated for the last three weeks.

On Friday, we’ve seen a strong weakness in demand but the evening news that the FBI is interested in the affair regarding Clinton mails, caused a strong depreciation of the US dollar which resulted that USDJPY stopped just around the growthtrend line coinciding with the level of 70.7% correction Fibonacci of lasting from Wednesday growth impulse

After a brief upward correction we got around 104.85 resistance coinciding with the 38.2% Fibonacci of Friday’s decline and in the near future we expect a short consolidation between that level and the trend line. Breaking in either direction could determine the direction of movement in the coming days.

AUDUSD

From the beginning of the week we saw increases, which on Wednesday reached and were rejected at resistance around 0.77250 forming on the daily chart bearish pin-bar candle .In next days, we arrived around downtrend line, where was a strong reaction of demand which established a bullish pin-bar candle. Given that the last bearish impulses are almost equal and the market rejects support given from the growth trend line, in the near future we can expect growth and re-test of the resistance .07725.

USDCHF

Last week market reached and then with a strong bearish impulse rejected the important from the point of view from daily chart resistance 0.9998. For the next three days we saw consolidation and only appearance on Friday evening information that the FBI is interested in the affair mail Hillary Clinton led a dynamic decline, which reached a very important support around 0.9859 coinciding with the level of 38.2% Fibonacci correction of previous increases.

At the H1 chart we can see that the rejection of the current support might cause an upward correction in the vicinity of the zone of resistance levels between 0.9908 and 38.2% Fibonacci correction of the ongoing Tuesday declines. I also encourage you to read the prepared Friday evening- a detailed analysis of WTI oil, which can be found here.

I also encourage you to read the prepared Friday evening- a detailed analysis of WTI oil, which can be found here.