Last week, despite of large number of important macroeconomic publications ( Wednesday’s FOMC statement, the British Super Thursday, and Friday’s US payrolls) was not very abundant in the new positions of the big players. The biggest players in the market were more likely to comment on the current situation on the market than share their positions. But after all, it is worth to take a look inside proposals that appeared in the first week of November.

Credit Suisse

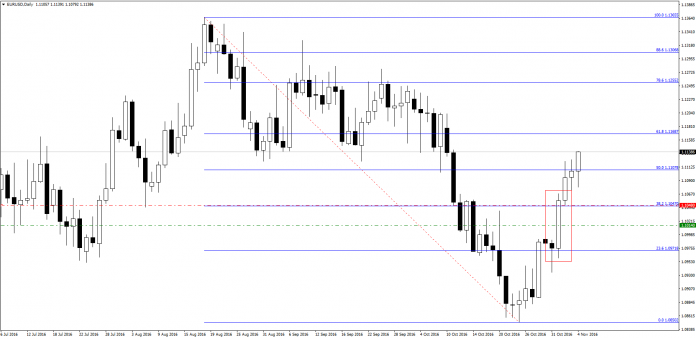

Very active so far, Credit Suisse analysts ,last week reported only one position on the market, which additionally … turned out to be lossy. Bank complained too low valuation of EUR against USD and at the beginning of the week announced submission of a new pending order.

Retest of 1.1100 area on Monday was quite distant and Credit Suisse decided to place a pending Sell order hundred pips below. Selling from 1.1014 quite quickly proved to be a mistake, and on Tuesday the position was first activated and afterwards closed by stop loss order. Weekly result of Credit Suisse based on that one trade ? -34 Pips!

Citi

Unlucky were also traders from Citi. The Bank indicated last Thursday on the possibility of consolidation of USD / JPY. Pair however, decided not to test 104.00 area and activate located there pending order of Citi. Analysts warned, however, that it was a long-term position, so perhaps the coming days will bring solution to the still pending order on USD / JPY.

FOMC

Wednesday’s FOMC statement was undoubtedly one of the most important macroeconomic events this week. On our website there are two interesting comments about this publication. The first of these was surprisingly accurate forecast of Nomura analysts . Correctly pointed to the lack of increase in November and recognized – as it turned out – the most important element of the statement. “FOMC probably is not going to get market used to the situation that promises to increase rates before approving such a decision (…)” claimed comment. Indeed, in the FOMC statement lacked confirmation that December is taken into account as the date of the next interest rate hike which resulted in the weakening of USD.

HSBC also drew attention on the lack of a real breakthrough minutes of FOMC explaining that the markets are more focused on drawing to the end of the presidential race than at the November meeting of the Committee.

Track newest positions and comments of biggest banks on the market. Try out free FxWatcher trial and gain a head start!