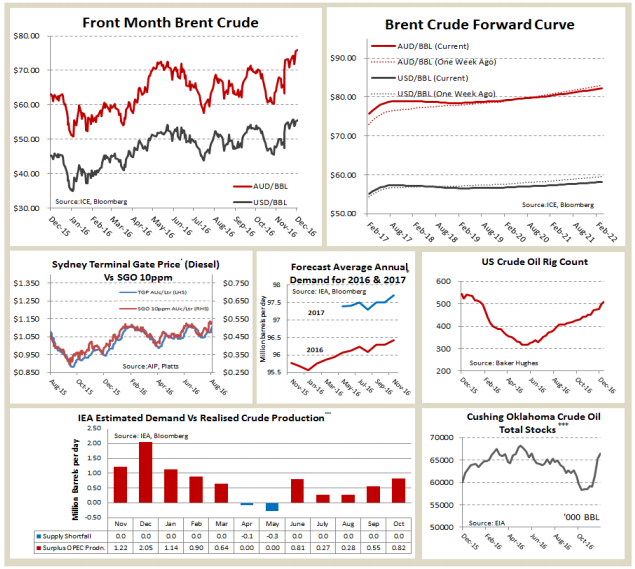

Oil jumped higher Monday as non-OPEC countries agreed to contribute a further 558,000b/d in production cuts and remained supported throughout the week on investor optimism. February Brent Crude futures closed up on the week by Friday close at $55.21/bbl, up $0.88/bbl (1.6%).

On Tuesday the IEA oil report upgraded 2016 oil demand growth by 120kb/d to 1.4mb/d, and 2017 demand growth to 1.3mb/d. But tempering this bullish view the report indicated global supplies had increased to a record 98.2mb/d in November as a drop in non-OPEC was more than off-set by higher OPEC output. In the lead up to the OPEC decision, the cartel’s output increased to a record 34.2mb/d, 300kb/d higher than October, 1.4mb/d higher than a year ago. (Note OPEC agreement to cut 1.2mb/d with 558kb/d from non-OPEC).

Commentaries, trading setups and many more are provided by FxWatcher. Try out FxWatcher service for 5 days for free!

Another significant event in the week saw the shape of the forward Brent curve shift to realign with that of the WTI curve. Calendar 2018 and 2019 WTI futures were in backwardation since the rally, as US shale oil producers hedged forward production, whilst Brent remained in contango. However late Monday 37.2 million barrels of options on the December 2018 WTI-Brent spread traded, according to data from the CME. This is a massive trade, and subsequent delta hedging of the WTI-Brent spread has caused downward pressure on 2018, 2019 Brent, moving Brent futures into bakwardation for the same period. It is thought the trade may have been placed by a US pipeline company that is hedging against a narrowing of the WTI-Brent spread, and a reduction in crude imports and hence pipeline fees, in the event the new Trump administration imposes oil import taxes.

The EIA weekly inventory data was bearish. Although crude stocks fell, a crude build at Cushing, Oklahoma of 1.2 mbbl to 66.5mbbl is bringing stocks to near capacity at the WTI delivery hub, putting pressure on futures. US production leapt 99kb/d while the Baker Hughes rig index was up a further 12 to 510 oil rigs (on top of 21 last week) operating in the US.

The EIA weekly inventory data was bearish. Although crude stocks fell, a crude build at Cushing, Oklahoma of 1.2 mbbl to 66.5mbbl is bringing stocks to near capacity at the WTI delivery hub, putting pressure on futures. US production leapt 99kb/d while the Baker Hughes rig index was up a further 12 to 510 oil rigs (on top of 21 last week) operating in the US.

Spot Singapore gasoil advanced slightly in the week by $1.00/bbl to $62.76/bbl by the close Friday.