Wide View Strategy (WiViSt) is a typical trend following strategy. Purpose of this strategy is enter in transaction at the end of correction which is identified in strong trend (uptrend or downtrend). There are two intervals used in this strategy: m30 and m15.

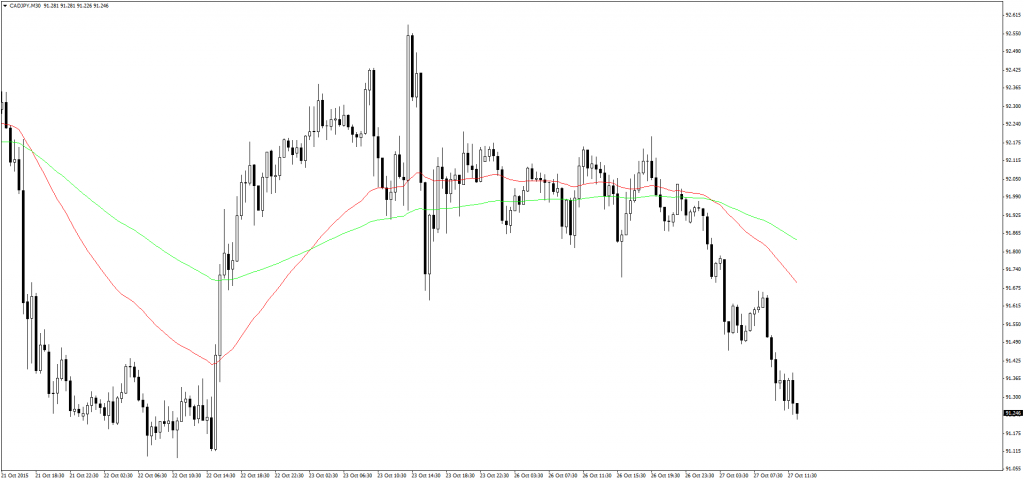

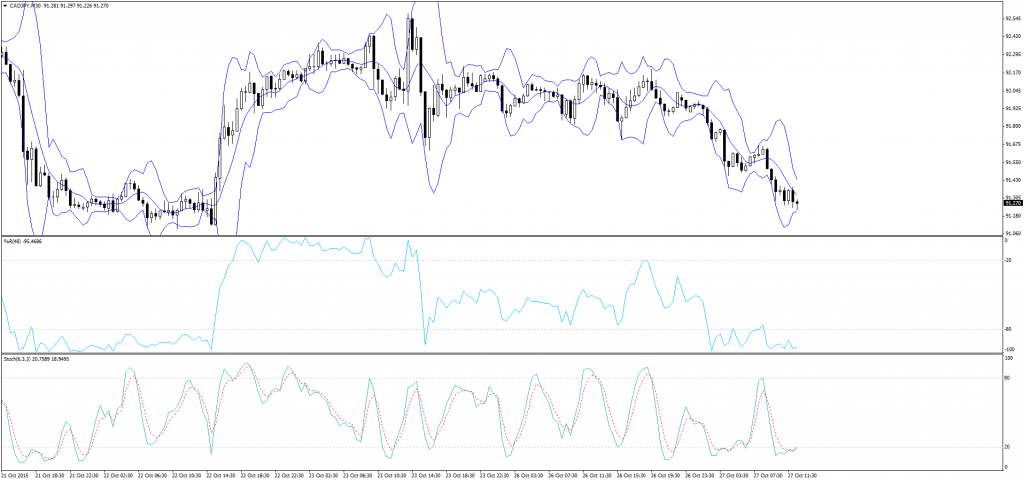

CADJPY

Canadian dollar starts to deppreciate against Japanese yen, which lately is very attractive to some traders. W can observe it on M30 chart.

Todays key event will be BOC Deputy Governor Timothy Lane speach. If speach will be more dovish we can expect downtrend continuation. On M5 chart sell signal will occur when %R come to overvalued area.

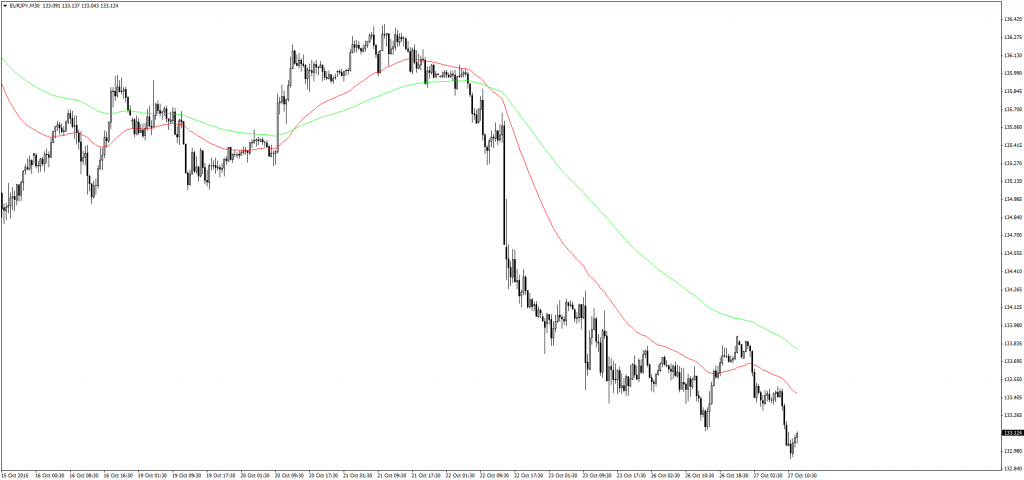

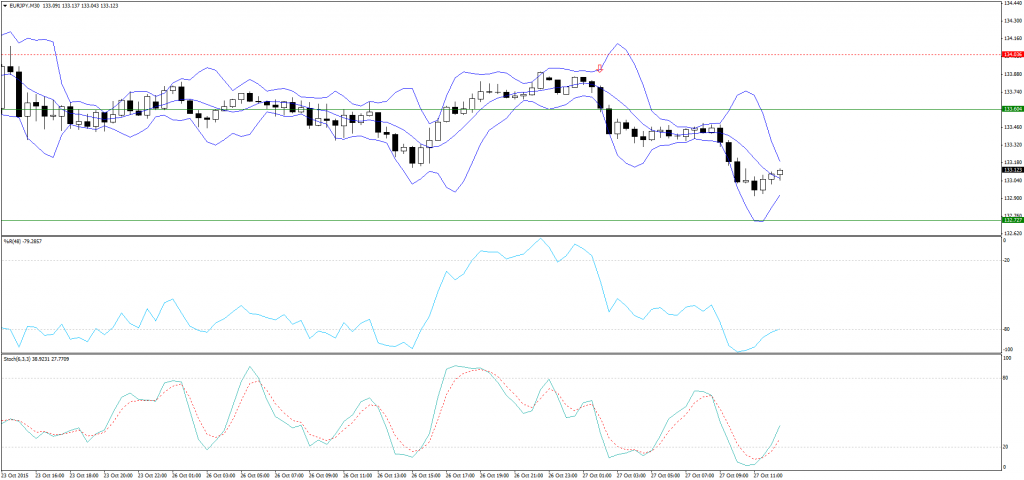

EURJPY

Euro lately deppreciate against other currencies. Mostly because of last EBC conference. First sell signal has occured during japanese session. First TP is set on 132.727. Those who missed that trade, can prepare to another sell opportunity, when %R come to overvalued area on M5 chart.

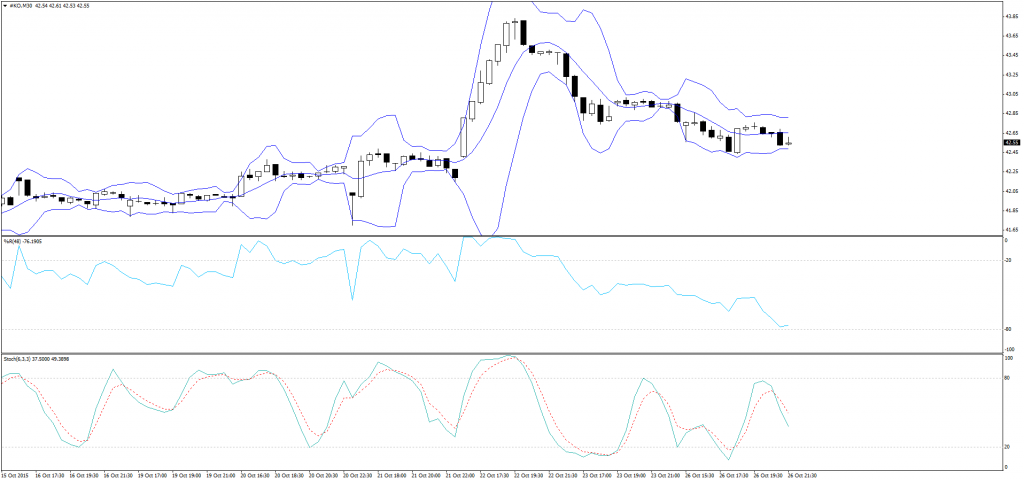

Coca Cola

After earnings data looks like now is the time when Coca-Cola Co. starts to deppreciate. M30 confirmed downtrend. On M5 chart sell signal will occur when %R come above -20.