Wide View Strategy (WiViSt) is a typical trend following strategy. Purpose of this strategy is enter in transaction at the end of correction which is identified in strong trend (uptrend or downtrend). There are two intervals used in this strategy: m30 and m15.

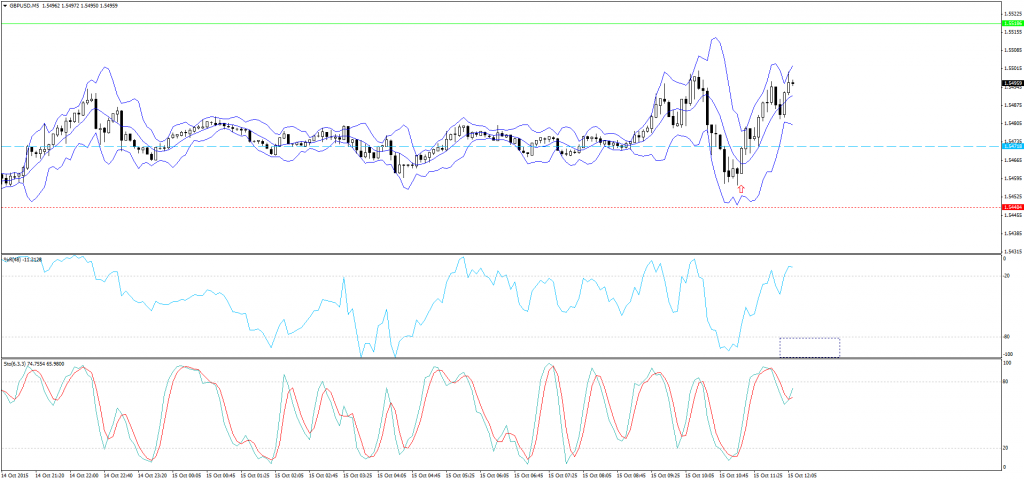

GBPUSD:

After yesterdays US PPI data, cabel has strongly appreciate. After strong uptrend was identified, we look at M5 chart.

Buy Signac Has appear after 10:00 am (GMT+1). First TP is on 1.55186 level. Another buy opportunity will occur, when %R come under -80.

USDJPY:

Yesterdays data put ninja under pressure. Todays CPI may be reason for further drop on this currency pair.

Now we wait for %R to come in to the overvalued area. If todays US data from will be better then forecasts then we will not trade.

JPM:

After gap down, averages on JP Morgan starts to accelerate.

When US market will be open, we can look for sell opportunities. But first, %R has to come above -20.