Due to the fact that the year 2016 comes to an end, we look at the graphs of key currency pairs in a broader perspective and consider what in theory we expect in 2017, or at least its first half.

Charts are made with the assumption that there want be unexpected fundamental news reversing the situation upside down for example, European banking sector does not collapse, the Japanese yen does not shoot up in the wave of risk off, and the United Kingdom will not sink like Atlantis in the depths of the Atlantic.

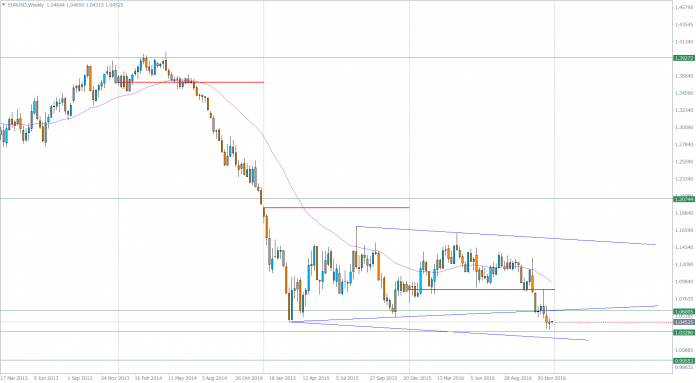

EUR/USD

Pair is in the course of overcoming support levels resulting from two major lows from last year set on 1.0500 and 1.0450. Although the average range of 40 weeks (corresponding to DMA200) indicates return to bearish trend, it is important to remember about 1.0330 support. It is also worth noting that the ‘mythical’ for this pair parity (equal level courses) is very close, because only 450 pips from the market price. The attack on round number 1.0000 and falling to 0.9950 can not be excluded. Any bullish correction should find strong resistance in the vicinity of the opening of the previous year and 200 DMA around 1.0900 / 1.10000.

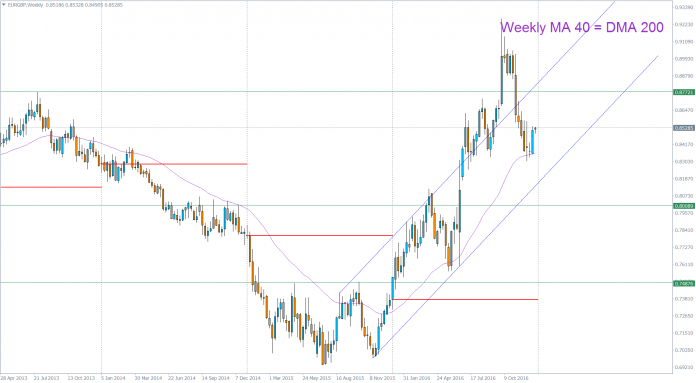

EUR/GBP

The weakening of the euro and the pounds sudden return to life – because United Kingdom has not sunk yet because of Brexit – turned the situation on the EUR / GBP. The pair in recent weeks responded in classic way to the support of DMA200 and price jumped up. However, we are clearly above the openings of years 2016 and 2015 and the pair probably would be willing to test them. Breaking DMA200 will be a good confirmation of changes in the mood for this pair. Approaching resistance at 0.8850 and 0.9000 should meet solid bearish response and 0.7550 seems to be a good target for them.

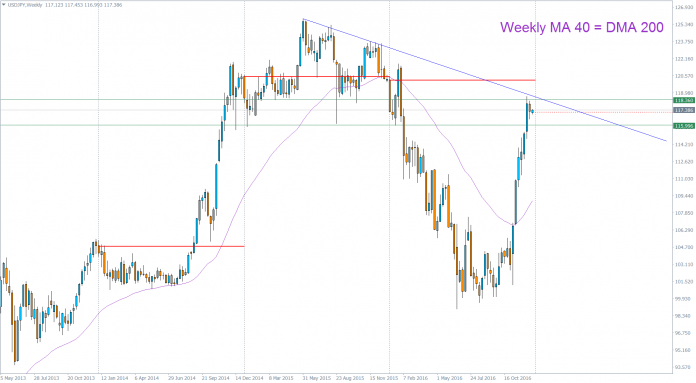

USD/JPY

In the 2016 was a big drop and big ‘come back’ of dollar, especially in tandem with the yen. A pair dived more than 22 figures and made back 17 of them in the last few weeks. The course is currently in technical zone of resistance and it seems that downward correction is inevitable. Average DMA200 is set rather bullish, but at a considerable distance from the current rate -it means that there is plenty of room for correction.

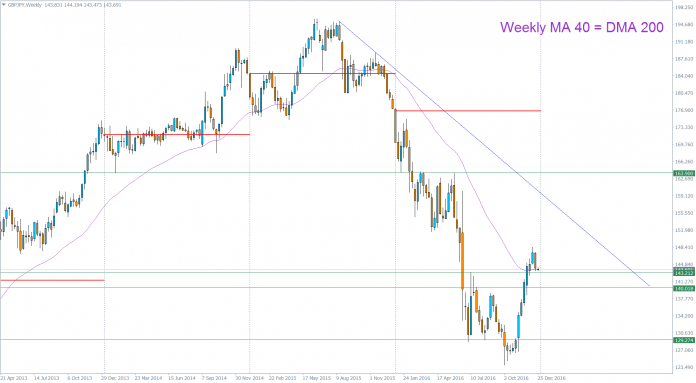

GBP/JPY

Pair GBP/JPY has experienced weakness of the pound mainly in tandem with the US dollar, which allowed pound tu make up almost half of the losses from the first half of 2016 years. It is difficult to be optimistic here, especially if will be fulfilled downward correction for the USD/JPY. It seems that the course will test even the level of 130.00. As a result, purchases should be here a lot cheaper in the future. We have a lot of space for growth, as far as the prospects for the economy of UK will permit so.

AUD/USD

Neither the technical situation nor sentiment on the Australian currency and raw material markets suggest that we can expect here increases. However, still here can show up a setup indicating accumulation – a double bottom in the format W-M-W. The moving average still signals consolidation, although the pair seems to be heading for re-test of the 0.6900 level – in this area may arise following a double bottom – the second ‘W’ of said format. If bulls are not successful here, the course could fall down to 0.6400 / 0.6300, but it will be rather difficult if the dollar would weaken in a correction in the first half of 2017.

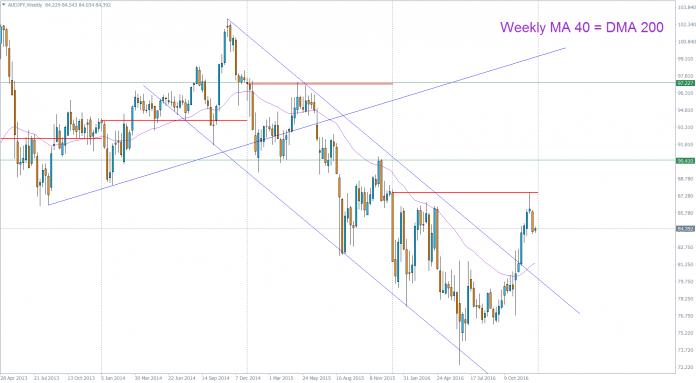

AUD/JPY

Here we have a very nice reversal setup. Average DMA 200 has been in recent weeks broken so was the downward channel, mainly due to the weakness of the yen and the return of light risk appetite. Here, the scenario may be similar, as in USD/JPY – correction of last increases to DMA200 and/or to previous accumulation zone, and then new growth impulse.

USD/PLN

Our native currency pair is listed here mainly because of the sentiment, as well as the key place where it is found now. We test the key resistance of 4.24 / 4.25, and though fundamentals still does not indicate it ,it is a good candidate for a turning point. The peaks of recent years indicate the possibility of creating triple-drive formation and a significant decrease (at least technically) even in the area not seen for long – the level of 3.5000. So far, it is too early to predict such big movements , but the level above 4.00 zloty seems to be untenable at this point. I look forward for returning to DMA200 around 3.95 and decision of the market whether we go back over 4 ,whether we stay below longer.