Something I’ve been awaiting for a while seems to have just happened but in sort of an unexpected way. The release of the world’s first viral decentralized application. Given the internet’s fascination with felines, I guess it makes sense for the first blockbuster blockchain based application has to do with cats. Crypto-kitties offers a unique marketplace where you can own your own cryptographically unique kitten.

Each cat is stored at a unique address on the Ethereum blockchain, which should allow third party developers to offer new ways to access your kittens and will guarantee that the kittens will stick around even if the original marketplace goes down.

Though this may not seem all that impressive, try and think of the first few websites you’ve visited, I’m sure many of them were not all that useful. This is a work in progress and clearly, there’s a long way to go before the decentralized web takes over, which is really a great sign for alternative investors like you and me.

Market Overview

The markets seem to be following the bittersweet updates from the White House rather closely. Over the weekend the Senate managed to pass Trump’s tax plan with a narrow margin, bringing it one step closer to becoming law.

On the other hand, Donald Trump and his associates are in a bit of hot water from special investigator Robert Muller who recently was able to turn Trump’s former National Security Advisor.

Refresher: Flynn was fired by Trump for “not doing a good job” but his recent testimony to Muller may indicate that the president did in fact obstruct justice by firing him.

On top of all that, a recent report on CNBC explains how some of the biggest benefactors of the Trump tax plan will actually be China, Japan, and Germany.

Markets in New York were rather flat on Friday. The Asian markets today were a bit divergent with the China50 rising and the Nikkei 225 falling, and the Asx in Australia flat. Europen markets have just opened with some significant gaps up, but are moving to cover those gaps quite quickly.

Perhaps the reason for the optimistic open has something to do with the meeting today between Theresa May and Jean Claude Junker, or maybe it has to do with the fact that today EU leaders will get together to choose a new President of the Eurogroup.

Gold made a push at the end of last week but the rally was short lived and after a negative weekend gap, is now testing support at $1270 an ounce (yellow line). If it does fall below that, there’s still another critical support at $1260 (red line).

Oil, on the other hand, has been on a rising trajectory for three months. Now that OPEC has done their thing and US producers have begun ramping production, will the yellow support line finally be broken?

Bittersweet Crypto

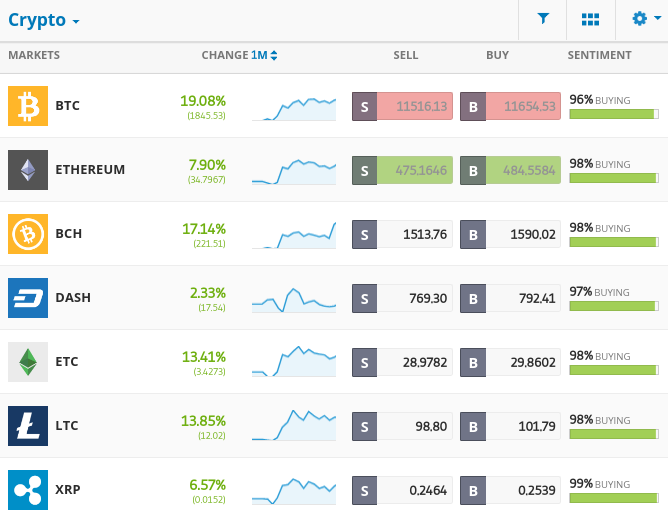

After the massive selloff last week, bitcoin is back near all time highs. Still, the ground seems to be a bit unstable. Last night there was a quick drop of more than $1000 per coin before a recovery this morning.

Even though Bitcoin has been underperforming the rest of the major cryptocurrencies for most of the year, over the past month it’s been the best performer by far and making major strides to reclaim its title as the digital king.

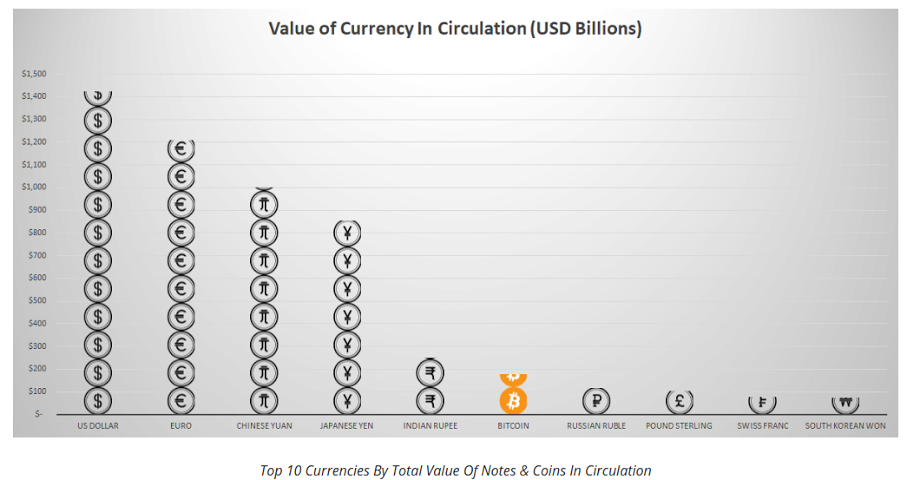

Not only is bitcoin king of cryptos, according to a recent report Bitcoin is now the 6th most widely circulated currency in the world, just between the Rupee and the Ruble.

Ladies and Gentlemen, our dream of making bitcoin a world-class currency is now a reality.

Let’s have an amazing week ahead!

![Reltex Group Reviews: Explore business opportunities by Trading [reltexg.com]](https://comparic.com/wp-content/uploads/2023/12/image001-218x150.jpg)

![Mayrsson TG Reviews: Why Choose Crypto-Trading with Them? [mayrssontg.com]](https://comparic.com/wp-content/uploads/2023/12/image1-218x150.jpg)