As we see bitcoin make up its mind, the stock markets are not hesitating to choose a direction. The Dow Jones flew right past 24,000 points. The most popular song on Wall Street at the moment is:

Indeed, Pop Stars and Wall Street Execs are among the only ones who can afford this type of lavish lifestyle while most of the world can only look and salivate.

We’ve spoken many times about the correlation between soaring stocks and the awesome surge of crypto. Both have been caused by irresponsible money printing by the world’s central banks but here’s the main difference.

Stocks are rising because the rich have excess liquidity that they need to put to work. Bitcoin is rising because the middle class is being backed into a corner. Savings in the bank are being punished. So people feel compelled to take on excessive risk in order to maintain their wealth.

Stocks are rising because the rich have excess liquidity that they need to put to work. Bitcoin is rising because the middle class is being backed into a corner. Savings in the bank are being punished. So people feel compelled to take on excessive risk in order to maintain their wealth.

It started with the lower middle class but as Bitcoin gains traction it spreads to the next rung up until we reach the top. Lately, we’ve been climbing faster and faster and should soon reach the top.

Goldman Sachs’ CEO was on TV yesterday with Mike Bloomberg bashing bitcoin. Those guys are at the top of the top and certainly have the most to lose from a tectonic shift in the economy. So we should expect them to defend their position with everything they got. Will be interesting to see how long they last.

Market Overview

The Dow Jones yesterday pulled off it’s most impressive single day gains since Trump took office. After bursting through the 24K barrier on the promise of a Senate Tax vote it just kept going.

Though the Senate vote has now been delayed it doesn’t seem to have affected anybody’s sentiment on the markets. Stocks in Asia are doing great, except for the China50, which is down on some poor manufacturing data. The Europen opening bell was notably flat this morning.

Oil is holding steady after OPEC delivered the exact amount of production cuts as the market ordered. Gold is holding near the bottom of it’s range. We should pay close attention to the short term support line at $1265 (yellow line) which is gaining increasing importance lately.

Bitcoin Network

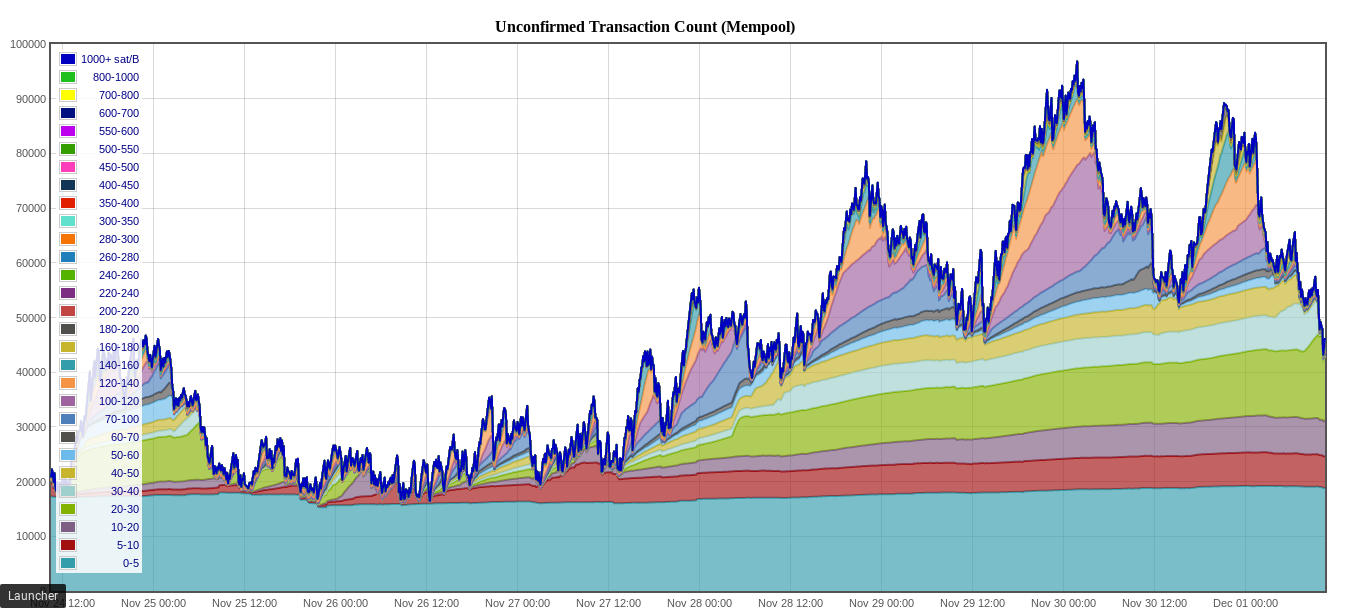

One of the biggest deciders on the price of bitcoin going into the weekend will likely be the network’s ability to process transactions in a smooth fashion. Lately, we’ve been seeing the bitcoin blockchain approaching the limits of its capacity.

This morning, the number of unconfirmed transactions is less than 50,000 again. We can see a notable dip in the chart of the mempool.

However, the number of transactions per second has ticked up again from 4.18 yesterday, today it’s up to 4.24. If we see a sustained level much higher than this we could get to a situation where payments are delayed or even canceled.

Wall Street Adoption

With the added Fud from Wall Street, Bitcoin is now at a decision point. One tool that may give us a hint on where the graph may be heading is the fibbonacci retracement tool.

The Fib Indicator shows us how far a pullback is likely to take us given the mathmatical patterns found in nature. So let’s take a look at bitcoin’s awesome rise so far this year and where a pullback is likely to lead.

Right now, the 38.2 retracement line is sitting near $7,300 a coin.

The next pattern that I’ve been tracking is the breakout levels. Every time bitcoin breaks out to a new all time high, it seems to surge for a bit and then pullback to test the previous all time high as a support level.

The last major breakout we had was when it punctured $8,000 in the second half of November.

So according to this analysis, if history repeats itself, we should find ourselves just under $8k before turning around and going to the sky. Of course, this is a highly unpredictable market so all the usual disclaimers apply.

Have an awesome weekend!!

![Reltex Group Reviews: Explore business opportunities by Trading [reltexg.com]](https://comparic.com/wp-content/uploads/2023/12/image001-218x150.jpg)

![Mayrsson TG Reviews: Why Choose Crypto-Trading with Them? [mayrssontg.com]](https://comparic.com/wp-content/uploads/2023/12/image1-218x150.jpg)