CBOE Holdings, Inc. (NASDAQ: CBOE) today reported December and full-year 2016 trading volume and average revenue per contract (RPC) data on its website under the Quotes & Data section.

The data sheet, with a complete overview of 2016 trading volume for CBOE Holdings, including Chicago Board Options Exchange® (CBOE®), C2 Options Exchange (C2) and CBOE Futures Exchange (CFE®), can be found at www.cboe.com/monthlyvolrpc.

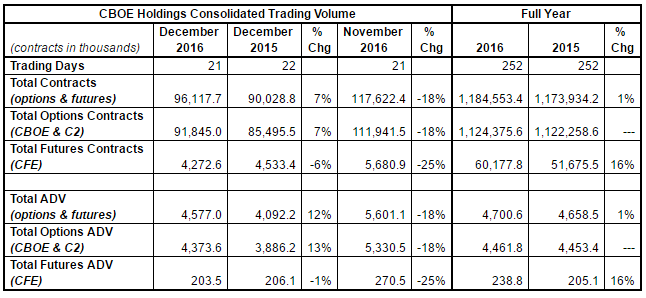

Several trading records were set for the year. Total volume and average daily volume (ADV) in index options trading at CBOE reached new all-time highs for the fourth consecutive year in 2016 with 430.7 million and 1.7 million contracts, respectively, each up 6 percent from 2015. Total volume and ADV in S&P 500®Index (SPX) options trading at CBOE reached new all-time highs for the fourth consecutive year in 2016 with 258 million and 1 million contracts, respectively, each up 9 percent from 2015.

Trading in CBOE Volatility Index® (VIX®) futures at CFE set new records for total volume and ADV for the seventh consecutive year in 2016 with 60.2 million and 238,773 contracts, respectively, up 16 percent from 2015. VIX futures at CFE set record total volume in non-U.S. trading hours with 6.6 million contracts, up 46 percent from 2015’s 4.6 million contracts.

CBOE Holdings Trading Volume: December and Full Year

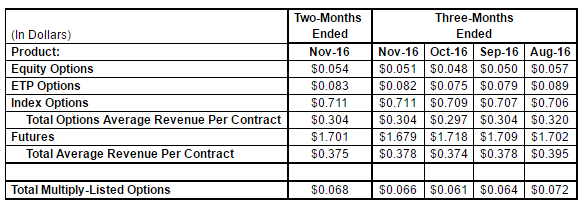

Fourth-Quarter 2016 RPC Guidance

The company currently expects average revenue per contract (RPC) by product category for the fourth quarter of 2016 to be in line with the amounts noted below for the two-months ended November 30, 2016. These expectations are estimated, preliminary and may change. There can be no assurance that our final RPC for the three-months December 31, 2016 will not differ materially from these expectations.

The following represents RPC based on a two-month and a three-month rolling average, reported on a one-month lag. The average RPC represents total transaction fees for CBOE, C2 and CFE recognized for the period divided by total contracts traded during the period. Average transaction fees per contract can be affected by various factors, including exchange fee rates, volume-based discounts and transaction mix by contract type and product type.

About CBOE Holdings:

CBOE Holdings, Inc. (NASDAQ: CBOE) is the holding company for Chicago Board Options Exchange (CBOE), CBOE Futures Exchange (CFE), and other subsidiaries. CBOE, the largest U.S. options exchange and creator of listed options, continues to set the bar for options and volatility trading through product innovation, trading technology and investor education. CBOE Holdings offers equity, index and ETP options, including proprietary products, such as options and futures on the CBOE Volatility Index (VIX Index) and S&P 500 options (SPX), the most active U.S. index option. Other products engineered by CBOE include equity options, security index options, Weeklys options, FLEX options, and benchmark products such as the CBOE S&P 500 BuyWrite Index (BXM). CBOE Holdings is home to the world-renowned Options Institute, Livevol options analytics and data tools, and www.cboe.com, the go-to place for options and volatility trading resources.

![Reltex Group Reviews: Explore business opportunities by Trading [reltexg.com]](https://comparic.com/wp-content/uploads/2023/12/image001-218x150.jpg)

![Mayrsson TG Reviews: Why Choose Crypto-Trading with Them? [mayrssontg.com]](https://comparic.com/wp-content/uploads/2023/12/image1-218x150.jpg)

![Bitogrand Opinion: Leveraging Trade Indices [bitogrand.com]](https://comparic.com/wp-content/uploads/2023/09/bitogrand-218x150.png)