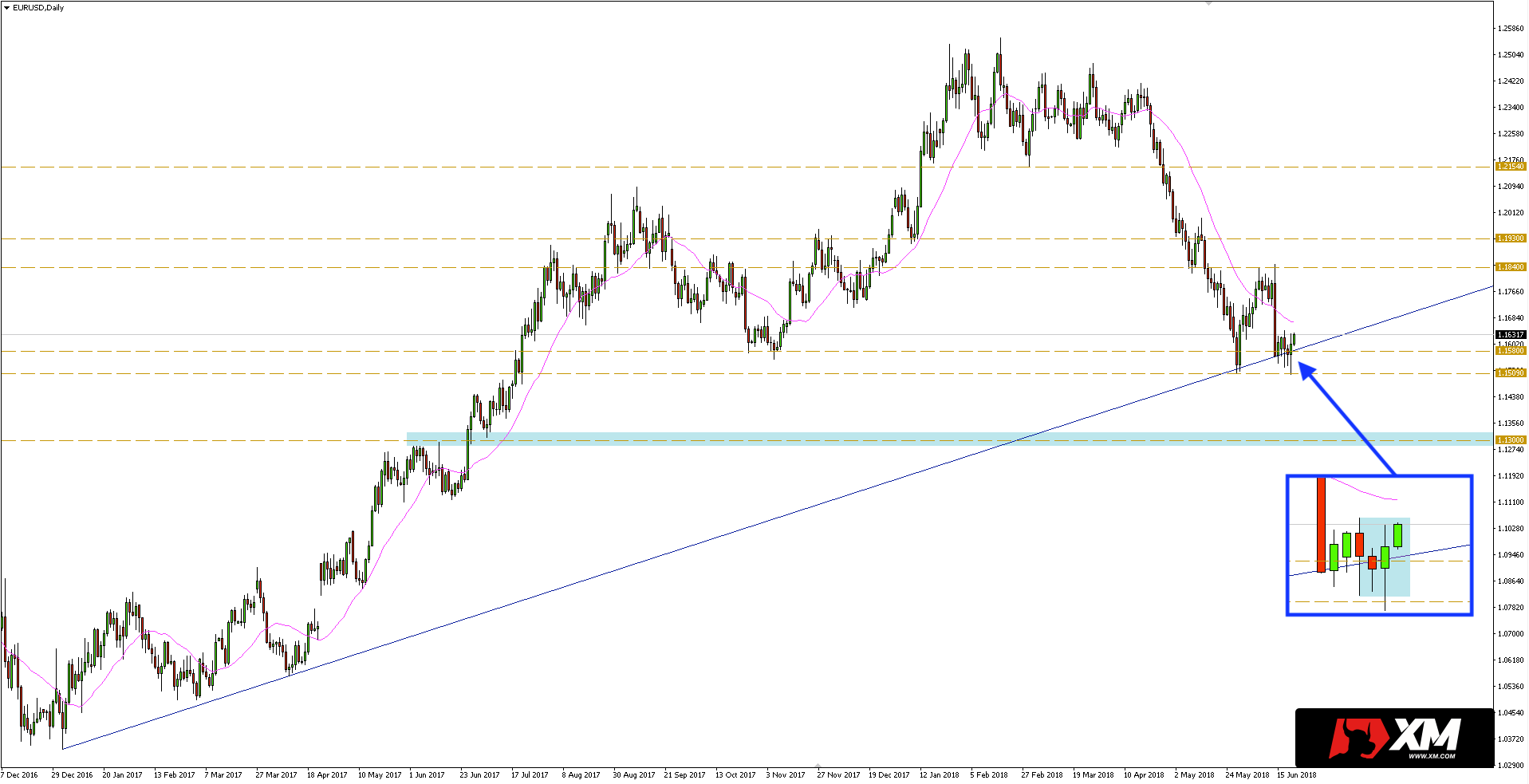

Quotations of the main currency pair once again test this week’s key support confluence zone, where the horizontal area between 1.1509 / 80 coincides with the upward trend line from last year’s minimum.

It was on this support that the Fakey formation was formed yesterday, indicating a potential reversal / upward movement. It is better visible on the magnificated part included in the daily chart below.

The range from Tuesday is the mother candle, which entirely includes trade during the Wednesday session, which gives us the formation of the inside bar. In turn, yesterday there was an attempt to break the bottom of the range, which turned out to be unsuccessful, and additionally, the day candle closed above the maximum inside the bar. Thus, the above-mentioned Fakey formation was formed, which gives potential for growth towards 1.1840.

It is worth to take a look at the 4-hour chart, which also shows the secondary levels of resistance that the bulls will have to deal with. Currently, there is a challenge for them overcoming the area within 1.1645. The next level of defense on the way to 1.1840 is 100-pips lower, at 1.1740.

Alternatively, negating the Fakey formation / yesterday’s lows, will open the way for declines towards the round 1.1300 level.

Alternatively, negating the Fakey formation / yesterday’s lows, will open the way for declines towards the round 1.1300 level.