British ONS after 10:30 published February report from the local labor market. As far as the main indicator – claimant count – noted positive declines, the Average Earning inflation expectations of investors failed. It is that this second factor caused depreciation of the GBP.

Last month, number of people applying for unemployment benefits decreased by 42.5 thousand. The report for February expected far more modest decline (-5,000), but the claimant count positively surprised investors (-11,300). This allowed to reduce further the unemployment rate by 0,1p.p. to 4.7%.

What failed the expectations of investors, is another month in a row lower than expected wages inflation. Average wages excluding bonuses increased on a monthly basis by + 2.3% (forecast 2.5%, previous 2.6%), while taking into account the bonuses of + 2.2% (forecast 2.4%, previous 2.6 %).

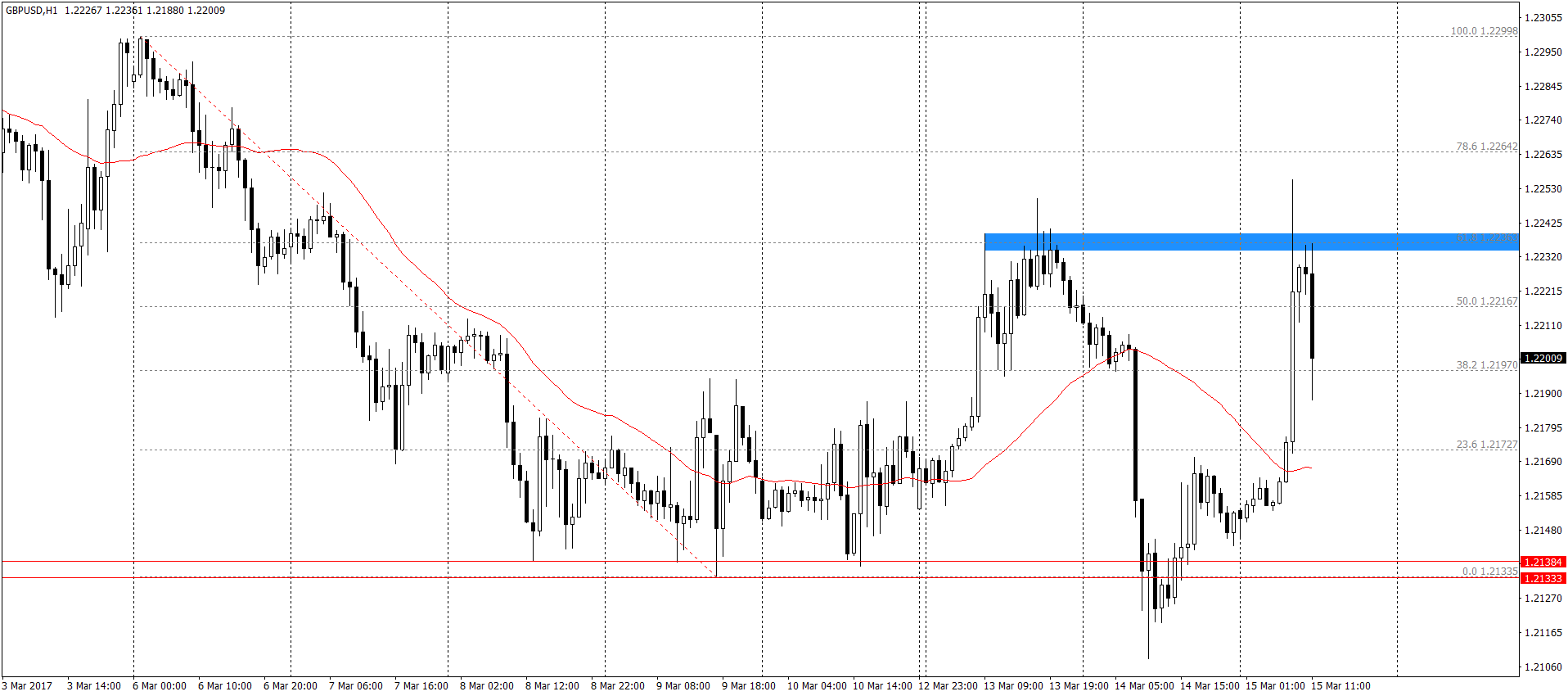

In case of pound sterling this publication triggered rapid declines. At first was tested intraday resistance connected to the 61.8% Fibo abolition, ultimately price slides in vicinity of 1.2200:

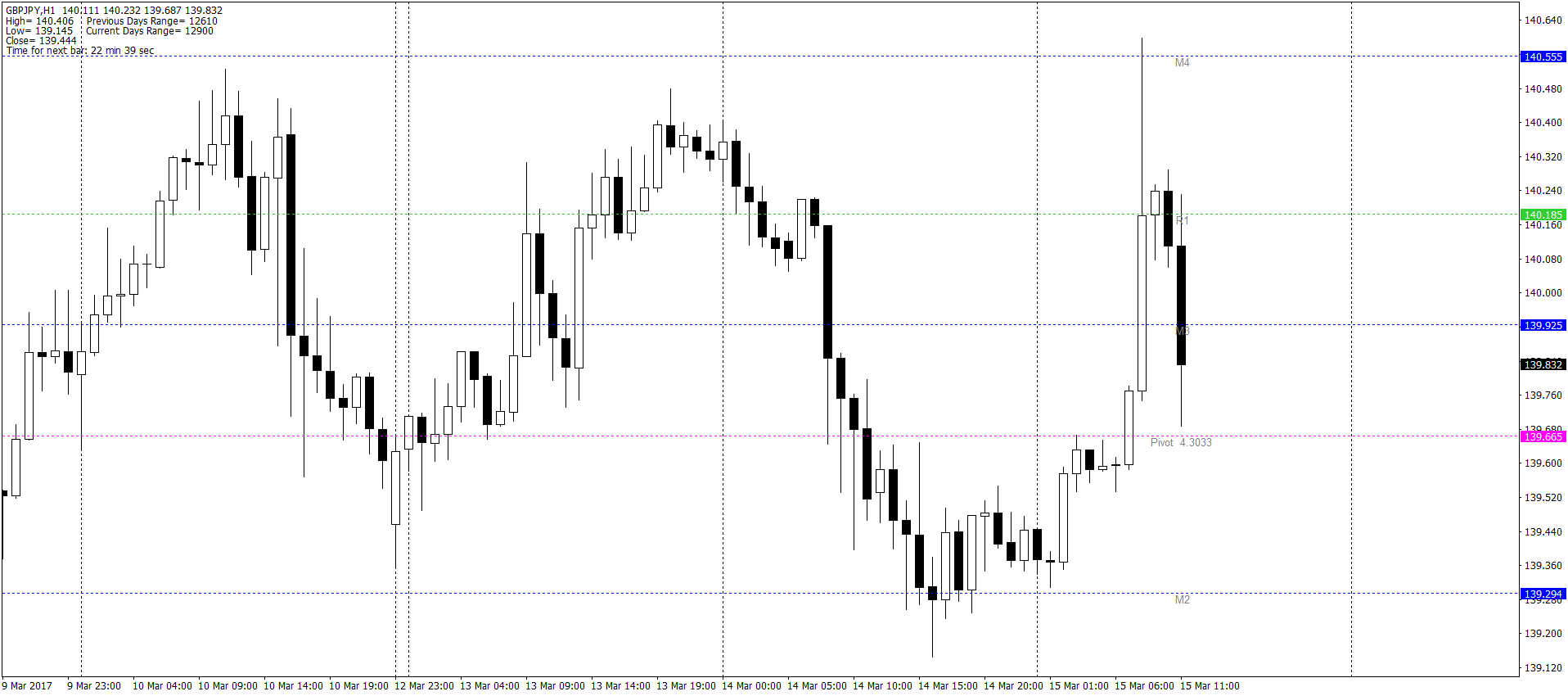

On EUR/GBP price rose in the first 5 minutes after the publication to more than 30 pips and on the GBP/JPY close to 40.Those moves practically abolished morning outbreak on GBP pairs. Before a stronger depreciation of GBP still protects us level of daily Pivot Point 139.66.