Ichimoku is an investment strategy of trend following, it works great on H4, D1 and higher time frames. In this series of articles I present my setups and observations using Ichimoku, supports and resistances and Price Action patterns. You can also check previous Ichimoku overview.

Ichimoku is an investment strategy of trend following, it works great on H4, D1 and higher time frames. In this series of articles I present my setups and observations using Ichimoku, supports and resistances and Price Action patterns. You can also check previous Ichimoku overview.

After yesterday’s FOMC meeting maybe there will be more action on the charts. I secured my position on Cable in protection against strong volatility during conference, more details below.

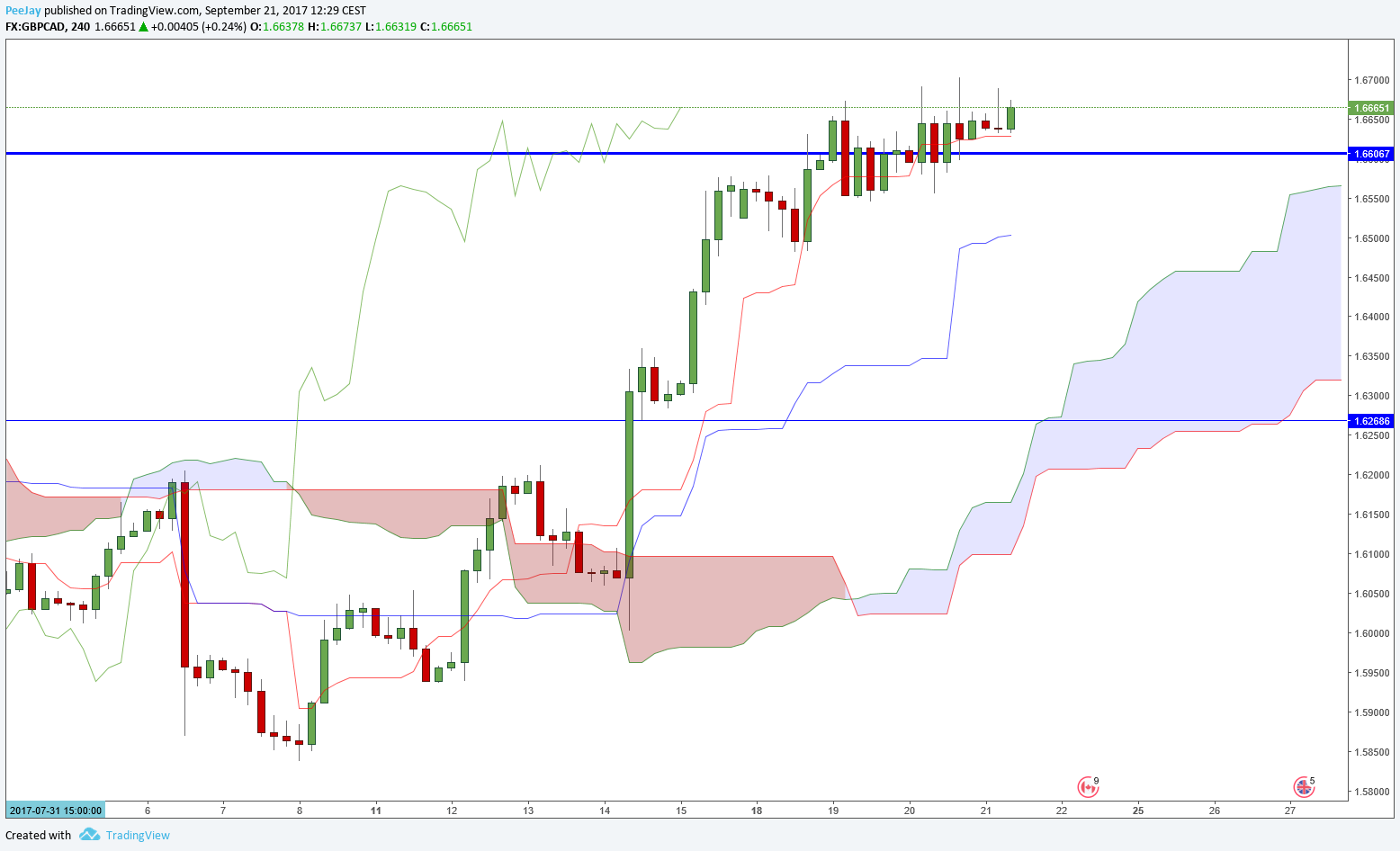

GBPCAD

On the H4 chart we can see that price broke through the resistance from daily chart on 1.6600, but it was really struggling with it. Currently we can think about opening long position. Tenkan is above Kijun, cloud is dynamically directed upwards.

GPBUSD

Yesterday in the evening I decided to secure this position against strong volatility connected with FOMC decision. In the beginning there was a strong appreciation and the pair had 2% profit, but later it fell and my position was closed on BE. Today I opened long again, technical situation is not any different. I opened this position with 24option broker which has in its offer more than 200 financial symbols.

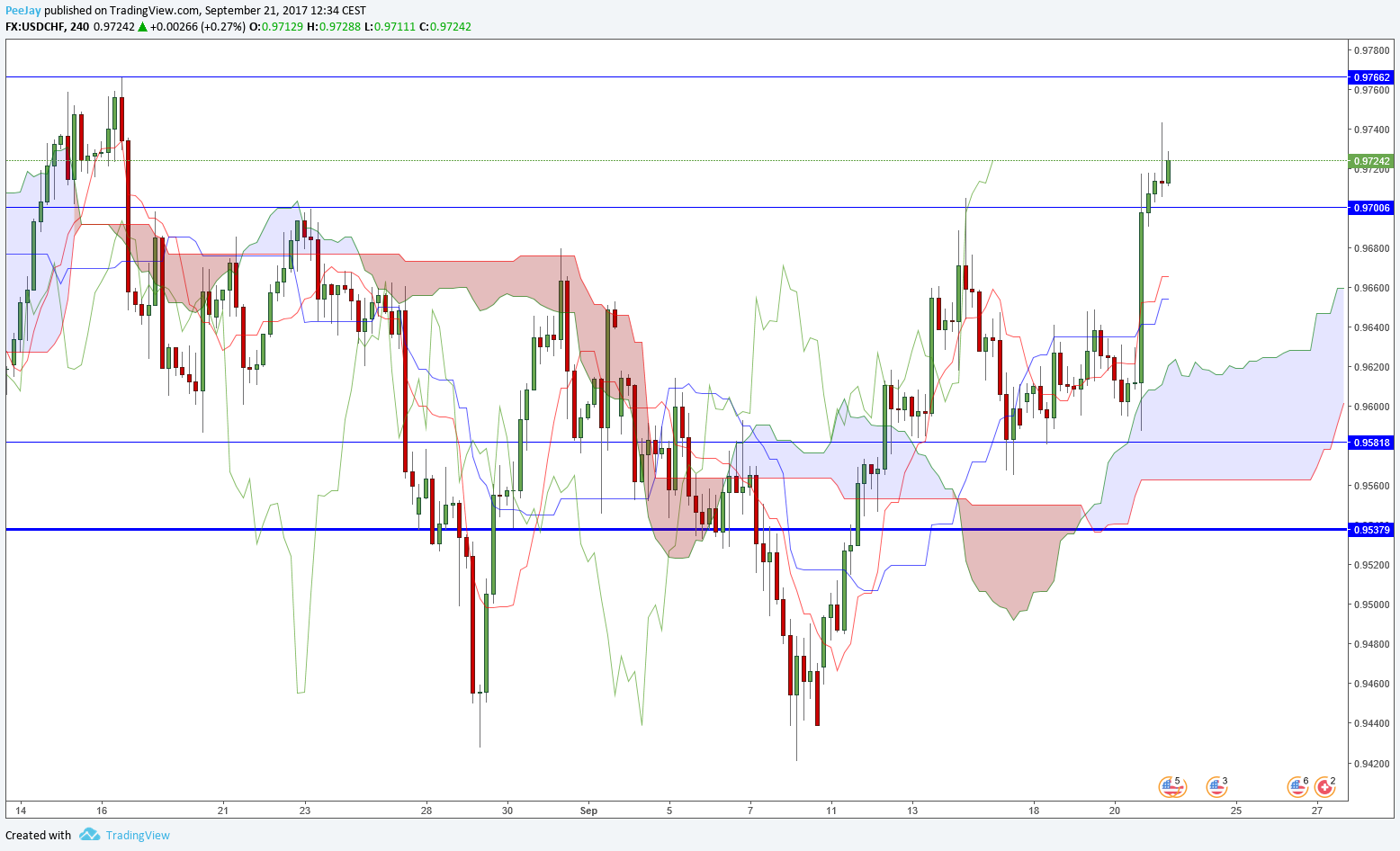

USDCHF

Price on H4 chart broke above upper band of consolidation. Kumo cloud is bullish and Tenkan line is above Kijun. We can open buy limit order close to broken level, so we have good risk/reward ratio.

USDJPY

Situation over here is really similar to the one on USDCHF. Here it is even more clear, sentiment is strongly bullish. We can open long position with the target on 113.50.