Interactive Brokers Group, Inc. (NASDAQ GS: IBKR), an automated global electronic broker, today reported its Electronic Brokerage monthly performance metrics for July.

Brokerage highlights for the month included:

- 694 thousand Daily Average Revenue Trades (DARTs), 15% higher than prior year and 2% higher than prior month.

- Ending client equity of $109.8 billion, 44% higher than prior year and 5% higher than prior month.

- Ending client margin loan balances of $23.7 billion, 49% higher than prior year and 4% higher than prior month.

- Ending client credit balances of $46.6 billion, 13% higher than prior year and 2% higher than prior month.

- 436 thousand client accounts, 21% higher than prior year and 2% higher than prior month.

- 373 annualized average cleared DARTs per client account.

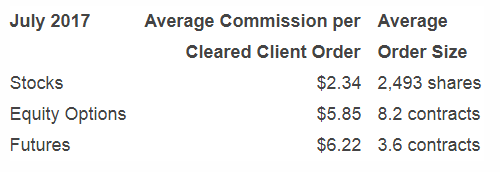

- Average commission per cleared client order of $3.95 including exchange, clearing and regulatory fees.

Key products

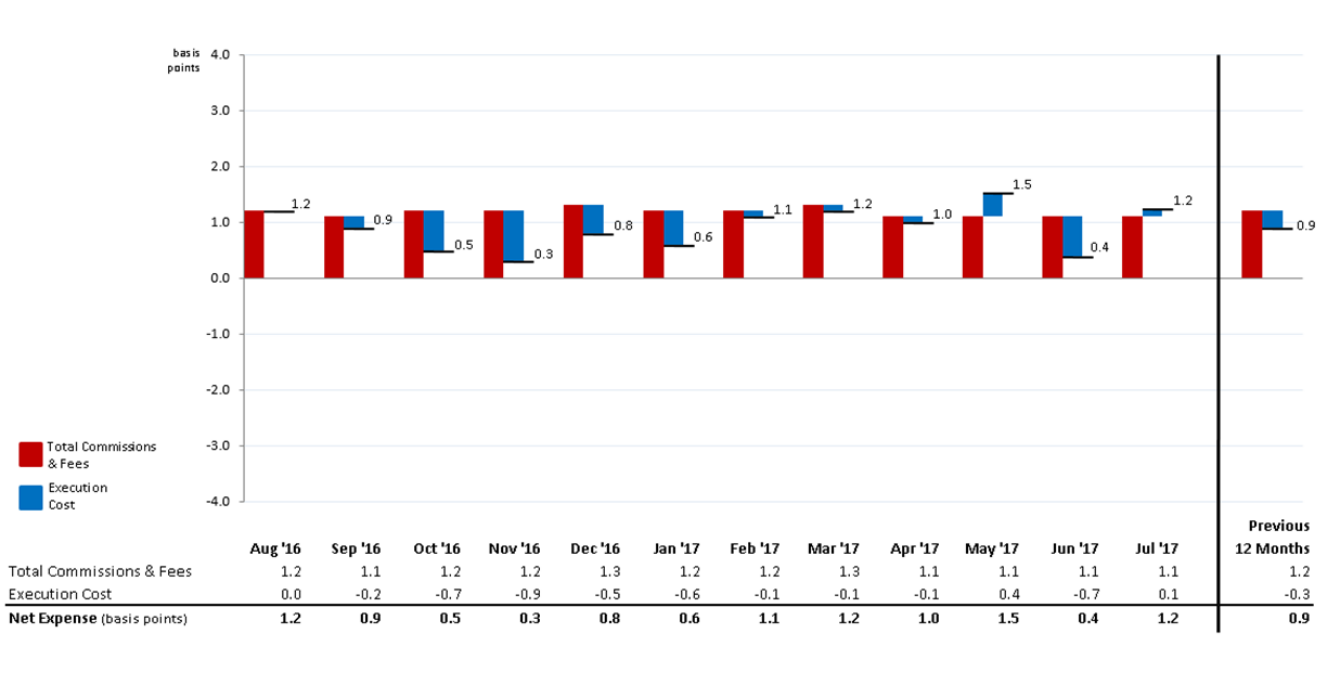

Interactive Brokers Stock Trading Expense Summary

For the full multimedia release with graph go to Interactive Brokers website

![Reltex Group Reviews: Explore business opportunities by Trading [reltexg.com]](https://comparic.com/wp-content/uploads/2023/12/image001-218x150.jpg)

![Mayrsson TG Reviews: Why Choose Crypto-Trading with Them? [mayrssontg.com]](https://comparic.com/wp-content/uploads/2023/12/image1-218x150.jpg)

![Bitogrand Opinion: Leveraging Trade Indices [bitogrand.com]](https://comparic.com/wp-content/uploads/2023/09/bitogrand-218x150.png)