![]() From Investor to Scalper – series of studies created in cooperation with broker BDSwiss, in which we take a financial instrument and the analysis includes a detailed look at the value from the monthly chart and ending with H4/H1.

From Investor to Scalper – series of studies created in cooperation with broker BDSwiss, in which we take a financial instrument and the analysis includes a detailed look at the value from the monthly chart and ending with H4/H1.

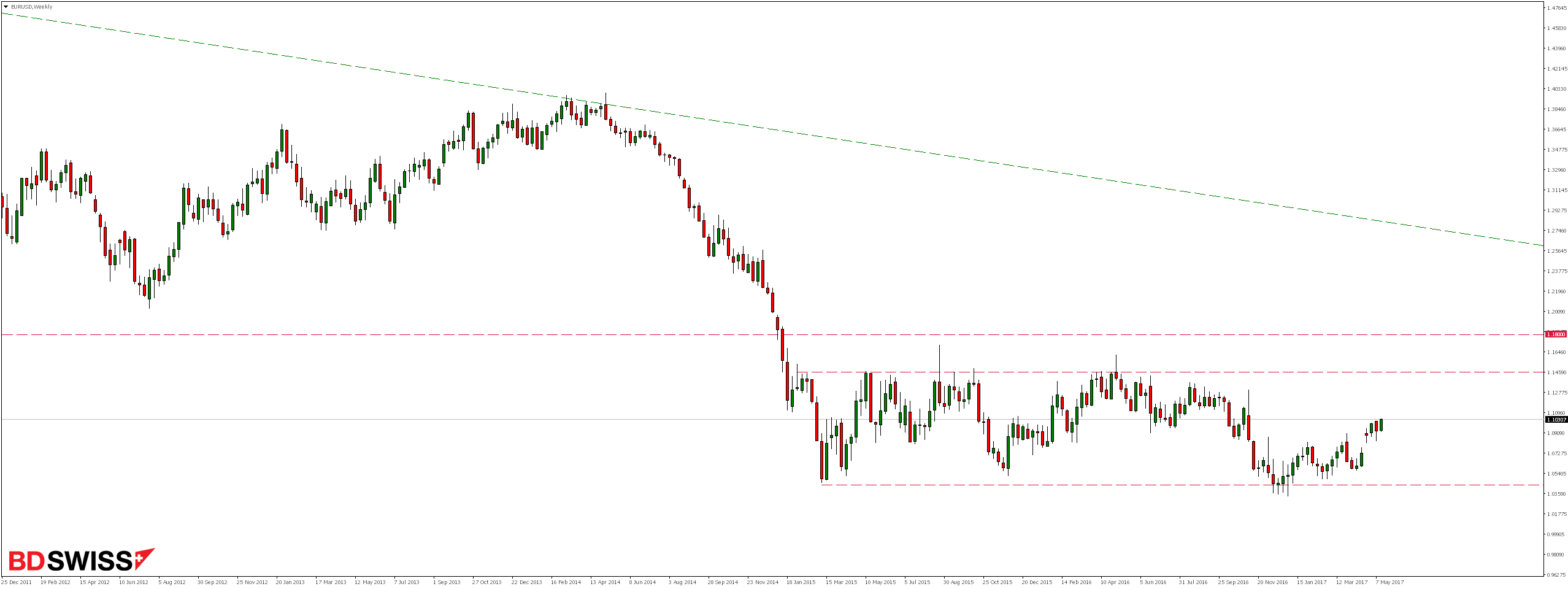

The EURUSD currency pair has moved south since 2008. As a result of breaking in January 2015 support zones around 1.1800 the pair have been consolidating for over two years, with lower limit coinciding with the 70.7% Fibonacci correction from earlier gains and the Fibonacci retracement of 38.2% from the last downtrend.

Looking on weekly chart, we will see that market in late December/January tested and rejected the lower limit of current consolidation and since than moved smoothly north. As a result, in the near future, we expect to be able to re-test the upper limit of the box.

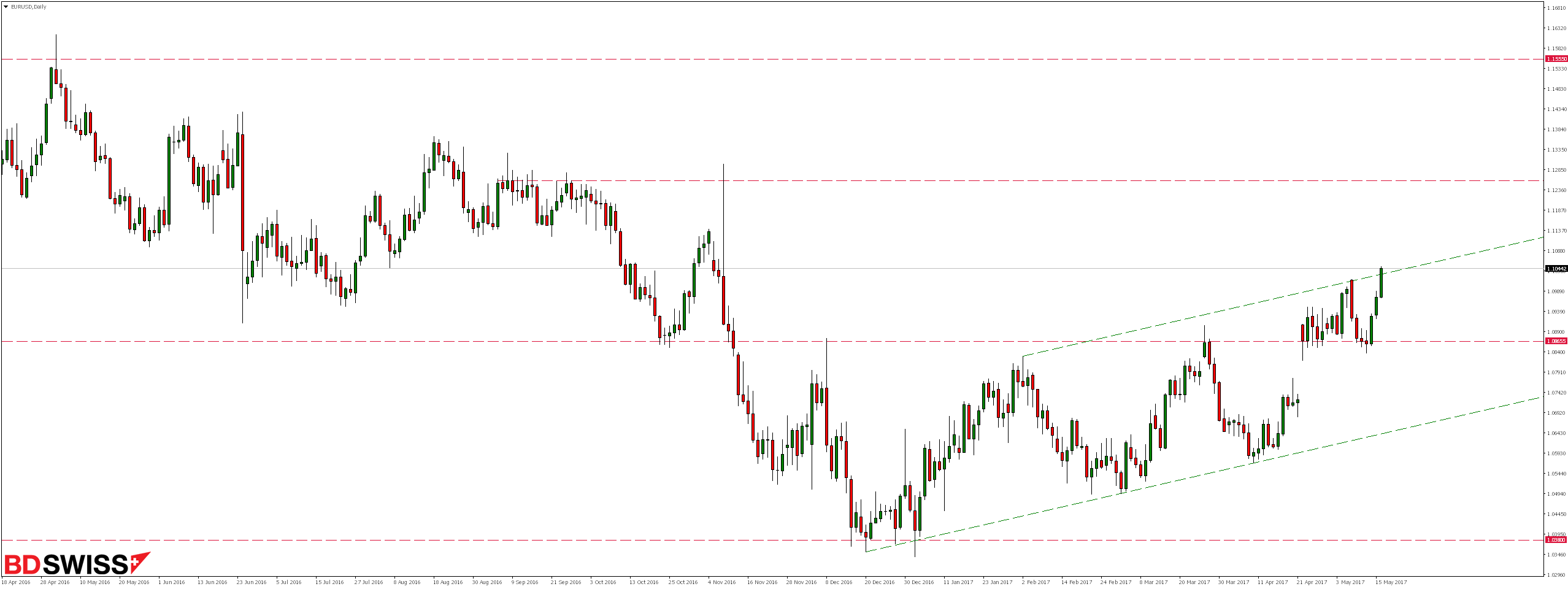

This may also be supported by the fact that market after re-test dropped to vicinity of 1.0865 and from last Friday again we see dynamic gains and efforts to break top of the long-term growth channel. If this trend continues, the first supply response would be expected only in 1.1135 resistance range, which is almost 100 pips from the current level.

On H4 chart, we note that as a result of today’s dynamic rally, pair EURUSD has reached the highest levels since last year.

Looking at the H1 chart, we can see that a chance to join the upswing could be a downward correction and a re-test of today’s 1.1015 level, whose rejection could signal continuation of the upswing.

BDSwiss offers its customers a sophisticated and reliable tool to invest in the market CFD/Forex. Especially novices can result in the safe introduction into the world of financial investments. The educational program of seminars and live comments market traders meet the expectations of those who want to learn how to invest successfully, which is building a great partnership between BDSwiss and its customers.