A few months ago, I had the pleasure of debating the potential of bitcoin with a person who manages upwards of a Billion Dollars in financial assets. I showed him some incredible gains that were being made by myself and my clients and made the argument that cryptocurrencies could eventually come to replace government money.

A few months ago, I had the pleasure of debating the potential of bitcoin with a person who manages upwards of a Billion Dollars in financial assets. I showed him some incredible gains that were being made by myself and my clients and made the argument that cryptocurrencies could eventually come to replace government money.

His response was quite static. If anything he laughed at the notion saying that the gains so far were unsustainable and the world doesn’t change overnight. Well, I hope he’s right. Such a drastic change in such a short amount of time could certainly have extremely negative consequences.

Think about the Arab Spring in 2011 when many Middle Eastern countries suddenly decided that they wanted a full democracy. Though this was well intended only a few countries managed to actually make the switch and even those are still experiencing political turmoil or at best a change in the dictatorship. In countries like Yemen and Syria, the dire consequences are still being felt.

Still, the amount of money going into the crypto market at the moment is only a drop in the bucket compared to what’s happening to the stock markets right now. So we’re certainly not in danger of toppling the system anytime soon.

However, the hordes of private investors coming into the markets because of cryptos at the moment are unprecedented. At eToro we’re witnessing this boom first hand, which has prompted our CEO and founder Yoni Assia to write this special message for you and all of our clients.

As always, please feel free to contact me directly with any questions or comments.

Market Overview

As expected the US Federal Reserve did indeed raise their interest rate yesterday for the third time this year. The move is just behind their target at the beginning of the year, which was to raise it four times. They expect to continue gradually raising rates an additional three times in 2018.

This gradual pace of tightening does in fact mean that money will remain cheap for the foreseeable future, which has sent stocks up and the Dow Jones to a new record high.

It’s not all “life of the party” though. The S&P500 in the USA declined slightly as did Asian shares this morning. The European opening was notably flat with a splash of small but nevertheless red numbers as they await some big news.

2 More Big Decisions Today

This morning we got an interest rate announcement from the Swiss National Bank, which was fairly uneventful. Still to come, today we are expecting interest rate decisions from both the European Central Bank (ECB) and the Bank of England (BoE).

Neither is expected to make any changes. As we said, money will likely remain cheap. Europe is still going with their money printing program and even though they will reduce the amount of cash injections in January, they will still be pumping €30 Billion into the system every month.

Head of the ECB Mario Draghi will likely do his best to be boring today. After all, the consequences of their printing program are not under any serious scrutiny at the moment.

Over in London however, Mark Carney from the BoE is in a bit of a pickle. With Inflation getting out of hand and salaries remaining stagnant, the good people of England will be turning to the Canadian born Governor for answers.

However, his hands are a bit tied as uncertainty mounts as to what the final Brexit situation is going to look like.

Prime Minister May has already concluded phase one of the Brexit talks, by the skin of her teeth. Today, she heads to a two-day summit in Brussels to begin phase two. Unfortunately for her, the UK Parliament has just passed a bill giving themselves the right to veto any final Brexit agreement. The Woman just can’t seem to catch a break.

The news doesn’t seem to have affected the GBPUSD much and it is holding well just below 1.3450. Carney’s speech today could certainly swing things a bit depending on what is said. Any thought of raising interest rates would likely push it up a bit.

Cryptosphere

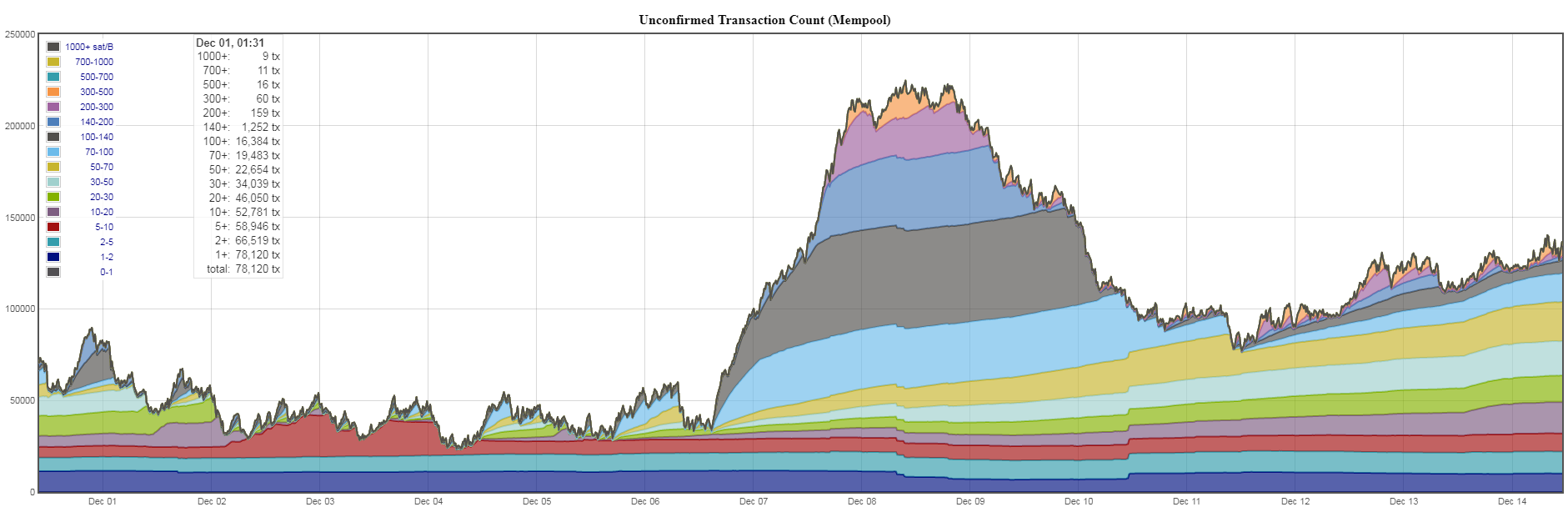

The bitcoin blockchain is still experiancing some stress with the number of unconfirmed transactions hovering steadily around 125,000 and the average time to confirm a transaction now close to 5 hours. Bitcoin is now coming down slightly as cryptopeeps begin to diversify into other digital assets.

Ethereum on the other hand seems to have their cat infestation under control with the two main crypto-kitties smart contracts now only accounting for about 8.63% of the total transactions on the blockchain. As the second most established crypto, Ethereum is seen by many as a safe haven. As such the rises have not been as drastic as some of the others and it’s only up 71% in the last week.

The chikun (Litecoin) excitement seems to be fading as the Wall Street crypto buff Mike Novogratz has called the top. It was certainly a good run. Many long term investors are staying in on this one but the short term cryptotraders are looking for the next big swing.

Ripple on the other hand, is currently seeing a liquidity crunch. As a private blockchain, they’re not subject to some of the scaling issues that are found in other cryptocurrencies and even very large Ripple transactions tend to go through in seconds flat.

The price per XRP token is now testing 60 cents. To think it was less than a penny on March 29th.

Let’s have a spectacular day ahead!

![Reltex Group Reviews: Explore business opportunities by Trading [reltexg.com]](https://comparic.com/wp-content/uploads/2023/12/image001-218x150.jpg)

![Mayrsson TG Reviews: Why Choose Crypto-Trading with Them? [mayrssontg.com]](https://comparic.com/wp-content/uploads/2023/12/image1-218x150.jpg)