Wednesday’s session, although much more volatile than those earlier this week passed relatively quietly. This was supported by lack of important macroeconomic publications, which translated into a intensive drop of EUR/USD, USD/JPY and USD/CAD. Positive surprise met us last night when API published the latest estimates of US oil stocks.

Wednesday’s session, although much more volatile than those earlier this week passed relatively quietly. This was supported by lack of important macroeconomic publications, which translated into a intensive drop of EUR/USD, USD/JPY and USD/CAD. Positive surprise met us last night when API published the latest estimates of US oil stocks.

According to newest API publication stock of black gold rose in the US by 4.8 million barrels. It’s a definite shift from earlier forecasts which assumed a decline of 1.5 million barrels. The estimated increase in inventories is thus the largest in six weeks, however, the markets seem to be waiting for the official confirmation of these revelations. The reason for uncertainty in investing in oil is the latest discord between the estimates of the API, and the official reading of the EIA. Just before Christmas, on December 24 we learned about a possible drop in inventories by more than 4 million barrels, while published the next day, official data showed a rise in inventories by 2.2 million barrels. The effect of this is that in spite of good data coming from the API, crude WTI ended yesterday’s session in red:

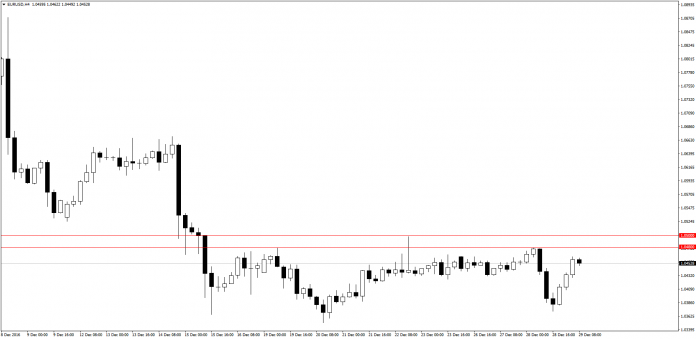

On minus are also some of the major currency pairs. EUR/USD, which for most part of yesterdays session sharply declined, now is making up the losses:

What yesterday looked like a bullish breakout from triangle formation on the chart USD/JPY fairly quickly turned into a strong bear rally, which not only endured yesterday’s gains, but defeated also level of the local last low:

Current trends on the major currency pairs will likely continue until the US session. No important macroeconomic publications in the morning, as well as their small number in the afternoon shows that Thursday’s trade will be quite similar to that of yesterday.

During the day, we will focus primarily on the most recent data from the US labor market. Scheduled at 14:30 publication of initial Jobless Claims which is a report on the number of submitted applications for unemployment benefits and may be the cause of changing sentiment on US dollar.

The second publication to which it is worth paying attention during today’s session is the EIA report for US oil stocks. Forecasts indicate a decrease in inventories by just over 2 billion barrels. If actually will be decline in inventories of crude oil prices and exchange rates of currencies correlated with it CAD and NOK should grow slightly.