NZDCHF – I described this pair on Tuesday in the analysis – “NZDCHF – Double Top, Head and Shoulders or maybe Inside Bar? . We had a bunch of Price Action formations, and in a couple of hours, we were to get a message from the Reserve Bank of New Zealand regarding future monetary policy and interest rates. After the announcement of the data, the New Zealand dollar suddenly gained in value, over 1% in relation to most currencies, including the USD.

The price rose from Inside Bar and reached the downward trend line, which is also the resistance of the channel in which the price has been moving since May 2017.

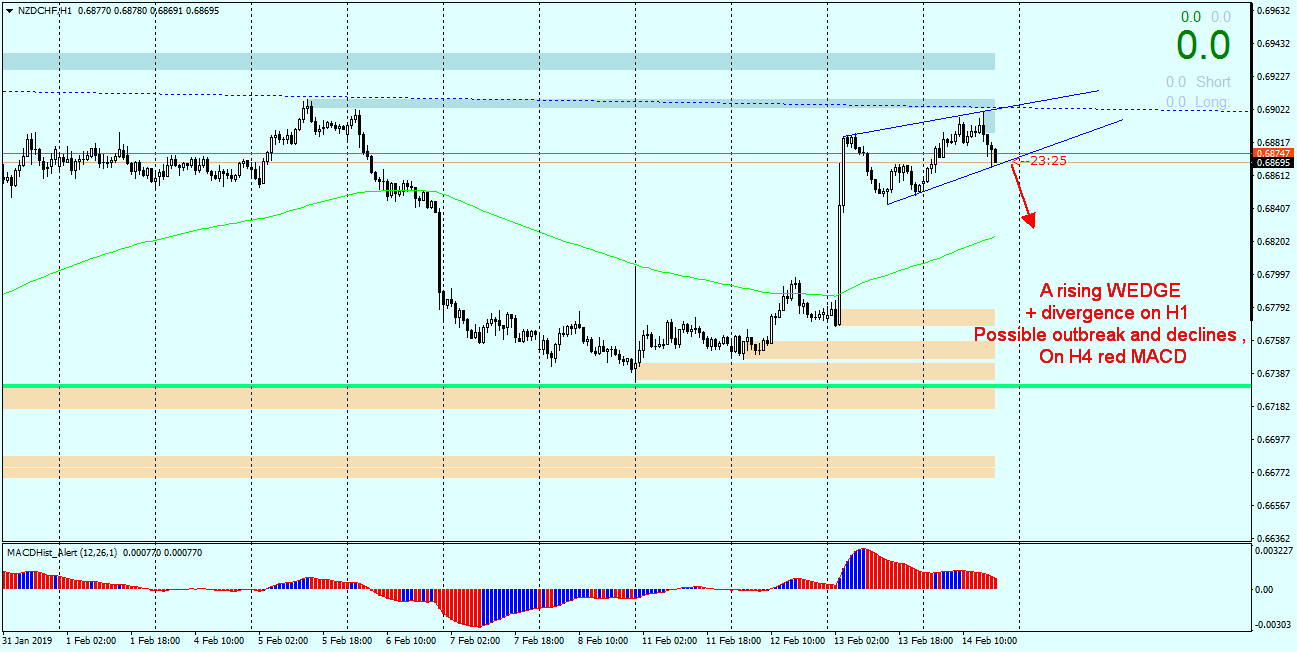

This is yet another attempt to beat it in the last few days. On chart H1 a trend reversal formation was formed – a rising wedge. There is a high probability of a downward breakout from this pattern, on chart H4 there is a maximum on MACD supporting the downward stance. Since I am analyzing this on H1, the range of possible falls may be limited to the nearest support, which is, in this case, the average EMA144.