The key to trading with the main trend

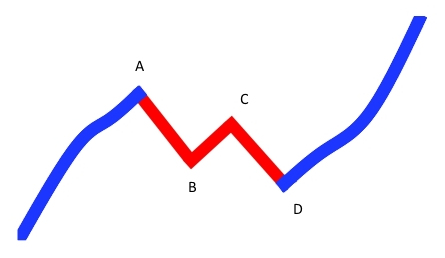

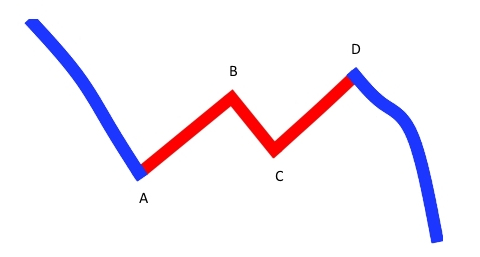

A simple ABCD correction appears in trends and in the movements opposed to the main trend.

This can be seen in every time-frame (TF). An ideal correction is when AB = CD (they have the same length).

Another type of correction, which is described in the next article is the situation when the length of the CD is to AB at one of the Fibonacci levels. That kind of correction is also described in Elliott Wave theory where it is referred to as the ABC three-wave move.

Knowledge of corrections is very important in trading.

After the movement against the main trend, the trader will expect a rebound in line with the main trend and a second movement opposite to the trend.

After forming a full correction, traders can more confidently enter into the market in accordance with the main trend. Ability to follow the trend is one of the keys to earn money on financial markets. The best moment to join the trend is to enter after a correction is complete.

Traders do this in two ways:

1) Entry into a long position after the price breaks above point A (uptrend), or a short position after price breaks below point A (downtrend)

2) Using tool “Fibonacci Expansions” to measure section AB and putting it at point C will forecast potential position of point D. In this variant, the problem is few corrections are a simple ABCD