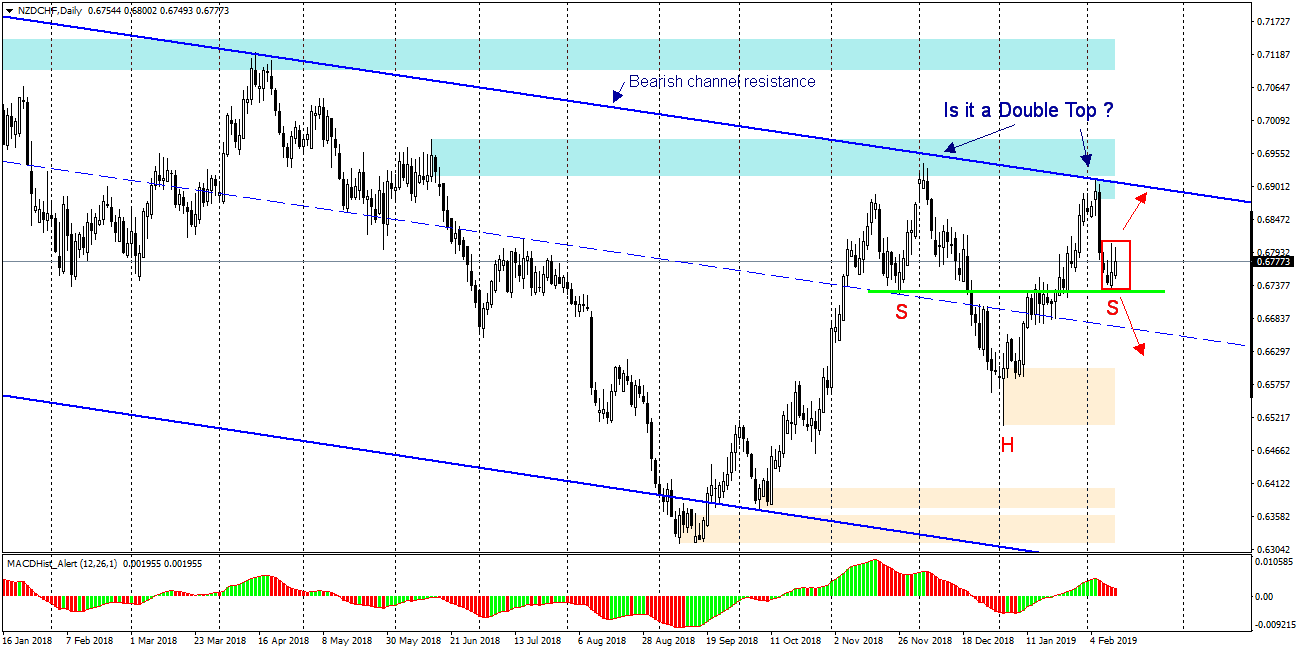

The NZDCHF pair has been moving since May 2017 in a declining channel whose height, i.e. the distance between support and resistance, is 620p.

In December 2018 and a week ago the price reached the resistance of the channel, but each time it was rejected and it does not break through the upper edge of the channel. Both unsuccessful attempts to overcome this barrier have created formations similar to a double top, which would indicate declines.

Looking at the graph we can also see the inverted Head & Shoulders pattern, the shoulder line is marked in green, it is a trend reversal pattern and suggests growth after crossing the neck line, which in this case is the resistance of the channel.

To make it more interesting, today’s daily candle is contained in yesterday’s candle forming the Inside Bar formation. So the question arises which formation will show us the direction of movement on this pair.

I think that the information from New Zealand will turn out to be the key information, where at 2 a.m. the Central Bank will decide on interest rates, and at 3 a.m. we will know the details of the future monetary policy.

Recent statements by the Chairman of the RBA (Australia) indicate that they are open to interest rate cuts again due to tensions in trade between the US and China, and the New Zealand economy is in the same boat, so I would not expect rhetoric other than the RBA and there is hardly any question of raising interest rates.

There is therefore a high probability that the NZD will weaken further, which in the case of the NZDCHF pair analysed here, would point to declines. The signal to enter the market and open a sell order may be to overcome the lower level of the Inside Bar and the H&S shoulder line. In this case, the nearest demand zone is around 0.6700, but I would recommend that you refrain from placing orders until Adrian Orr’s speech and get acquainted with his position on the nearest monetary policy of the RBNZ.