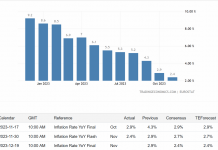

In an era of rising prices for raw materials and most industrial and agricultural products, capital is seeking protection against the effects of inflation. Traditional safe havens also include gold. Apart from inflation, another factor supporting the gold price is the ongoing Russian invasion of Ukraine. You could see how panicky gold reacted to the start of the military action on 24 February.

- Inflation and war in Ukraine – factors moving the gold price

- the double top and overcoming the neckline of the H&S could start a series of declines in gold

As the conflict escalated gold prices soared to $2050/oz and a double peak formation appeared on the chart. From 8 March the gold price began to fall, yesterday at its lowest point the price fell below $1900/oz. Yesterday’s sharp drop and then return above 1900 was due to news of a possible meeting between Putin and Zelenovsky and peace talks. Subsequent news that these were only unspecified dates cooled optimism in the markets somewhat. As you can see, gold is extremely susceptible to the information coming from Ukraine, so you should be prepared for any eventuality and carefully plan your trade on this instrument.

Technical analysis of Gold

We have no influence on the unexpectedly good or bad news that causes rapid movements in gold. So maybe it is better to look at the charts from the technical side?

On the H4 chart we can see the H&S formation, where the neckline is a very clear support for the price. Three consecutive attempts to break it failed and the price turned back north.

Breaking the neckline may initiate a period of declines on gold.

On Friday, 1 April, the data on new jobs in the USA will be published. The expectation is for 470,000 – if the current data is better, this could be a boost to gold’s declines as the chances of a US interest rate 50bp hike at the next Fed meeting, which is scheduled for 4 May 2022, will increase.

The above analysis is based on the PA+MACD strategy, a detailed description of which you can read HERE . I will talk more about the PA+MACD strategy applied to these currency pairs during the live trading sessions which you can attend from Monday to Friday.

More current analysis on the group : Trade with Dargo

LIVE TRADING SESSIONS- FREE ENTRY

I invite youtoday- Thursday, 31 of March at 13:00-14:00 GMT and also to my – Friday’s, 1th of April at 08:00-09:00:00 GMT live trading sessions here: https://www.xm.com/live-player/basic

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo