On Wednesday Fed Chair Yellen will testify in front of the House Financial Services Committee at 10 AM ET/14:00 GMT. The prepared text by Yellen will be released 90 minutes earlier at 8:30 AM ET/12:30 GMT. Yellen will repeat her comments on Thursday in front of the Senate Banking Committee at the same time. The Q&A session will be different but it can give us some info about Fed chair ideas on monetary policy.

On Wednesday Fed Chair Yellen will testify in front of the House Financial Services Committee at 10 AM ET/14:00 GMT. The prepared text by Yellen will be released 90 minutes earlier at 8:30 AM ET/12:30 GMT. Yellen will repeat her comments on Thursday in front of the Senate Banking Committee at the same time. The Q&A session will be different but it can give us some info about Fed chair ideas on monetary policy.Other key macro events for the week include:

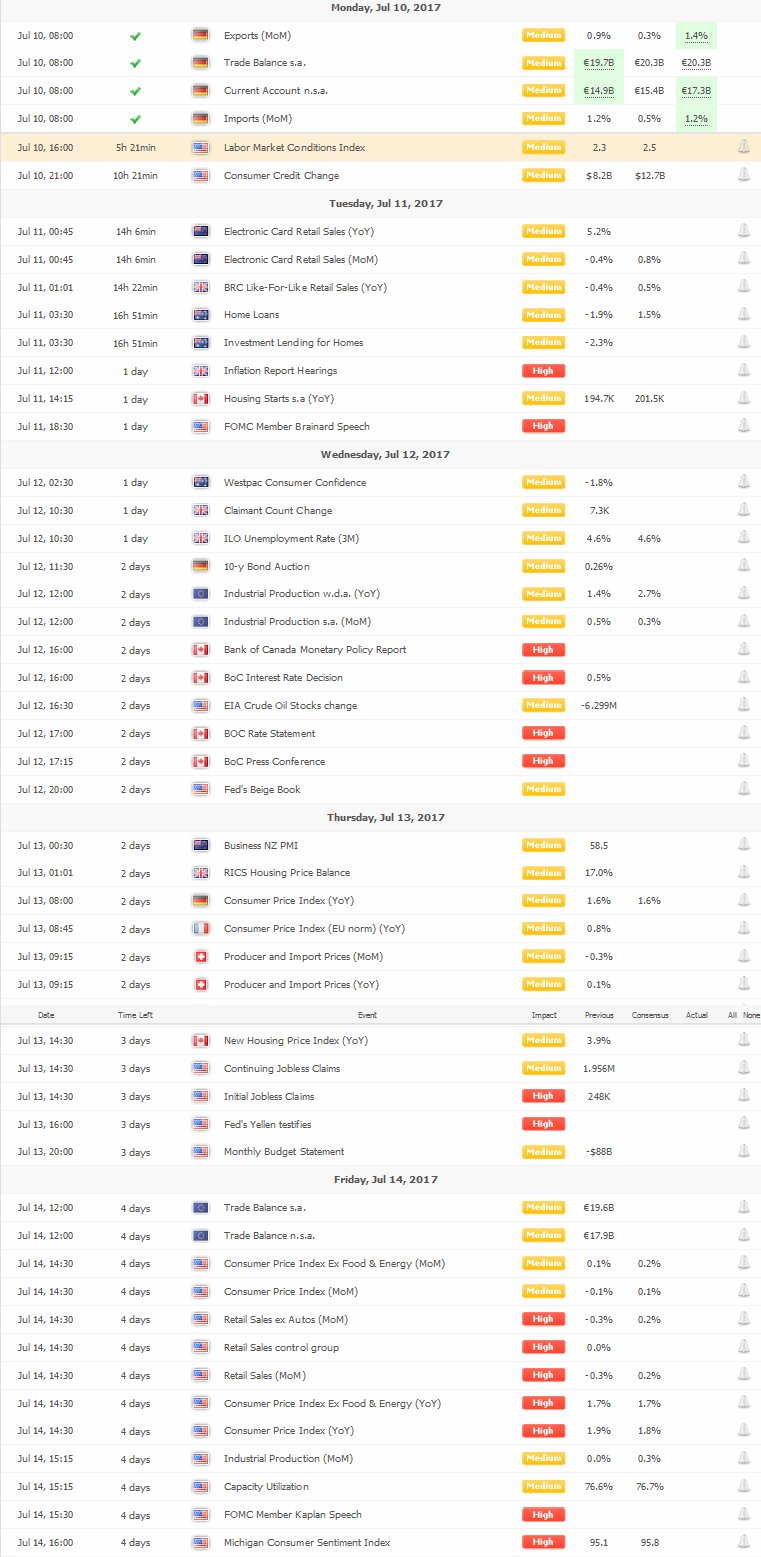

Monday:

- China CPI (9:30 PM ET on Sunday). The expectation is for 1.6% vs 1.5% last month

Tuesday:

- US JOLTs job openings (10 AM ET/1400 GMT).

- FOMC Member Brainard speaks about monetary policy at the Columbia University’s School of International and Public Affairs, in New York

- Inflation Report Hearings – GBP

Wednesday:

- UK employment statistics (4:30 AM ET/ 0830 GMT)

- Bank of Canada interest rate statement. The Bank of Canada is expected to tighten by 0.25% to 0.75% from 0.50%. BOC Poloz will hold a press conference at 11:15 AM ET/1515 GMT.

- Yellen testimony in front of the House financial services committee (10 AM ET/1400 GMT). The text will be released at 8:30 AM ET/1230 GMT

- Crude oil inventories from the DOE. This week there was a larger than expected draw down. Will that trend continue in the new week? Will the market believe the numbers? This week’s large draw down led a a spike higher but then a fall back lower.

Thursday:

- US PPI (8:30 AM ET). The estimate is for an anemic 0.0% change MoM. YoY is expected to show a rise of 1.9% vs 2.4% last month. Ex food and energy est 2.0% vs 2.1% last month

- Fed Chair Yellen testifies before the Senate banking committee.

- FOMC member Evans speaks about the economy and monetary policy at the Ninth Annual Rocky Mountain Economic Summit, in Idaho. Audience questions expected.

Friday:

- US CPI (8:30 AM ET/1230 GMT) is estimated to rise by 0.1% MoM and +0.2% ex food and energy. YoY is expected to rise 1.7% vs 1.9% last month. Ex food and energy is expected to also come in at 1.7% vs 1.7% last month

- US retail sales (8:30 AM ET/1230 GMT) is estimated to come in at +0.1% vs -0.3% last month. The ex auto and gas are expected to rise by 0.4% vs 0.0% last month.

- FOMC Member Kaplan speaks (9:30 AM ET/1330 GMT) about the Federal Reserve and monetary policy at the Center for Economic Studies of the Private Sector, in Mexico City. Audience questions expected