Takeprofit Tech has launched its own “Takeprofit Hub” liquidity aggregator to compete with established players in this field with a cheaper and fully self-hosted solution.

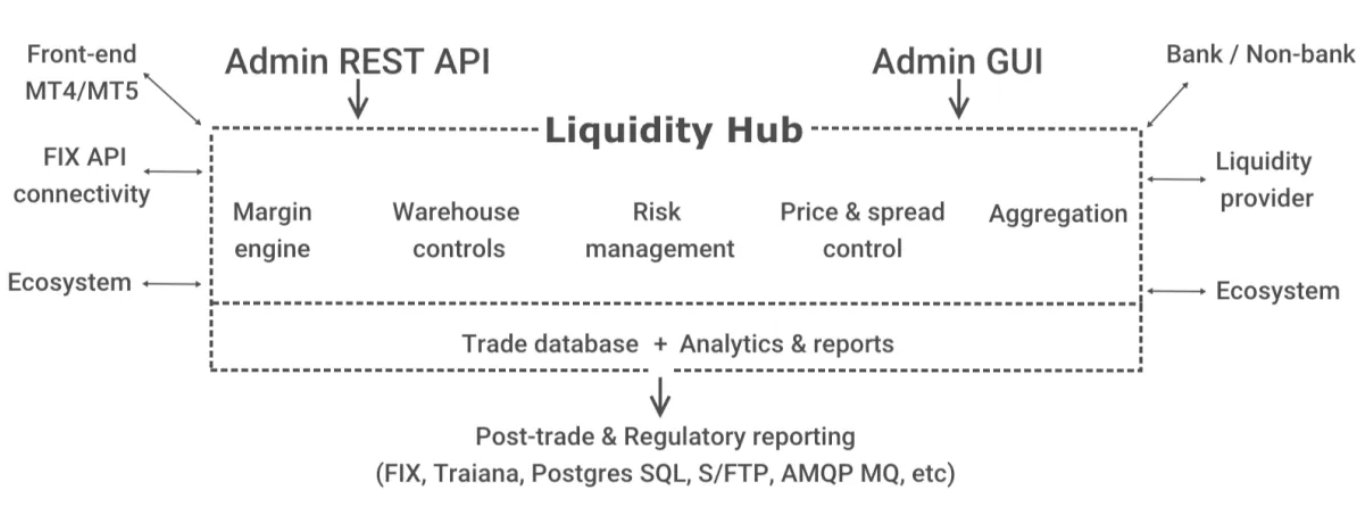

The solution allows brokers to control liquidity streams, aggregation logic, and risk management. It empowers to deliver tight spreads into MetaTrader 5 and MetaTrader 4 servers and execute orders at the best available prices from liquidity providers a broker chooses.

The solution allows brokers to control liquidity streams, aggregation logic, and risk management. It empowers to deliver tight spreads into MetaTrader 5 and MetaTrader 4 servers and execute orders at the best available prices from liquidity providers a broker chooses.

There are two key features that distinguish Takeprofit Hub from the top liquidity aggregators on the market, like oneZero Hub or PrimeXM xCore. The first one is no extra charge for advanced features. And the second — ability to host the data and routing logic completely on the broker’s side.

Takeprofit Tech’s director Timur Latypoff describes the opening opportunity: “We see that there’s room for a solution that is as full-featured as the other guys, but is at least twice cheaper and gives the customer full control over valuable financial data without compromises”.

Pricing features a flat one dollar per million volume fee with all the features included: advanced aggregation, multi-venue routing, warehouse inventory management, margin protection, multi-vendor FIX APIs, and direct report database integration.

The product took a full one year to develop, and already has two major paying customers. It is the first major product that goes beyond the company’s usual offering of plugins for MetaTrader 4 and 5, and starts with support of multiple additional trading platforms.

Takeprofit Tech is a fintech software developer founded in 2013, having offices in Saint Petersburg, Russia and Limassol, Cyprus. The company makes and sells liquidity bridges, multi-account management solutions, and risk management extensions for Forex and CFD brokers based on MetaTrader Server platform.

![Reltex Group Reviews: Explore business opportunities by Trading [reltexg.com]](https://comparic.com/wp-content/uploads/2023/12/image001-218x150.jpg)

![Mayrsson TG Reviews: Why Choose Crypto-Trading with Them? [mayrssontg.com]](https://comparic.com/wp-content/uploads/2023/12/image1-218x150.jpg)

![Bitogrand Opinion: Leveraging Trade Indices [bitogrand.com]](https://comparic.com/wp-content/uploads/2023/09/bitogrand-218x150.png)