What Are They and How Do They Work?

Currency is defined as a system of exchange used in a specific country.

The Swift payments system which dates back to the late 1970’s and has developed to keep pace with current fintech developments allocated three letter abbreviations to all the world’s currencies for ease of identification.

The United States Dollar is the primary global reserve currency. It has the abbreviation of USD which is globally acknowledged. The dollar is used more outside the U.S. than it is inside. Oil, gold and a number of other commodities are priced in dollars and a number of countries pegged their currency to it. This can be seen particularly in the Middle East where since their economies are almost entirely dependent upon oil and gas exports, their currencies would be very sensitive to the dollar.

On the Forex market the most important other currencies are:

- EUR – euro;

- JPY – Japanese yen;

- GBP – British pound;

- CHF – Swiss franc;

- AUD – Australian dollar;

- NZD – New Zealand dollar;

- CAD – Canadian dollar.

Currencies move in price against each other in a giant matrix and the sophistication of the market is demonstrated by the lack of arbitrage opportunities. Arbitrage is is created when a currency is “out of line”. For example the EUR/GBP rate is the same whether is is derived from the GBP/USD and EUR/USD as it would be if it were derived from the GBP/JPY and EUR/JPY exchange rates.

BASE CURRENCY / QUOTE CURRENCY = 1 / PAIR PRICE

For example, if Australian dollar to US dollar is 0.95 it means that we can buy 1 AUD for 0.95 USD and we can sell 1 AUD for 0.95 USD. If we make transaction like in the example, we buy or sell AUDUSD for 0.95, it is 1 AUD for 0.95 USD. Currency pairs on Forex are divided to main pairs with US dollar (major), cross pairs of major currencies without US dollar (cross), commodities pairs or exotic pairs. Different sources can show different sections, sometimes commodity pairs with US dollar are connected to majors, other time not.

YOU CAN START INVESTING ON FOREX MARKET USING FREE XM BROKER ACCOUNT.

Below we show logical division, but not the only correct one, it depends on criteria:

- Majors: EURUSD, GBPUSD, USDJPY, USDCHF

- Cross: EURGBP, EURJPY, AUDJPY, GBPCHF etc.

- Commodity: AUDUSD, NZDUSD, XAUUSD etc.

- Exotic: USDPLN, USDZAR, USDBRL, USDHKD etc.

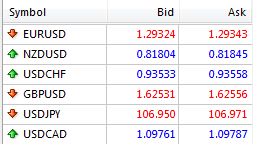

Here we can see example of currency pairs with BID and ASK prices on platform MetaTrader4.

Here we can see example of currency pairs with BID and ASK prices on platform MetaTrader4.

Exotic pairs aren’t so liquid, they generate small volume and can be violent. Small liquidity connects often with big spread. Beginning traders shouldn’t play on exotic pairs, but they can generate very profitable signals.

![How to install MetaTrader 4 / 5 on MacOS Catalina? Simple way. [VIDEO]](https://comparic.com/wp-content/uploads/2020/07/mt4-os-218x150.jpg)