Breakout from the “night channel”

One of the more simple trading strategies is the so-called “breakout from the night channel”.This system works well for the currencies and futures markets.

It works following the night hours, in which the price moves in a narrow range. The night channel is set on an M5 chart between the “night hours”

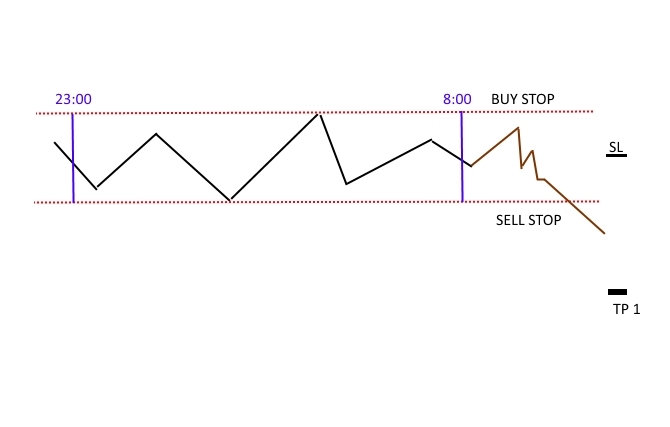

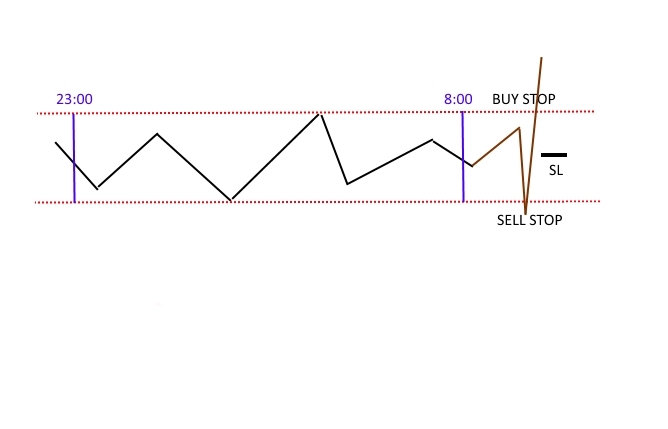

Typically, this is between 23:00 – 8:00. After 8:00 we place two orders. To enter into a long position in a buy stop and to enter into a short position using a sell stop. The buy order is set at 1 pip above the maximum of the channel, and the sell order is set at 1 pip below the minimum of the channel. SL is positioned on the opposite end of the channel or in the middle of the channel.

Depending on the assumed TP. The minimum level of TP should be equal to the range of night channel.

YOU CAN START TRADING ON FOREX MARKET USING FREE XM BROKER ACCOUNT.

Often there can be a slight false breakout of the channel and movement in the opposite direction.

Therefore, it is preferable to set the order of SL in the middle of the channel which will reduce potential losses.

Once one order is executed the other is removed. However, it may be left in place if the trader feels confident once the market moves against him that the breakout will be opposite to his first inclination. Example

Example

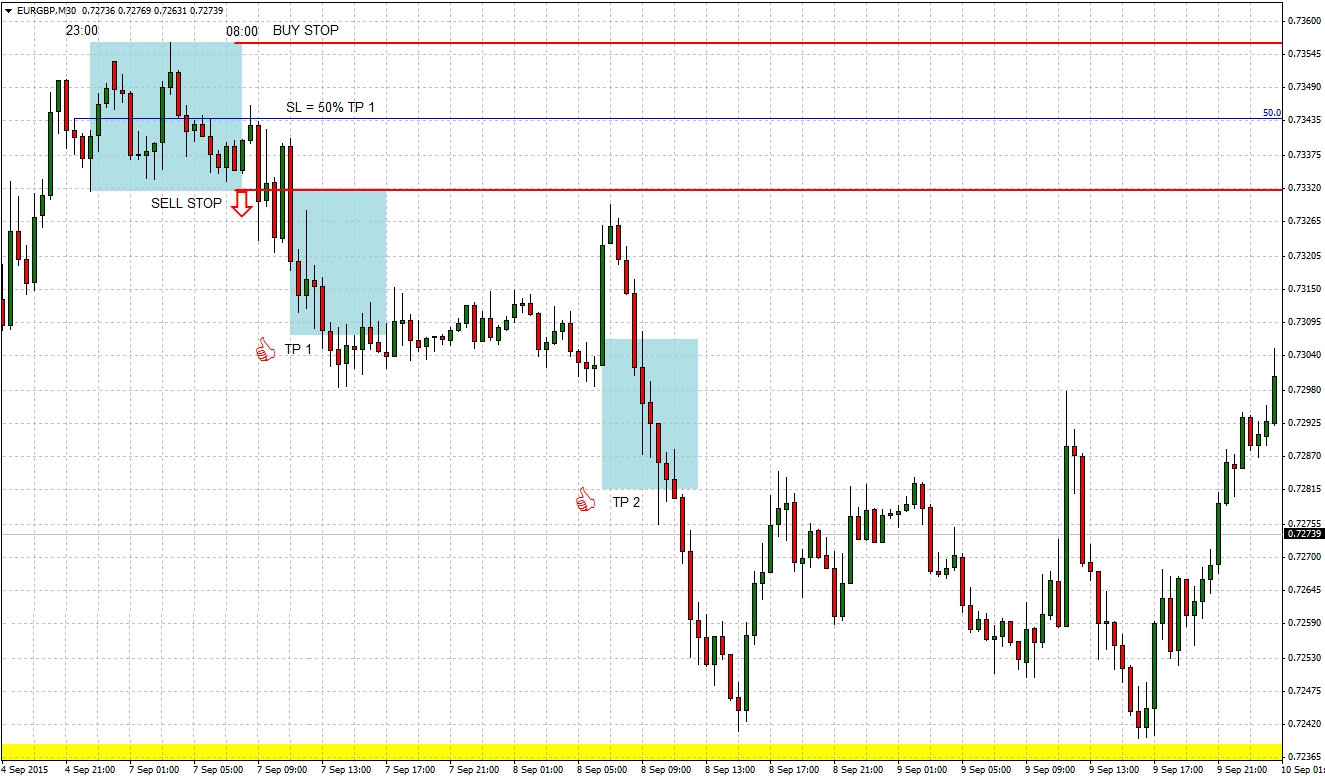

In the example below on EURGBP during early September, the first blue square shows the range overnight. Then, after 9:00 am SELL STOP order was activated. A short position was opened. The return movement that followed didn’t reach 50% so the SL was not activated. At point TP 1 on the chart, half of the position closed with a profit. This was done due to a lack of overall confidence in the position.

The second half remained open but with a shift in SL level. The SL order was moved to the point of entry the position (Break Event). After a rebound, the price again moved down and reached the level TP 2.

In this example, the initial risk/reward was 2:1. However, for the entire position, it was 3:1 (first position 2:1, and the second 4:1).

DETAILS OF THE SYSTEM:

• Select an hour in which we will draw a channel. Check the currency that you are interested in. If often happens that the first breakout is false that hours can be extended, for example, 23:00-9:00.

• Create two orders BUY STOP and SELL STOP it can be opened with One Cancel Other mode. These are the orders for the breakout, and the OCO mode will remove one of the orders when the second will be activated.

• If the range of price movement in the night was too large it should reject such a transaction.