Harmonic trading is another strategy presented on Comparic.com. Below we present details of the system used by Peter Drabik. He uses these patterns to enter positions.

Strategy Details

Peter’s strategy is based upon one of the harmonic patterns mentioned below appearing.

Any retracement is measured by Fibonacci levels:

- Internal retracement: 0.236, 0.382, 0.5, 0.618, 0.786, 0.886

- External retracement: 1.272, 1.5, 1.618, 2.0, 2.618The pattern must be consistent with the main trend. He uses a risk reward ratio of 3:1

Point “D” of the pattern is a price action candle or a pattern forming direction.

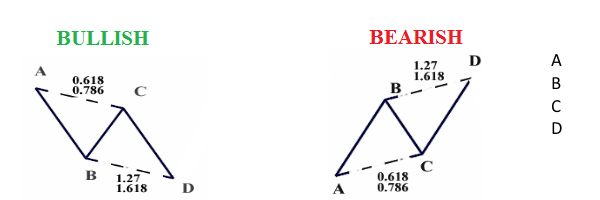

ABCD

This pattern can often be spotted. It happens in almost every trend.

In Elliott Wave theory it is called an ABC Correction. The basic levels are shown below but points C and D can also happen at different Fibonacci levels.

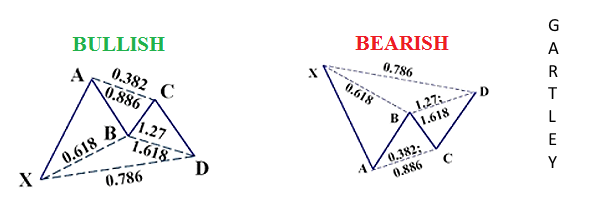

GARTLEY

This is the first harmonic trading pattern.

It was described by Gartley in 1935. When you measure XA, then B point must be at 61.8% retracement and point D at 78.6% retracement. Also the AB distance must be equal to CD.

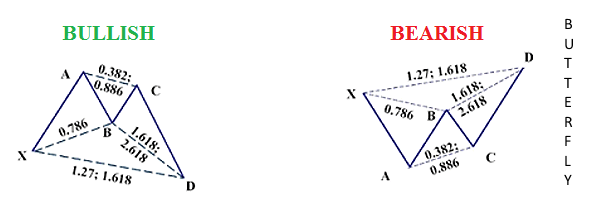

BUTTERFLY

This is another common pattern since point D can show up on various retracements. Point be must be at the 78.6 retracement of XA.

BAT

Point D is strictly set at 88.6% retracement of XA line. Point B can be at different levels as described below. This is another often seen pattern.

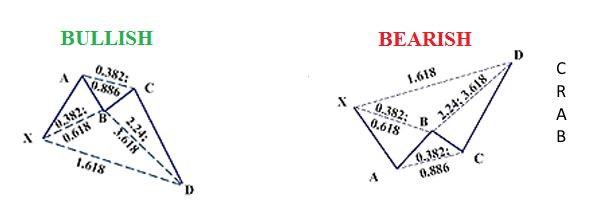

CRAB

This is a pattern in which D point is strictly set at the 161.8% retracement point of XA . Point B is an internal retracement and it can be dvariable. It can be in 38.2%-62.8% area.

![How to install MetaTrader 4 / 5 on MacOS Catalina? Simple way. [VIDEO]](https://comparic.com/wp-content/uploads/2020/07/mt4-os-218x150.jpg)