Trading for experienced people can be very pleasant and extremely profitable. Unfortunately, on the way to reach such status, a number of traps wait for a newbie. Some behaviors are appropriate in everyday life but can give catastrophic effects on the stock market.

Trading for experienced people can be very pleasant and extremely profitable. Unfortunately, on the way to reach such status, a number of traps wait for a newbie. Some behaviors are appropriate in everyday life but can give catastrophic effects on the stock market.

Here are two of the traps that are waiting for beginners:

1) Following the crowd

On stock market most investors are never right. For this reason, investor sentiment is monitored and is interpreted contrarily – if most investors expect growth, means that they have already taken positions on the market and there will be no more traders willing to buy at higher prices.

A beginner investor searching through forums for an idea to gain profitable positions is doomed to failure. On one hand there is no certainty that the person who wrote something on the forum actually has more experience in the market. On the other hand, a good investor is the one who can quickly change wrong decision. As a result, the “counsellor” may already be out of the market, while the novice is still holding a losing position praying for reversion.

2) Chasing hot news

“What are we doing with hot news? We throw them straight into the trash bin.” This is the lesson of famous American investor and investor trainer Ed Seykota. This is one of the principles of a good trader because hot news from the market or from companies are usually used only for short-term moves, after which price returns to the main trend.

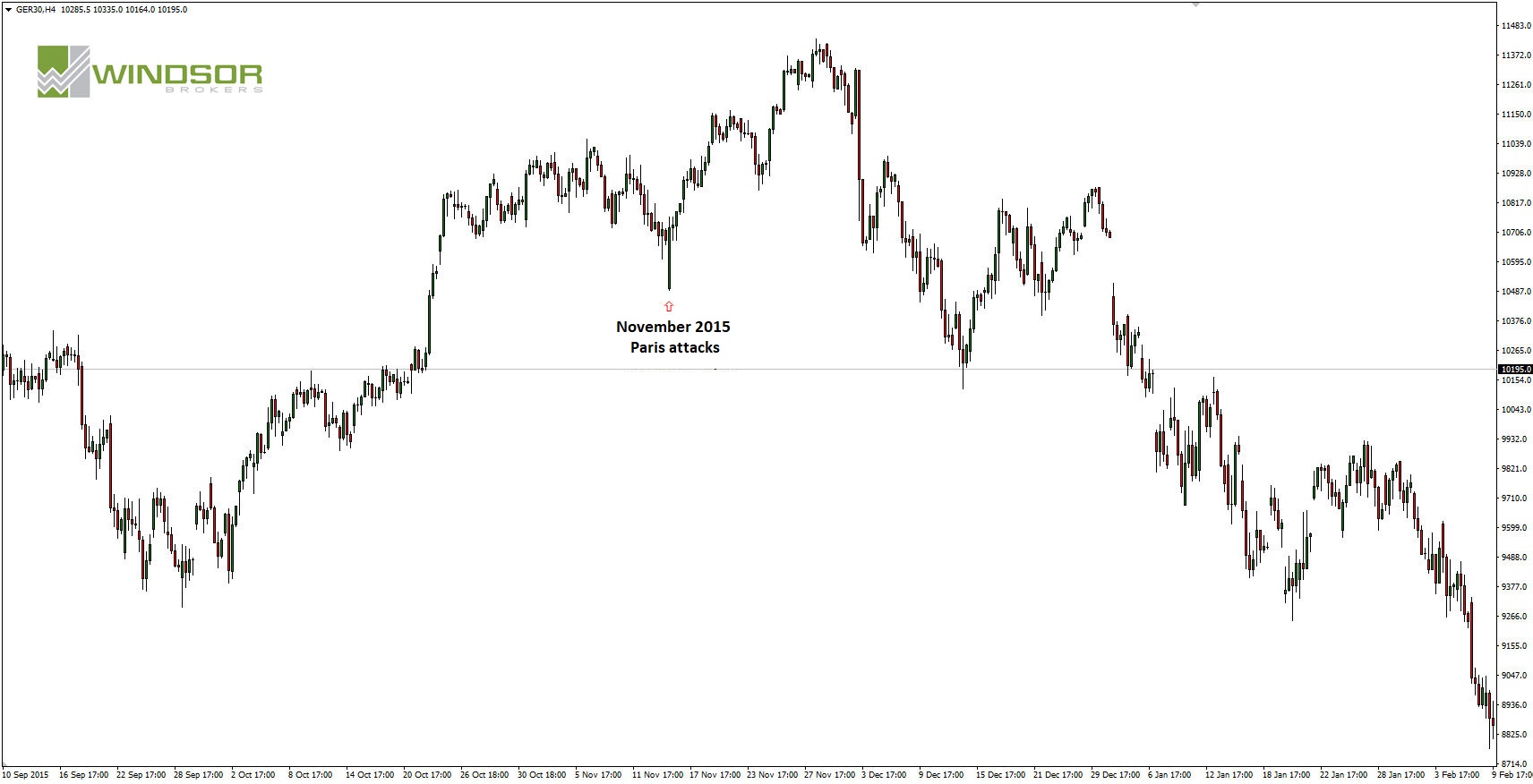

An example of such a situation is the terrorist attack in Paris. Financial portals predicted crash on financial markets. And actually some of the traders believed in that scenario and escaped from the market, others opened positions awaiting declines straight after Monday opening. The final of this sell-of on German DAX index is shown on the chart below. Terrified investors sold or opened positions at the very bottom.

German DAX30 chart after terrorist attacks in Paris in 2015:

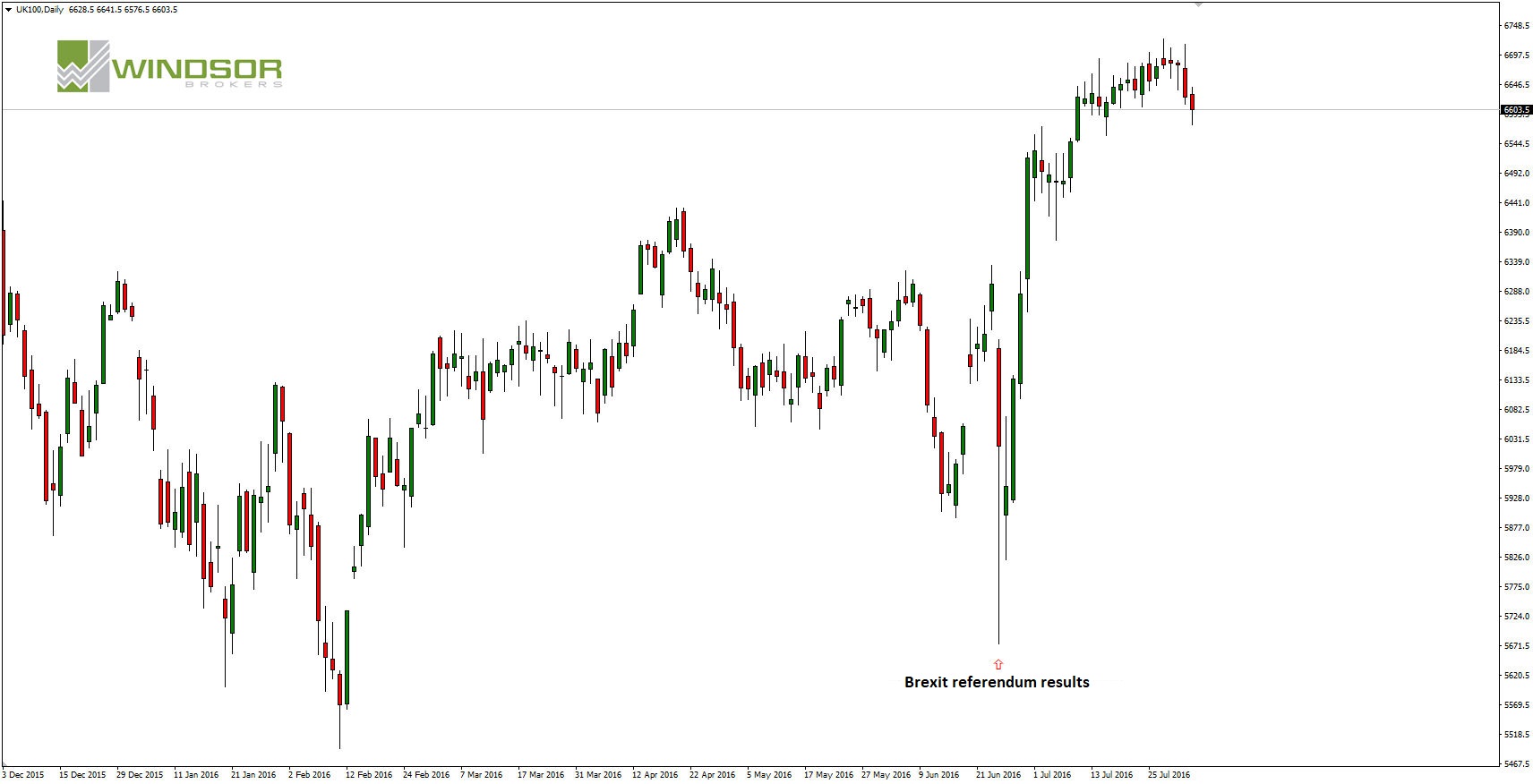

FTSE100 English Index Chart after announcing BREXIT referendum results: