It is a common belief that an extremely wide variety of financial instruments that investors can choose from, allows them to conveniently diversify their sources of income. It seems that a broad array of possibilities and appropriately tweaked investment methods make one believe that he or she adheres to one of the rudimentary laws that prescribe reduction of risk on financial markets. Have you ever thought, however, that an (over)abundance of instruments and their inherent features, may turn against investors?

It is a common belief that an extremely wide variety of financial instruments that investors can choose from, allows them to conveniently diversify their sources of income. It seems that a broad array of possibilities and appropriately tweaked investment methods make one believe that he or she adheres to one of the rudimentary laws that prescribe reduction of risk on financial markets. Have you ever thought, however, that an (over)abundance of instruments and their inherent features, may turn against investors?

By way of an introduction

In this day and age individual investors are lured by offers extended by numerous institutions. The choices that those investors make often mirror the types of solutions a particular institution or entity has up for grabs. Frequently, investors go for what the unregulated OTC market has on offer and that is based on several grounds. First and foremost, this is due to the broad range of assets (starting from currencies, commodities, indices – to stocks and even bonds), as well as user-friendly platforms and leverage which, depending on the regulations applicable to a given entity, may be as high as 1:500. As a rule, everybody is given access to trading on those markets and intricate specialist knowledge is not required in order to start off one’s market adventure and the simplicity of unregulated markets usually stems from CFD instruments that are available, as well as forward contracts, contracts that mirror stock exchange indices and others. In other words, when it comes to the possibilities that these markets offer, they are huge, which obviously translates into advantages. One is not limited to a specific asset that may be hard to trade at a particular time and is given convenient access to all instruments via one single platform. Yet, one must not forget about disadvantages that such solutions inevitably have.

New products on the market

The fact that no specialist expertise is required in order to start trading on the OTC market may seem a big advantage – as one does not have to delve into a market’s or instrument’s mechanics, rely on complicated tools or work out various correlations between specific assets to get the hang of them. However, technical or fundamental analysis on its own may prove not to be sufficient to guard an investor against (oftentimes) heavy losses.

So called hybrid solutions that have been gaining popularity recently as an alternative offered by various brokers, can serve as a good example. By a hybrid product I clearly mean a vehicle that combines a given instrument (e.g. an option contract) with another one (e.g. an option-related CFD). As a result, the former loses its inherent properties that may have attracted an investor in the first place. And there would be nothing harmful in all that, if it wasn’t for the fact that tying those instruments together may result in more losses that actual investment occasions. And, after all, our goal is to invest in order to multiply our capital – not to lose it or expose to unnecessary risk.

Turning the simple into the incomprehensible

Thus, while taking a closer look at one such concrete solution, which is merely an example of what we would like to focus on, we need to understand the mechanics that set an underlying instrument apart from a CFD.

A CFD constitutes an instrument that equips investors with easy and unrestricted access to countless assets. One of their features is that, unlike futures contracts or options, they are not time-bound (CFD brokers usually maintain positions for a year from the moment they were opened) and they are based on liquid assets. Yet such contracts are also derivatives, thus becoming a separate tool and even though their value is directly related to the value of the underlying instrument, such parameters as liquidity, swap points or costs of transactions may vary considerably – which may result in trading them being less profitable or even totally pointless. It often is the case that even though the underlying instrument is liquid, a related synthetic CFD contract may be lacking in liquidity (as may be the case with CFDs on options described at the beginning), which can translate into erratic moves on a given asset in search of the theoretical counterparty (i.e. liquidity being a case in point).

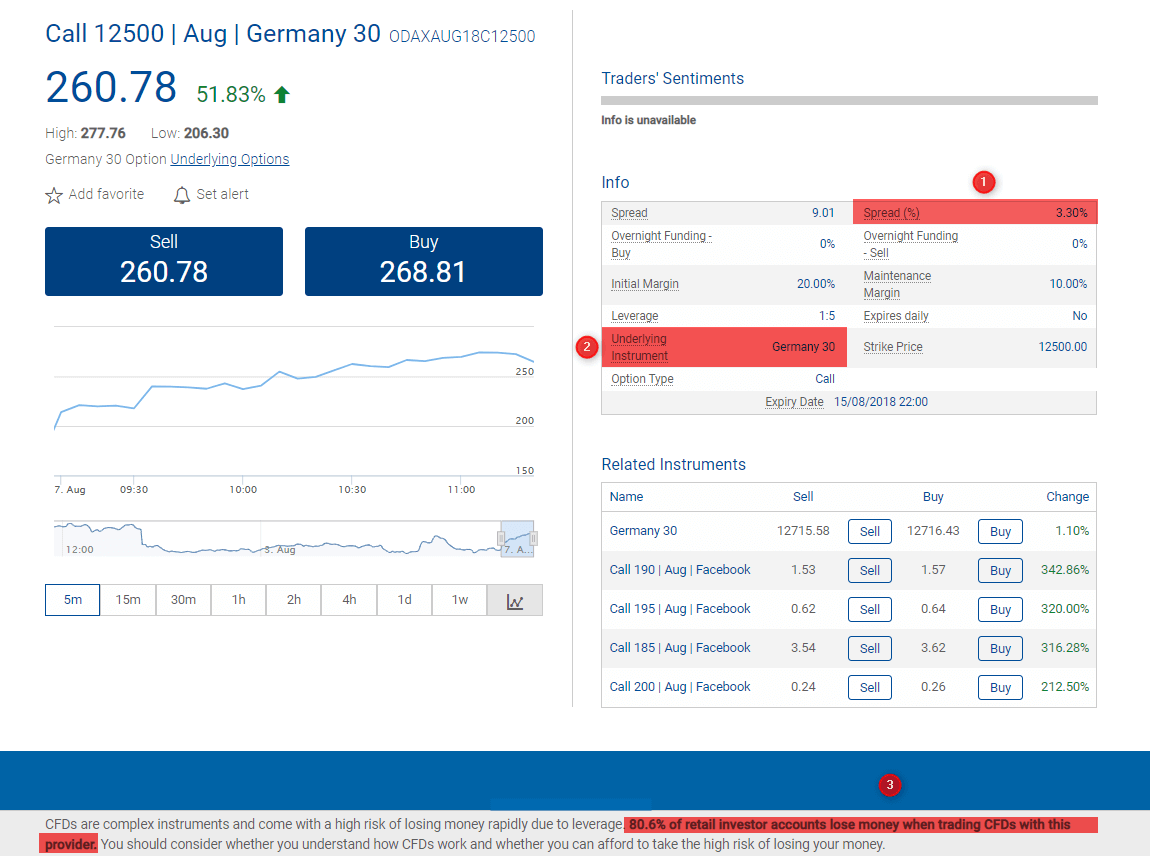

Another important question to which attention should be paid is the very information provided on a given asset and the risk borne while trading that instrument. Below, we have presented an interesting “being” offered by one of the brokers, i.e. an option contract on Germany 30 index (ticker name DAX) that is available, obviously, via a CFD.

The very first element on which we should focus our attention is the costs we bear, i.e. the spread. In this particular case it is 3.30%. In order to put it in a clearer perspective, when buying an index option contract at 260, as in the case mentioned above, spread itself is 8,58 points.

Another element that we highlighted is information on the underlying instrument. Here, as we can see, German 30 index is the underlying instrument for the option from which the CFD is derived, and not, as one would assume, for the CFD itself. Therefore, it can pay off to study thoroughly characteristics of the product being offered before we trade it.

The third element to which we should pay attention is the risk warning itself indicating high level of capital exposure if we decide to trade via the service provider in question.

“CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80.6% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.”

Clearly, each and every investment carries risk and that investors should be aware of that. Yet an extra piece of information in the form of a warning about how many retail investors using this tool lose should give us pause for thought.

What is noteworthy is also a fact that results reported by brokers regarding regular CFDs are much better, too.

Conclusion

To sum up what has been written so far, these days an individual investor has access to thousands of various products and instruments that are at their fingertips. Many of them give efficient earning potential, allow to diversify existing sources of income or even protect funds against risk. On the other hand, many such instruments created by brokers motivated to expand their offer or event to boost profitability, may expose deposits of less experienced investors, traders or speculators to additional risk. The only solution that can give effective protection against excessive risk is diligent examination of the offers or parameters of specific instruments on which we would like to focus, in order to avoid unnecessary adverse consequences resulting from lack of knowledge of what specifically we want to trade. It is worth talking to your broker and ask them questions to dispel any ambiguities, and if you have doubts about a specific instrument, perhaps it is better to refrain from the actual investment altogether.

Therefore, it is a good idea to ask yourself the question posed at the beginning of the article – does the (over)abundance of easily-accessible instruments add to the improvement of investing conditions, or rather does it present a challenge that each investor has to face?

Author: Maksymilian Bączkowski

Editor’s comment – Marcin Nowogórski:

We have been observing for some time now a tendency among brokers to seek new ways of attracting clients’ attention and new sources of profits, as traditional CFDs have recently been the focus of regulators and their profitability for brokers has dwindled, as leverage levels and volumes have dropped. Therefore, some CFD brokers have been searching for possibilities of offering exchange-traded products, which, however, entails significant difficulties (execution) and costs (market data) for those brokers – who have not encountered such products while operating in the OTC sphere.

We have been observing for some time now a tendency among brokers to seek new ways of attracting clients’ attention and new sources of profits, as traditional CFDs have recently been the focus of regulators and their profitability for brokers has dwindled, as leverage levels and volumes have dropped. Therefore, some CFD brokers have been searching for possibilities of offering exchange-traded products, which, however, entails significant difficulties (execution) and costs (market data) for those brokers – who have not encountered such products while operating in the OTC sphere.

Other brokers have been developing their cryptocurrency offer; however, they are facing imperfections and risks involved in this new market.

Finally, we have observed a third group of brokerage firms who have embarked on creating derivatives based on other derivatives. Some of us have had a chance to trade with brokers offering CFDs on futures, as well as CFDs on CFDs (we are talking in terms of probabilities, as the exact mechanism is hard to be fully brought to light by an outsider). Recently, we have seen CFDs on options, which may be particularly misleading, as option valuations are governed by their own complex rules and the underlying instrument is but one of the factors. Moreover, it is unclear what instruments with GER30 or Germany 30 symbol (as they appear in the above examples) really are, because I can only guess that their relationship with proper DAX index is fairly loose, to say the least.

We are also in the process of discovery when it comes to certificates of various descriptions – the grounds of which were concocted by financial engineers from big banks back in the 80s and 90s.

An inherent feature of the OTC (i.e. non-standard, off-exchange) is that a financial instrument comes into existence as a result of a contract made between two market participants and this creates space for diversity, but at the same time results in considerable complexity. An individual investor will oftentimes not be able to understand what he or she is really trading without having conducted a complex analysis of the instrument in question, applying sound financial expertise.

For example, what gives rise to some doubts is the fact that the option, mentioned above by Maksymilian as an example, that we meant to trade via a CFD, is in fact an option on an asset called Germany 30, but what asset is that? We have managed to establish – as the broker claims, that the said option is based on DAX option listed on Eurex. And if that is the case, then Call on Germany 30 is not listed and it looks like another off-exchange instrument. Are we, then, dealing here with a CFD on an OTC option based on another option on DAX from Eurex? You may have lost your bearings already? We dare to suspect that was the original intention.

A deeper underlying problem is that, as opposed to primitive, outright scams and dishonest tricks played by some brokers, in this new reality many a broker could claim that they played fair as everything is laid down in their documentation. And the brute fact that investors in fact traded what was in their imagination, seems to be none of our (i.e. brokers’) business.

Sadly, this may be a new method – deployed by brokers, to generate new profits at the expense of careless or even somehow reckless investors, and quite soon it may turn out that more and more institutions will start to offer such ethically dubious products. However, even if those new “inventions” are fully legitimate, they will not add any glory to the already tainted reputation of the whole industry.

Translated by Mirosław Wilk