The most important news of yesterday’s evening was RBNZ meeting during which – as expected – bank cut rates by 25 bp to 1.75%.

It is the lowest interest rate since introduction of OCR in 1999. Markets estimated chances of cut for 81%, all economists surveyed by Bloomberg said that there will be a cut.

What we could find in the RBNZ report?

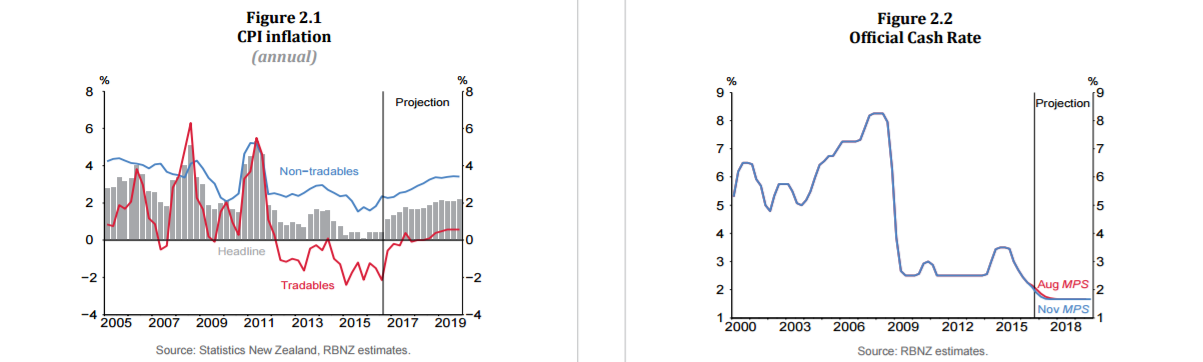

New Zealand’s central bank presents a lot of data in their reports. We can find a lot of interesting information. Few of the most important ones are below:

- OCR average will be 1.8% in Q1 2017

- OCR average at 1.7% in Q2 and Q3 2017 – possibility of further cuts

- NZD drop is essential

- Inflation should reach 2% target in Q4 2018 – earlier Q3 2018 was suggested

- Environment correct to speed up inflation

- Too high NZD rate bad for inflation

- PolMon will be still adjusted

- Yesterday’s cut should push inflation at least to half of the target

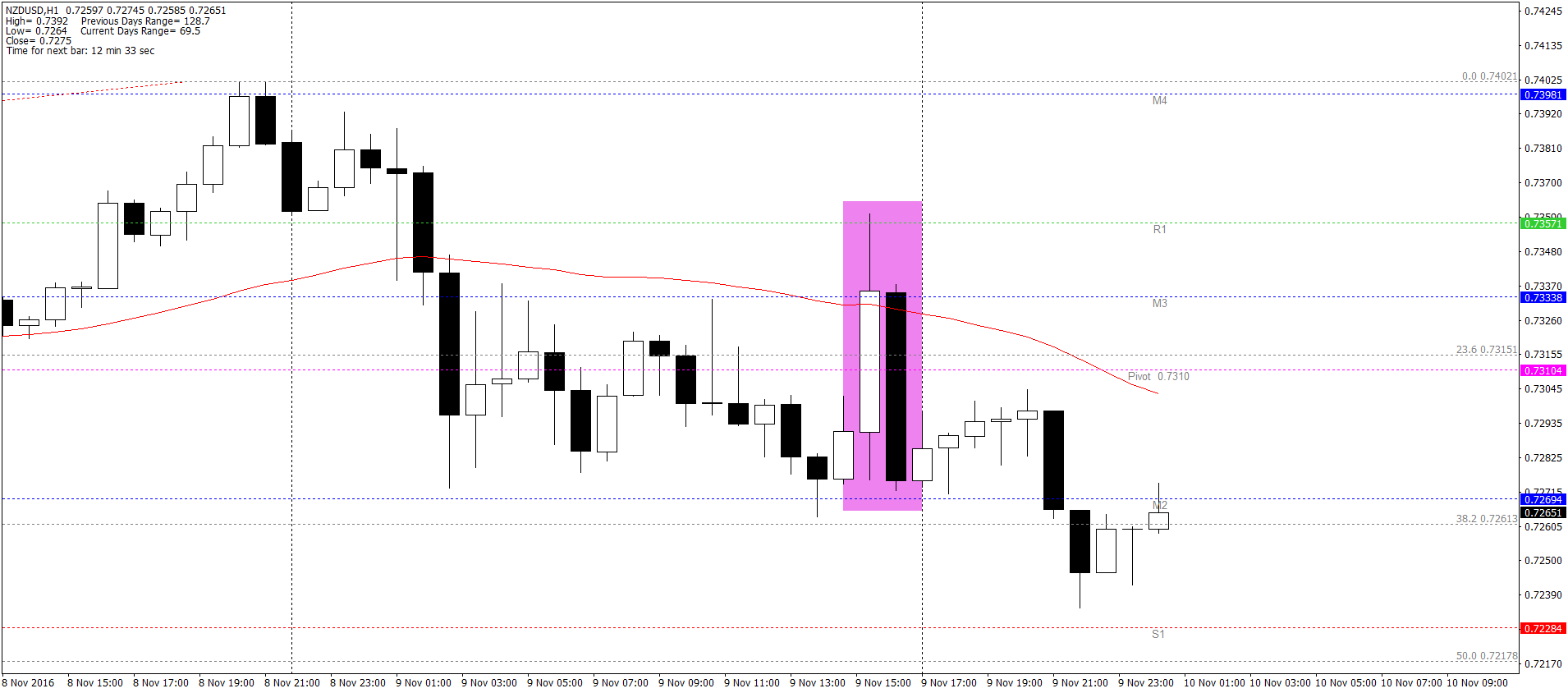

Although PolMon report pushed NZD few dozen pips up, it was reversed by Wheeler conference – RBNZ President.

Press conference – RBNZ considered US election

- RBNZ conference reversed moods on NZD. What could cause this reaction?

- RBNZ considered US election in decision about rates cut

- Accumulation of Chinese debt and uncertainty about Brexit do not help local economy

- In this moment we do not need another rate cut – policy will be loosened with another tools

- RBNZ has “open mind” about direct intervention on NZD and is ready to weaken domestic currency

- New Zealand’s economy is working well, Wheeler doesn’t want to create higher volatility by surprising markets

- Low interest rates in the longer term

Before President’s speech NZDUSD was gaining 80 pips but during conference it was rejected. Today we can see continuation of decreases. The session started below 33 SMA and Pivot Point at 0.7310. In this moment sentiment looks really bearish. First of the target is below today’s lows at 0.7728.

Nothing important on Thursday

There is not a lot of important data today. At 1:30 PM there will be US jobless claims report and new houses price index from Canada.