NAB business sentiment last night has soared to 11 from 8 previously along with HPI which accelerates to 1.8% vs. 1.1% expected and 1.5% prior. NAB sentiment is improving since October 2013 and housing market seems to stay robust, therefore AUD received some fresh support. Meanwhile, question whether RBA’s monetary policy is still appropriate arises.

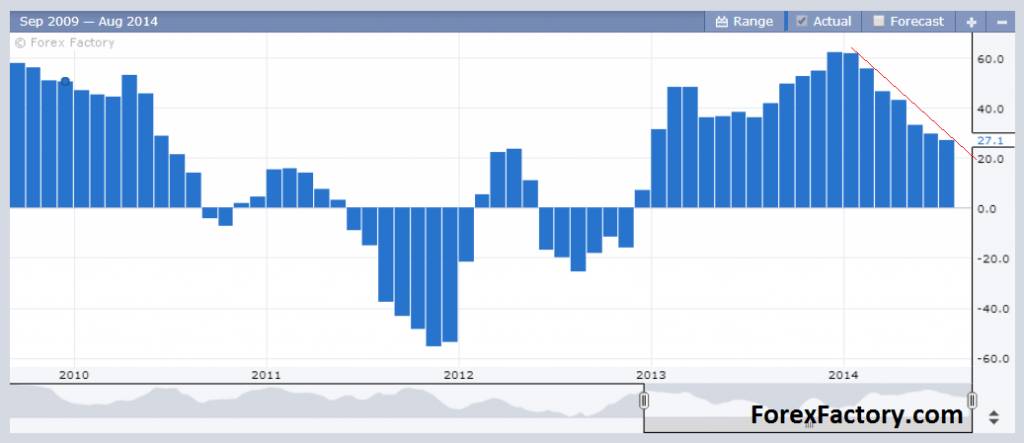

Today markets focus on ZEW economic sentiment both from EMU and Germany. Consensus is on record low level pointing on 18.2 vs. 27.1 prior. Such sentiment deterioration may be caused by mutual EU-Russia economic sanctions, but we need to keep in mind that ZEW for Germany is consistently declining since the beginning of 2014.

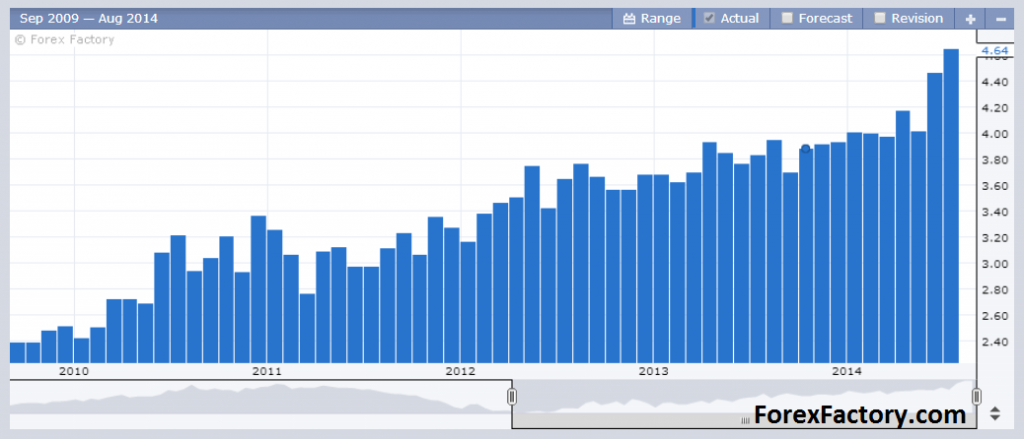

Another important indicator in today’s calendar is jobs openings report – JOLTS. Readings here are substantially improving since 2010, when post-Lehman low was hit at 2.30-2.40M. Now JOLTS boosts from around 4 million to 4.60 million and beats 2007 high at 4.43M. Therefore, even keeping current levels will be very positive for US.

Also Japanese GDP growth reading will be of some importance. Last quarterly report showed strong expansion of 1.6%, and now analysts expect economy to shrink by 1.7% which is pretty pessimistic consensus.