We started 26th week of 2017,below are the key events and macro data releases which can make market volatile and surprise market with unexpected swings. Be careful and keep eye on macro calendar ,not only on charts…

We started 26th week of 2017,below are the key events and macro data releases which can make market volatile and surprise market with unexpected swings. Be careful and keep eye on macro calendar ,not only on charts…

Coming week looks rather calm and only few macro events can have high impact on markets and its volatility. Most important can be BOE Carney speech concerning financial policy on Tuesday and of course data from USA on Thursday and Friday.

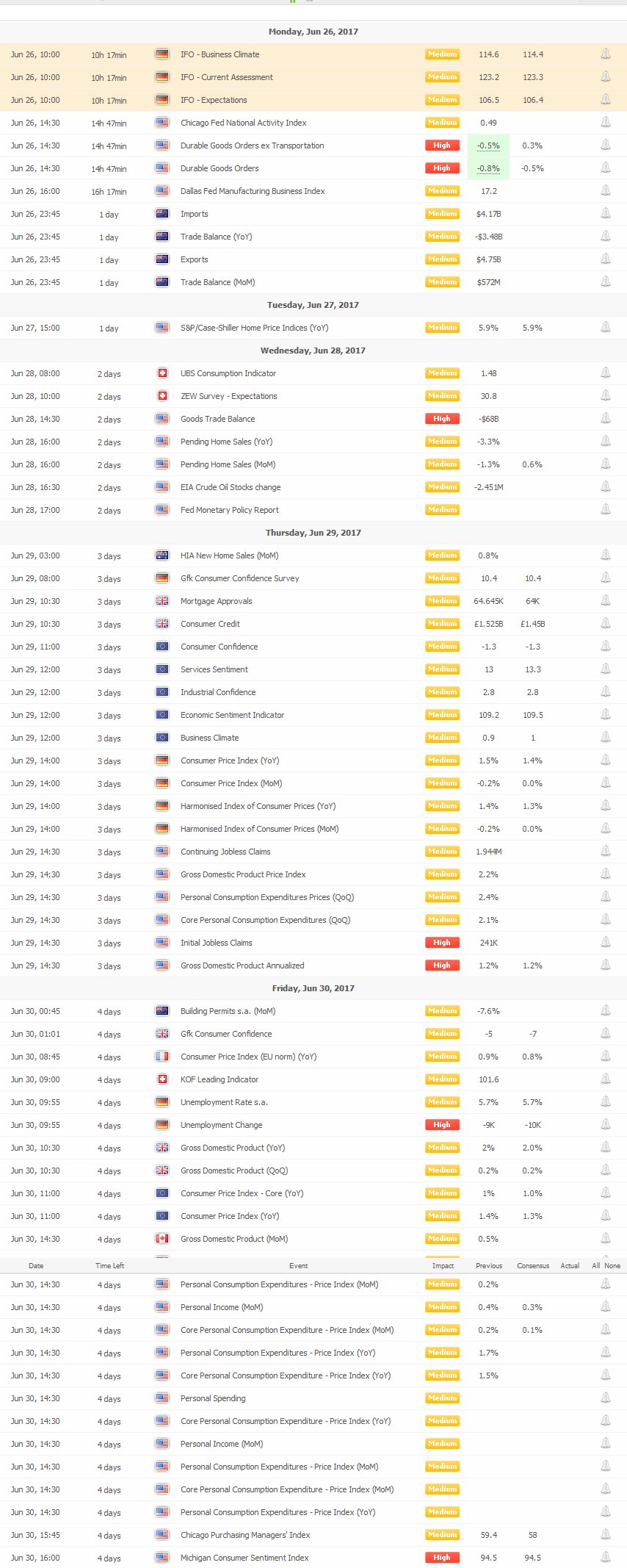

Monday:

- 09:00 GMT: German IFO business climate. Est. 114.7

- 12:30 GMT: US durable goods orders. Est -0.5%

Tuesday:

- 9:30 GMT : BOE Financial Stability Report

- 10:00 GMT: BOE Carney speaks about the Fin. Stability Report

- 14:00 GMT. Conference Board consumer confidence

- 15:30 GMT: FOMC Harker speaks

- 17:00 GMT. Feds Yellen speaks in London

Wednesday:

- 1400 GMT. US pending home sales. Est +0.6%

- 1430 GMT Crude oil inventories

Thursday:

- All day: German Preliminary CPI. Est 0.0%

- 1230 GMT. US final GDP for 1Q. Est 1.2%

Friday:

- 0100 GMT. China PMI Manufacturing, Est. 51.0. Non-manufacturing PMI

- 0600 GMT. German retail sales. Est 0.3%

- 0830 GMT. UK current account. Est -16.5B

- 0900 GMT. EU CPI Flash. Est 1.3% YoY. Est. Core 1.0% YoY

- 1230 GMT. CAD GDP

- 1230 GMT. US core PCE. Est. MoM +0.1%

- 1400 GMT. Revised UoM Consumer Sentiment , Est 94.6