Beware Mr. Fear and Miss Greed they are not your friends!

It is often said that the best traders are the least emotional traders.

Mr. Fear!

Why should we fear losing money? Only if you invest more than you can afford to lose. There is no risk-free investment, other than perhaps U.S. Treasury paper. But even that has been somewhat debased.

What’s to fear about losing money?

Every investment has a cost. Treat losing money as the cost of being profitable. Even big bank traders should lose money. It’s character building and helps in being a better manager of risk and adds to experience.

As an entrepreneur, you invest in an idea or as a small business owner there is no bigger risk than starting out.

Treat trading as, not a single investment, but a journey to profitability. Of, course the fear factor can be managed. Test theories, use a dummy account and take small positions. Build confidence and use the fear as a tool to sharpen instinct.

Getting the basics right is the only way to proceed. What is the basic driver of price? Ask anyone! It’s present in every aspect of daily life.

Supply and demand.

The most volatile (literally and figuratively) daily staple is fuel. The price fluctuates wildly at times. Why? Supply and demand. OPEC tries to control it but cannot.

Dealing with Fear and Social Stigma

Do you regularly tell your friends your salary or how big a bonus you received? No! Well certainly not in western society. So, your investments and savings coupled with the risks you are prepared to take are also private. Facing questions every time you walk in the bar from “experts” will drive fear and attract possible ridicule. Keep it private, take your time and then in ten years’ time turn up in a Ferrari (or not).

Miss Greed

Mr Fear has been dealt with, now meet Miss Greed. She is not related to Mr. Fear doesn’t share any characteristics but can have an equally devastating effect of your trades.

Miss Greed sits on your shoulder encouraging you to do things outside your strategy; “go long here, run your profit a little more, move the stop loss another twenty pips”. This are all Miss Greed’s sayings.

Trading is a marathon, not a sprint and Miss Greed can make you impatient. You have worked out your strategy, calculated your risk parameters and know your limits. Don’t let miss greed rock the boat!

Who Listens to Miss Greedy?

Miss Greedy thrives on impatience. Once the decision is made that you want to trade, getting that first position on the book is all she cares about.

Think about these H. Jackson Brown words: “Do not resign from the target just because you need time to achieve it. Time goes by anyway”. Miss Greedy will hate you but there are plenty of fish in the sea!

Be patient. There are plenty of ways to make money trading but there are even more ways to lose it!

What is the key to success?

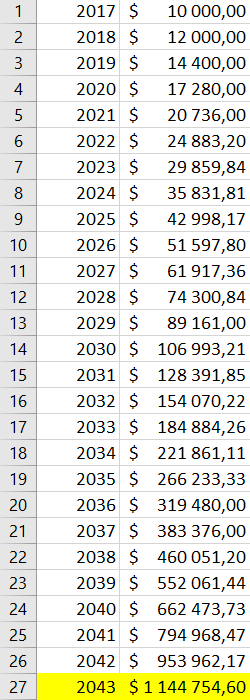

Warren Buffet, a man who seems to own the key to success makes a 19.7% average return. Not spectacular but consistent and he remains “in the game” after many years. They key? A return of 19.7% a year every single year. Not 1000% then nothing.

When you have time and you have finished dealing with Mr. Fear and Miss Greedy try a test. Start with $10,000 compound it by 20% every year and see how it grows. You will be a millionaire in twenty-seven years! Not stellar but a decent retirement pot if that is your desire.

![How to install MetaTrader 4 / 5 on MacOS Catalina? Simple way. [VIDEO]](https://comparic.com/wp-content/uploads/2020/07/mt4-os-218x150.jpg)