G7 Central Banks eye a return to rate normality

When the global financial crisis hit, and Central Banks realized that they had to act decisively to avert a catastrophe they seemed to act in unison in taking extraordinary measures that were seen at the time of something of a “hail Mary play”.

Now as a recovery looks sufficiently robust to allow a return to normalization, policy divergence and a game of “chicken” over inflation seems to be taking place. The Bank of England despite various stances being taken over the past eighteen months or so now seems to be on a tightening schedule despite the fall in inflation so far in 2018. It is now concerned about the pace of growth in pay rises which were shown by last week’s employment report to be at the highest level since 2016 and outstripping consumer prices.

So, to be clear, UK workers are receiving their first positive pay increases for years and the Bank of England is concerned over CPI which is retreating.

So, to be clear, UK workers are receiving their first positive pay increases for years and the Bank of England is concerned over CPI which is retreating.

The ECB on the other hand desires a “lower for longer” policy despite yesterday’s comments from Bundesbank President Jens Weidmann who said that expectations for a rate hike by summer 2019 were not completely unrealistic”.

Weidmann has long been the favourite to replace Mario Draghi as ECB President, and yesterday’s longest of long range advance guidance could be a taste of what is to come. Banque de France Governor, François Villeroy de Galhau is being suggested as an alternative despite it being Germany’s “turn”.

Fed wants to hike but data unsupportive.

When Jay Powell took over as Fed Chairman, it was assumed that due to his background in law rather than economics that he would bring a more pragmatic approach to the job, relying more on hard fact than rumour and expectation.

So far, those expectations have not been realized as Powell sanctioned a hike in rates last week despite there being more than sufficient reasons for the Fed to hold fire.

A pre-emptive move was not expected to be part of Powell’s “playbook”, preferring to wait for confirmation from the data that inflation was on the increase. This week’s Q4 GDP data may contain an upside surprise but it’s difficult to justify hiking rates based upon a quarterly increase in growth from 2.5% to 2.6%.

The continued trade concerns are not hurting the dollar as much as could have been expected for two reasons. First other G7 currencies have headwinds of their own. Behind the scenes the ECB is toiling to “keep a lid” on the common currency and in the UK, the recent rally of the pound based upon a sudden “goldilocks scenario” is seeing the pound bump against strong resistance. Further rallies for both currencies will be needed to push the dollar to fresh lows.

“Brexit Chickens” coming home to roost!

There has been sufficient “kicking of the can down the road” in Brexit negotiations to open a recycling plant but at some point, the UK and EU are going to have to face the issues that have been simmering for close to a year.

Ever since Michel Barnier handed David Davis Brussels Brexit demands, the UK have been avoiding the issues, claiming small successes in both the stage one agreement and transition period.

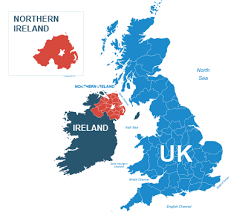

Let’s be honest, the move from stage one to stage two meant absolutely nothing, only one stage matters and that is the UK’s departure from the EU which following a transition will now take place on 31st December 2020. The amount the UK will pay into the EU budget is now known but has been hidden from view and the Irish border could be about to explode in the face of the UK Government.

The population of Britain are confused. A majority voted to leave (or maybe not, depending on how you define a majority). Each “leaver” had a clear agenda for their vote (or should have had) and no one envisaged the border between the North and South of Ireland as being close to the top of their list.

The population of Britain are confused. A majority voted to leave (or maybe not, depending on how you define a majority). Each “leaver” had a clear agenda for their vote (or should have had) and no one envisaged the border between the North and South of Ireland as being close to the top of their list.

We could still see Sterling collapse back towards 1.3000, a General Election and a socialist Government before the final act of the play ends.

Watch this space!