Binary Options Strategy

An odd title perhaps but nonetheless a very simple binary option strategy that is suited primarily to short term trading but for all levels of experience.

MA AO & STOCHASTIC are the three indicators used in this strategy.

Moving average, awesome oscillator and stochastic oscillator.

We encourage you to see system description and its use in practice. We have an offer exclusively for Comparic clients at uTrader where you can see this strategy in action.

Setting the indicators

- Moving average – change of period to 12, the rest of the settings stay default;

- Awesome Oscillator – default settings;

- Stochastic Oscillator – %K at 12 pts, %D and Slowing at 3 pts.

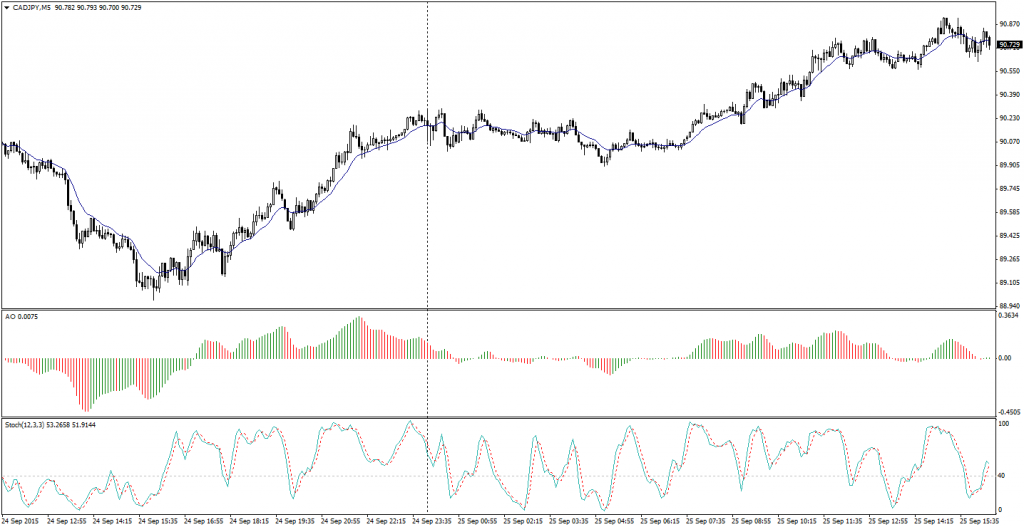

After setting the oscillators the chart should look like this:

System rules

- Time frame – M5;

- Options expiring in M10-M15 (so we are interested in second and third candle).

You can also use this strategy on smaller time frames (for example M1 charts). Then you should consider opening option the after the closing of the first or second candle after the signal. You can consider M1 time frame when there will be not enough signals on M5.

Using a PUT option

- MA must cross the body of the candle and be above next candle;

- AO should be near 0;

- Stochastic oscillator must be in overbought area (70-100) and moving downward;

- When all three signals are happening buy a PUT option with time frame of 2-3 candles (for M5 chart it will be 10-15 minutes options).

Using a CALL option

- MA must cross body of candle and be below next candle;

- AO should be near 0;

- Stochastic oscillator must be in oversold area (0-30) and is moving upward;

- When all three signals are happening we play CALL option with time frame of 2-3 candles (for M5 chart it will be 10-15 minutes options).

You can check this strategy with risk-free uTrader Binary Options Broker.

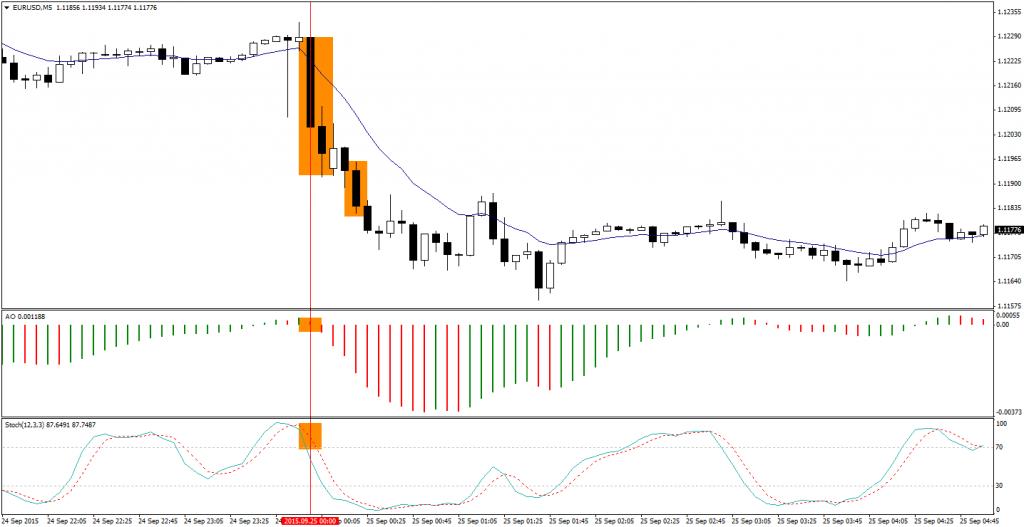

Example for PUT option

MA is moving through body of the candle and is above next one. AO is near 0 area and stochastic oscillator is clearly above 70 but it is moving down. Then you should open PUT option expiring in 15 minutes. As you can see, third closed below signal candle so the transaction is right.

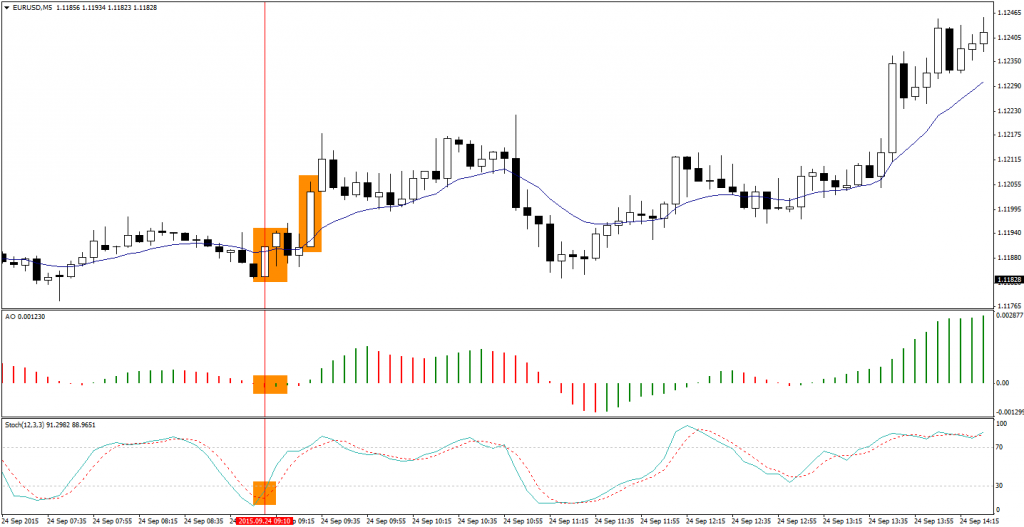

Example for CALL Option

MA is crossing body of candle and is below next one. AO is very flat, near 0 and stochastic oscillator will leave oversold area soon (0-30). We can buy a CALL option expiring in 15 minutes (3 candles). Price closed above signal candle so this option is also profitable.

![How to install MetaTrader 4 / 5 on MacOS Catalina? Simple way. [VIDEO]](https://comparic.com/wp-content/uploads/2020/07/mt4-os-218x150.jpg)