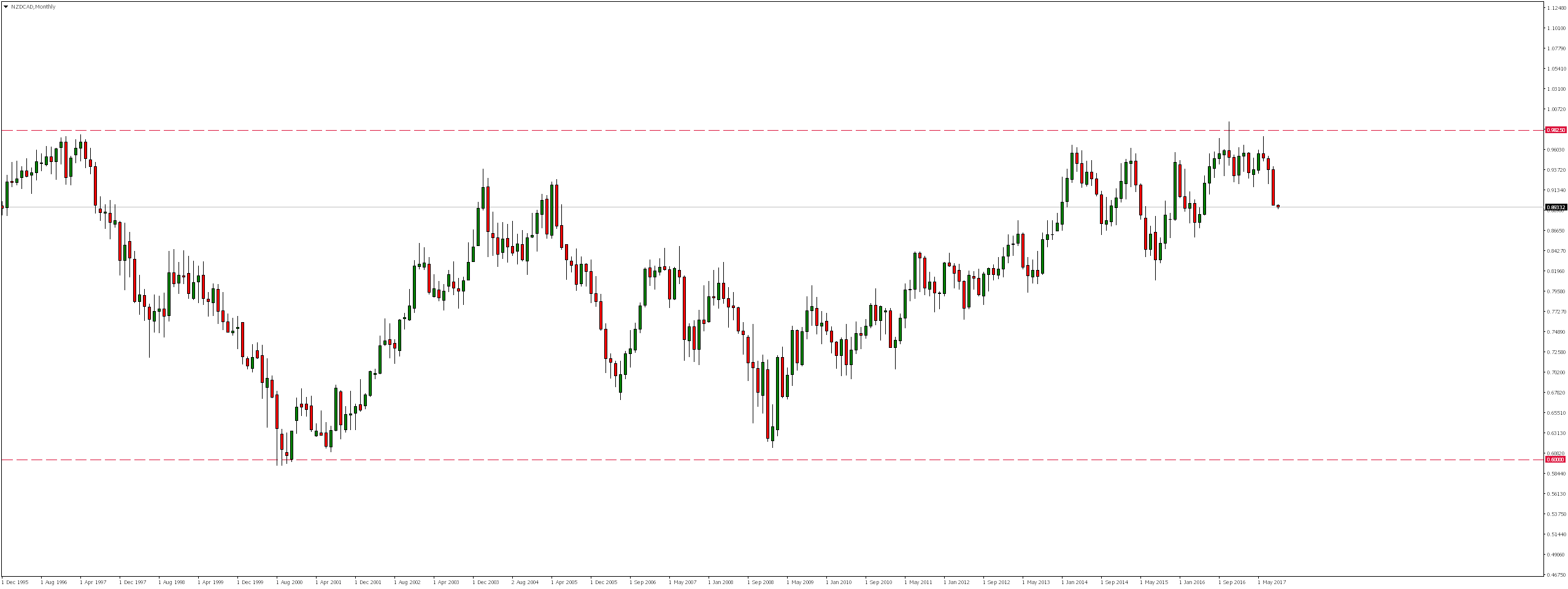

NZDCAD has been moving in a horizontal trend (consolidation) since January 1982. As a result of market rally since February 2009, pair again reached level of 0.9800, where already in November last year first strong supply reaction emerged. In spite of that, during the following months price was in the vicinity of this resistance and began to decline in June again.

Looking on weekly chart, we will notice that as a result of these falls price has approached the upward trend line we are currently experiencing. A permanent breakdown of this support could change the general attitude of the market and open the way for further declines.

On daily chart we will note that yesterday the line was defeated and the market ended the day below it. However, given that this is a support of the 2009 trend, better confirmation would be to close the week candle below this level.

If this happens and the declines will continue, we might even be able to test last year’s minimum around 0.8600.

To take advantage of the analysis and invest now, please check out HotForex Broker Offer