System Description

Start with a weekly chart.

We treat two neighbor candles as the setup. The height of the candles doesn’t matter. It is only important that one of them is a continuation of the one before: The closing price of the second one must be above/below the previous candle.

On this kind of setup we mark a line with a 20 pip buffer zone which will be the area to open a position. If the first candle has a small body and long wick, we put the lines in the shadow and body of the first candle.

If the first candle has a small body and shadow, we put lines on its body and in the middle of second candle.

If two candles are crossing, which means they are similar size, lines are put only on the body of the first one.

If the second candle has a long body you have to put three lines. First on the body of first candle, second on the shadow of first one and third one in the middle of second candle.

To every candle you have to add 20 pip buffer. Thanks to that there will be area in which we will look to open a position. The setup of these two candles is working until it is negated. Negation happens when a weekly candle closes in a downtrend above its top or in the uptrend below the bottom.

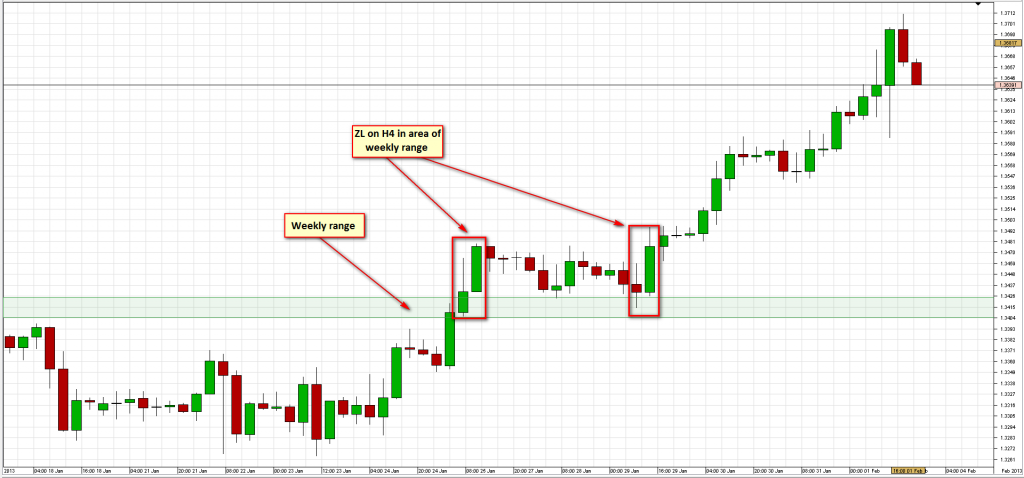

After setting weekly areas, take a look at the H4 chart. We look for typical setups in created areas or in the neighborhood. If the body of second candle is at least twice as great as the candle before, we should put lines the same way as in weekly setups.

The setup on H4 must be at least 30 pips. The height is calculated as on this screen.

H4 setup is valid about a month unless it is negated. Negation here works the same as on the weekly chart.

We already have a weekly range. We have the ZL (Zero Line – a place where the profit equals zero) on H4. Opening a position comes on M30 chart after weekly range test and breach ZL on H4 chart with either bull or bear candle. We always use a test and breach of the H4 line as close as possible to weekly range. The rule is anything that is close and more recent has priority.

The Stop Loss is fixed and is exactly 25 pips.

Change that to Break-even after 50 pips.

We have three potential situations that lead to a closing of the position. The first one is a fixed TP set at 250 pips.

The second one is getting to another weekly range, opposite to our position. If the price stops in this area and we have already 175 pips of profit we can close position.

The third depends on waves. If we have about 175 pips of profit and we are in fifth wave we should also close the position.

![How to install MetaTrader 4 / 5 on MacOS Catalina? Simple way. [VIDEO]](https://comparic.com/wp-content/uploads/2020/07/mt4-os-218x150.jpg)