Overbalance Price Action is a strategy which use classic definition of trend supported by Price Action setups. Below we present exact description with charts.

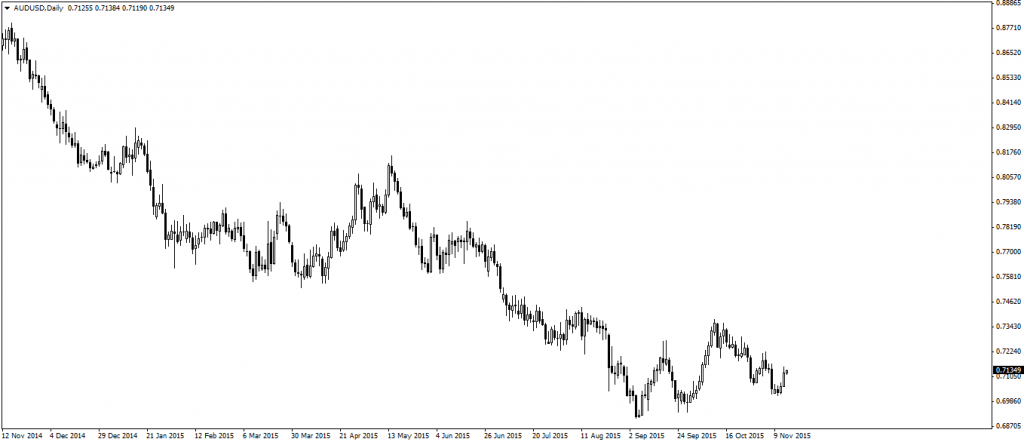

Trend Determination

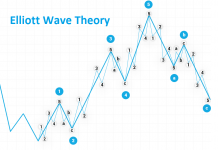

Strategy refers to classic trend definition which assumes that in bullish trend lows and highs are higher and higher and in bearish trend they are lower and lower. At the same time it assumes that trend lasts as long as the biggest trend correction is not retraced. Every piece of chart we can divide to smaller parts, thanks to it we can go from higher time frames to lower with coherent view on the chart.

The best method to set the trend is spotting lows and highs. We can do it for example with ZigZag indicator. However I prefer to do it by myself using trend line. This way it is easier to “feel” sentiment on the markets.

YOU CAN TRADE USING OVERBALANCE PRICE ACTION STRATEGY WITH FREE FXGROW ACCOUNT.

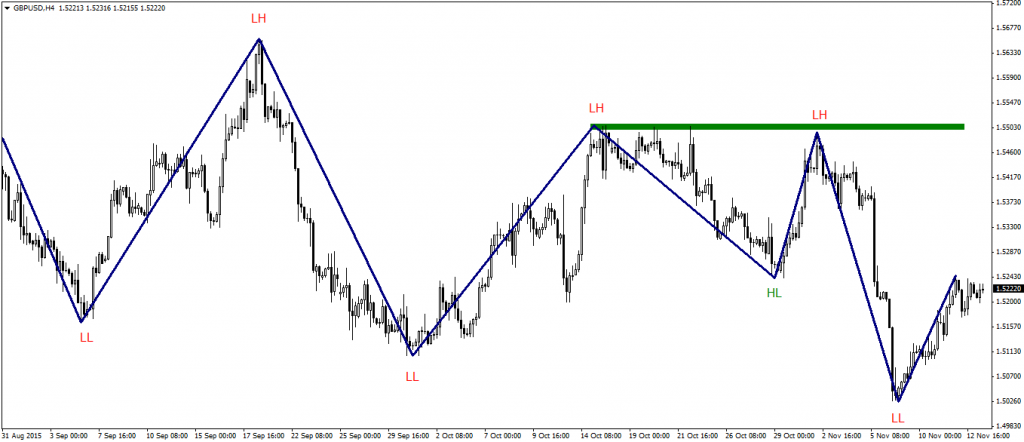

Then we mark highs and lows to understand in which trend we are currently.

- HH – higher high;

- HL – higher low;

- LH – lower high;

- LL – lower low.

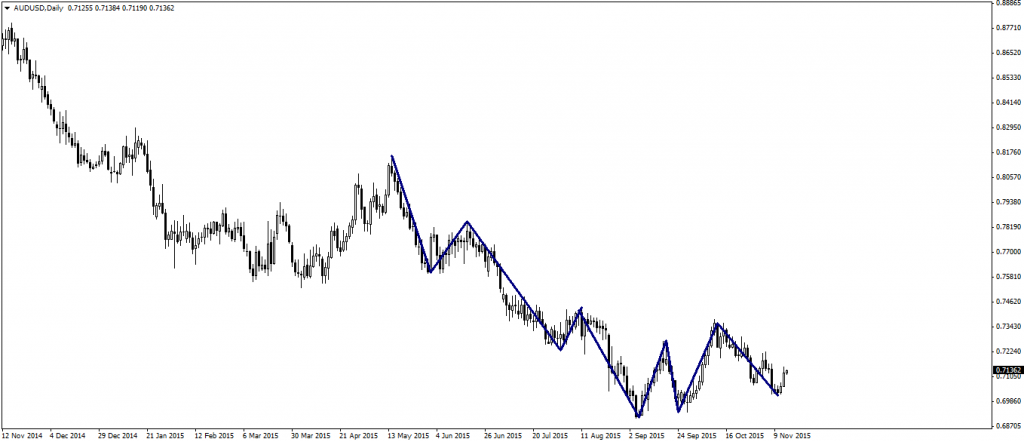

Overbalance

When we already marked levels we can use overbalance methods. It assumes that trend lasts as long as the biggest correction in trend is not retraced.

In the example below we are in bearish trend. Considering that we have to find the biggest correction here to set potential end of trend. To change the trend price must break the biggest correction. In case it isn’t break we believe trend still lasts.

Entering Position

There are two ways to enter position: in case of defending range of biggest correction in trend or in case of breaking it. In the first one we enter position if in the area of the biggest correction there will be any Price Action pattern, we set SL above correction range and TP in the beginning of it. This way RR is very effective for trader.

In the other case we take position when the biggest correction in trend is broken.

In this case we enter the trend with setting SL above/below high/low. In both cases expected move is few times higher than Stop Loss.

Capital Management

In this strategy we use classic capital management, we don’t open position with more than 1-2% of our equity.