[sc name=”Menu top ffb”]

- Previous part of tutorial: How to learn to trade Forex

- Next part of tutorial: Best time frame for Forex trading

There are questions that we hear a lot, so we decided to anwer to them in one place.

Naked trading and price action

You must try it at least once. As stated before, most indicators are calculated based on price. Yet, still many traders can’t read a single thing from a chart. It is all because they relay so heavy on indicators and do not put enough attention to price itself.

Goal here is to remove all indicators, all moving averages and other indicator from chart. You want chart to be naked. This way you can see clearly price action and make decisions based on price itself.

I have read about trader who uses indicators and other tools. Every few weeks he turns them off and trade only based on price action.

Why is that important? Thanks to naked trading you will learn much faster about price action. There are moments when it is crucial. You will get first signals from price and then, later, from indicators. Therefore, it is important to know how to spot signals which price gives you.

Fundamental vs technical analysis

It is a personal choice.

Only one advice here. Do not ignore the other side. If someone says that he is technical trader and do not look at fundamentals and news, then he is not someone you want to follow.

There are so many evidences that news can move the market. Many big players simply close all trades before important news, because market can be unpredictable.

I mostly use technical analysis, but I always start the day from checking news schedule for current day.

Good source for news and data? https://www.forexfactory.com.

Avoid magic trading systems!

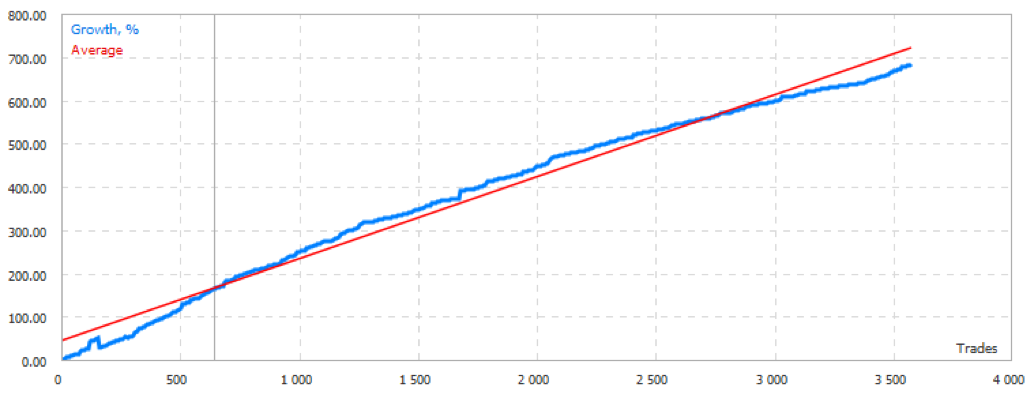

When you browse Internet looking for info about Forex, most likely you will see ads or reviews of some super automatic trading systems. In a description, you will see list of trades made on historical data even 10 years back:

Looks great. Where is a catch? These systems are optimized for historical data. On many times, you will see that possible drawdown is very big. It is because authors use very wide stop losses. This way many trades are closed eventually with profit, but when something goes wrong, you end up with huge loss.

Another way to con the system is to optimize robot for historical data. When you put that same robot in real live trading results are not so great anymore.

There is no magic automated system for 99$ or 999$. Forget about it. Work hard, learn, trade.

Forex major currency pairs

You can see a lot of pairs in your brokers offer, but four of them are most popular. Traders call them majors:

EUR/USD: The euro and the U.S. dollar.

USD/JPY: The U.S. dollar and the Japanese yen.

GBP/USD: The British pound sterling and the U.S. dollar.

USD/CHF: The U.S. dollar and the Swiss franc.

Which pair is best to trade?

I think that it is best to start with majors, because you have there the lowest spreads and best liquidity. Maybe without USD/CHF, because after Swiss central bank interventions it is not good pair to trade.

EUR/USD is still a good pair to trade; it is great both on lower time frames and on bigger ones.

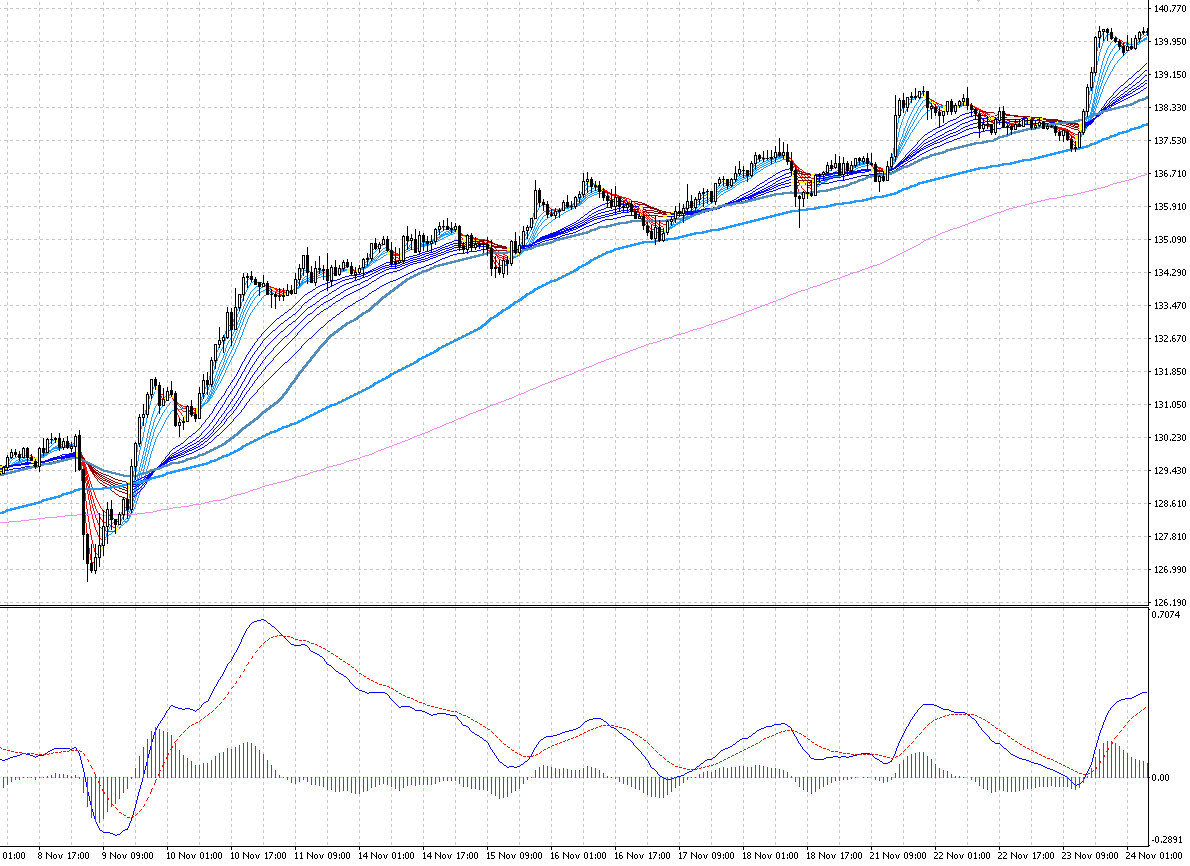

I also recommend to check Yen pairs, especially GBP/JPY. Here you can find many good trend moves, even on lower timeframes. On chart below there is 1-hour GBP/JPY chart. It took only couple of days for this pair to move more than 1300 pips up.

Other Yen pairs are also nice to trade.

Now, because of Brexit it is good to keep close eye on GBP pairs. Pound is generally getting weaker and weaker across the board. Thanks to that we can see here some strong moves both down and strong corrections up.

It is not recommended to trade on exotic pairs. There are two reasons for that:

- High spreads – costs of trading here can be very high

- Liquidity is not that good as on major pairs

Unless you have some long-term approach; maybe you are resident of that country. But stick to the most popular pairs.

How many pairs should you trade?

As a new trader, you should start with one pair. Why? Two or more pairs are hard to follow. Remember that you should check situation on few time frames to take a trade. With two or more pairs you will struggle to follow price actions. Select one pair. It is enough.

Every pair has its own characteristic. If you jump between pairs, you won’t notice this. Also, it is important to check situation on higher time frames. When you do that on many trading pairs, it is hard to follow price action for new traders.

Do I need 10 displays?

You probably saw photos of trade stations where traders have 4, 6 or even more displays. It is not necessary; you can easily start with your current setup.

So why traders use so many displays? Couple of reasons. They follow action on many pairs. They also follow news, check important levels on other time frames. Simply, it is much easier to do all that with few displays.

But if you start trading, don’t worry about that.

If you want to have more than one monitor, it is not that costly. You can buy a PC with graphic card which has two slots for displays or you can use SLI technology (more than one graphic card in one computer). Displays are also not expensive. You can buy a 24 inch display for around 150 – 200$; 32 inch displays are also rather cheap and cost around 400$.

- Previous part of tutorial: How to learn to trade Forex

- Next part of tutorial: Best time frame for Forex trading

[sc name=”menu_ffb”]