Financial authorities in Japan, particularly the Ministry of Finance and the Bank of Japan, in the wake of the yen’s depreciation, have issued statements in recent weeks designed to bolster the weakening national currency. These are so-called “verbal interventions.” The authorities do not want the currency to fall sharply and are using the comments to slow its decline.

However, at some stage, if the yen falls too far, there will be an actual intervention in the form of USD/JPY selling. There may be cross selling i.e. on crosses ( GBPJPY, EURJPY, CHFJPY), but most of the intervention will be on USD/JPY.

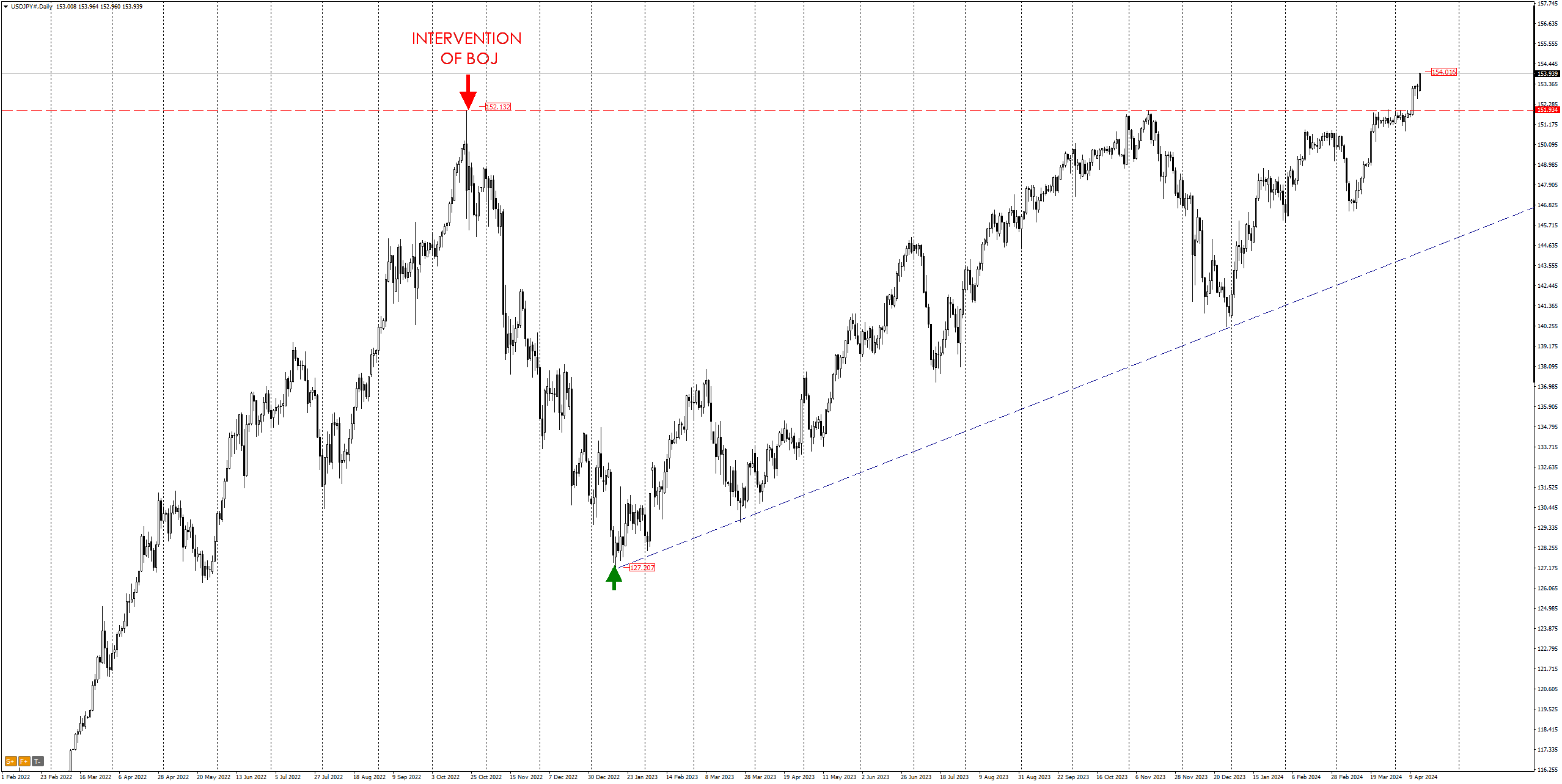

In October 2022, there was an intervention on the yen pairs, which caused nearly 12 weeks of declines of more than 2,500 pips. Prior to that, we had seen “verbal” actions by the BoJ aimed at stopping the weakening of the yen, until finally there was a proper intervention, as the market disregarded verbal interventions.

What foreshadows an intervention?

What can foreshadow that such an intervention will occur? History teaches us that we can distinguish several warning stages before the actual intervention takes place.

Based on previous currency interventions by the BoJ, there are four stages of language before actual intervention.

- Stage 1: Excessive and chaotic exchange rate movements are undesirable.

- Stage 2: We will closely monitor exchange rate movements.

- Stage 3: We will take specific actions if necessary.

- Phase 4: We have just carried out an intervention 🙂

Phase 1

Pay attention to words such as “undesirable,” “rapid” and “not reflecting fundamentals.” For example:

- sudden/rapid/rapid exchange rate movements are undesirable

- markets that do not reflect economic fundamentals are undesirable.

As an escalation of statements, beware of “unilateral,” “excessive” and “speculative movements.” For example:

- movements in the foreign exchange market are speculative

- The yen’s movements are speculative in nature

- The yen’s movements were one-sided, the moves were excessive

Phase 2

Further escalation is indicated by a warning of imminent action, and this is the time to prepare for actual intervention:

- does not rule out any options

- readiness to take action at any time

- we can carry out stealth intervention

- we are on standby

Phase 3

The next step is the so-called ” rate check.” This involves the Bank of Japan contacting foreign exchange dealers at banks and asking for USD/JPY transaction levels. The dealers give the bank a two-way price, a bid to buy and a bid to sell. This is a bit of a farce, because everyone knows what the purpose of the inquiries is, the BOJ intervenes, threatening to intervene. At this time, dealers will contact other banks and sell USD/JPY intensively, in effect “getting ahead” of the BOJ. This is what the BOJ wants to provoke, that is, a form of intervention with “someone else’s reserves” without buying the yen and selling USD from its own reserves.

Phase 4 and final – Intervention.

The next step is the actual selling of USD/JPY by the BOJ. This occurs after checking the rate, maybe after a week, maybe after a day, or maybe just after an hour. Instead of simply asking for a two-way price, i.e. checking the rate, the BOJ will obtain the price and then make a big deal on it, selling USD/JPY to the dealer. The bank dealer will then try to get out of the position as quickly and as well as he can, all the while trying to sell more than offered, because the BOJ is in the market, lowering USD/JPY and money can be made. The result is an avalanche of USD/JPY selling, strengthening the yen at the expense of the USD of other major currencies such as EUR, GBP, CHF.

Who will decide?

The Ministry of Finance (MOF) in Japan is responsible for formulating the country’s monetary policy, while the Bank of Japan (BOJ) is responsible for implementing such policy, particularly with regard to currency interventions.

The MOF may decide to intervene in the foreign exchange market if it believes (in the current situation) that the yen is too weak. When the MOF decides to intervene, it transmits instructions to the BOJ. The BOJ then conducts operations in the foreign exchange market (in the current situation) buying yen. The special account of the Foreign Exchange Fund (FEFSA), which is under the jurisdiction of the MOF, is used for intervention. It should be noted that in the current situation, when the BOJ buys yen, it taps into USD reserves to finance the other side of the transaction, buying USD (or other currencies if necessary).

BOJ operations are usually conducted through commercial banks, which conduct transactions in the foreign exchange market. These can be spot transactions or forward transactions to come. It should be noted that while the MOF has the ultimate authority to decide when to intervene, it does so in close consultation with the BOJ. The BOJ provides expertise and advice on monetary and financial market conditions that may affect the MOF’s decision. This cooperation reflects a balance between the roles of the two entities: The MOF as the government’s chief financial and economic advisor and the BOJ as the country’s central bank, which maintains the stability of the financial system.

Who will push the “red button” ?

And just who?…. is the gentleman in the photo….

Japan’s Deputy Minister of Finance for International Affairs Kanda. It is the Ministry of Finance that will instruct the Bank of Japan to intervene. And Kanda is the official in charge. Kanda is often referred to as “the man for intervention in the yen market,” or ” Japan’s most important currency diplomat.”

LIVE EDUCATION: Here you will find schedule of my live sessions:

Links: BASIC (beginners room) ADVANCED ROOM

Links: BASIC (beginners room) ADVANCED ROOM

The above analysis is based on the PA+MACD strategy, a detailed description of which you can read HERE . I will talk more about the PA+MACD strategy applied to these currency pairs during the live trading sessions, which you can attend from Monday to Friday.

More current analysis on the group : Trade with Dargo