Important central policy decisions will take center stage this week, and there will be several. The major central banks – the BOJ, the RBA, the Fed, the SNB and the BOE – will get into the action. This will make for an interesting week, to say the least. So let’s take a look at what could be the biggest impetus changing the market picture so far.

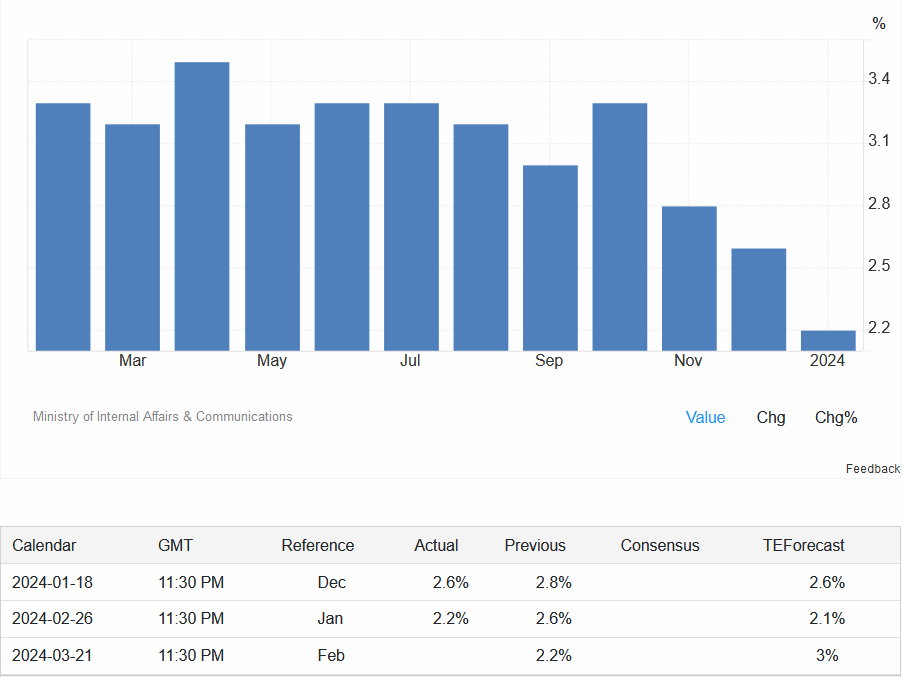

Although we will learn about the Fed decisions on Wednesday, uniquely this week all eyes will be on the central bank of Japan. Until recently, it seemed impossible for Japan to avoid deflation and for us to even discuss tightening monetary policy. But the covid-19 virus emerged and turned most of the world’s economies, including Japan’s, upside down. Paradoxically, the pandemic helped achieve the goal of taking the country out of deflation and into inflation.

Given all the reports and rumors, it is almost certain that tomorrow the BOJ will end the negative interest rate phase. Moreover, they are also likely to abandon the yield curve control (YCC) policy.

What about the USDJPY?

For the pair to fall much lower, it will also need some support in the form of lower US Treasury bond yields. During the past few weeks, US 10-year yields have risen from 4.10% to 4.30%, and the persistently wide gap between US10Y and Japan10Y, whose interest rate is just 0.76%, does not encourage yen buying.

From the technical side, the situation looks interesting. The price is inside a large symmetrical triangle. This is a bilateral formation – a breakout can occur in either direction with the same probability. However, when the breakout occurs, this direction is usually continued.

On the H4 chart we find an unfinished Head & Shoulders formation. If the price headed to the neckline (green) it could herald more declines after its eventual defeat. Tomorrow’s morning news from Japan could be the determining element for the further fate of the USDJPY pair in the longer term. For more live analysis, check out everyday’s live sessions and the Telegram group: https://t.me/TradewithDargo.

LIVE EDUCATION SESSIONS

This WEEK (18-22 March 2024 ) I am pleased to invite you to several online sessions. Below is the schedule of meetings:

Links: BASIC (beginners room) ADVANCED ROOM

Links: BASIC (beginners room) ADVANCED ROOM

The above analysis is based on the PA+MACD strategy, a detailed description of which you can read HERE . I will talk more about the PA+MACD strategy applied to these currency pairs during the live trading sessions, which you can attend from Monday to Friday.

More current analysis on the group : Trade with Dargo