When in June this year the British decided in a national referendum secession from the European Union, we knew that now history is created in front of our eyes. Nevertheless, the voice of the people is not sufficient to break the international agreements which bind the continental part of Europe with British Isles. To let the secession happen, it is necessary to run through the procedures described in Article 50 of the Treaty of Lisbon, signed in 2007.

“We decided to leave the European Union and become a fully independent state. We are not leaving the European Union only to give up control of immigration again,” she said Sunday. “We are going to be a fully independent, sovereign country—a country that is no longer part of a political union with supranational institutions that can override national parliaments and courts.” with these words Theresa May treated the gathered at the annual convention of the Conservative Party, which took place this weekend. In the same time we got to know the most likely date to start talks between London and Brussels on leave by the UK EU structures.

March 2017 – is the deadline to trigger Article 50 of the Treaty of Lisbon. This article is an introduction to the final leaving by UK the EU and states in the course of the whole procedure. According to the provisions of the Treaty, negotiations on the leaving can take up to two years. In the Treaty, however, we find legal record on a possible extension of the procedure with the consent of the European Parliament. It remains unknown, however, whether the Parliament will express such a wish, and judging by the previous statements of the most important European politicians – the chances are rather small.

Brexit will be a considerable challenge for the London-based Citi, which on secession can only lose. Many actors in the financial markets chose London because of its long tradition of financial centre of the world. Much more practical reason, however, is the possibility of expansion in the market of United Europe if you have a representative in one of the EU countries. London stock exchange already started to hedge against the final split on the line London-Brussels, leading discussions on merging with the largest continental financial centre in Frankfurt.

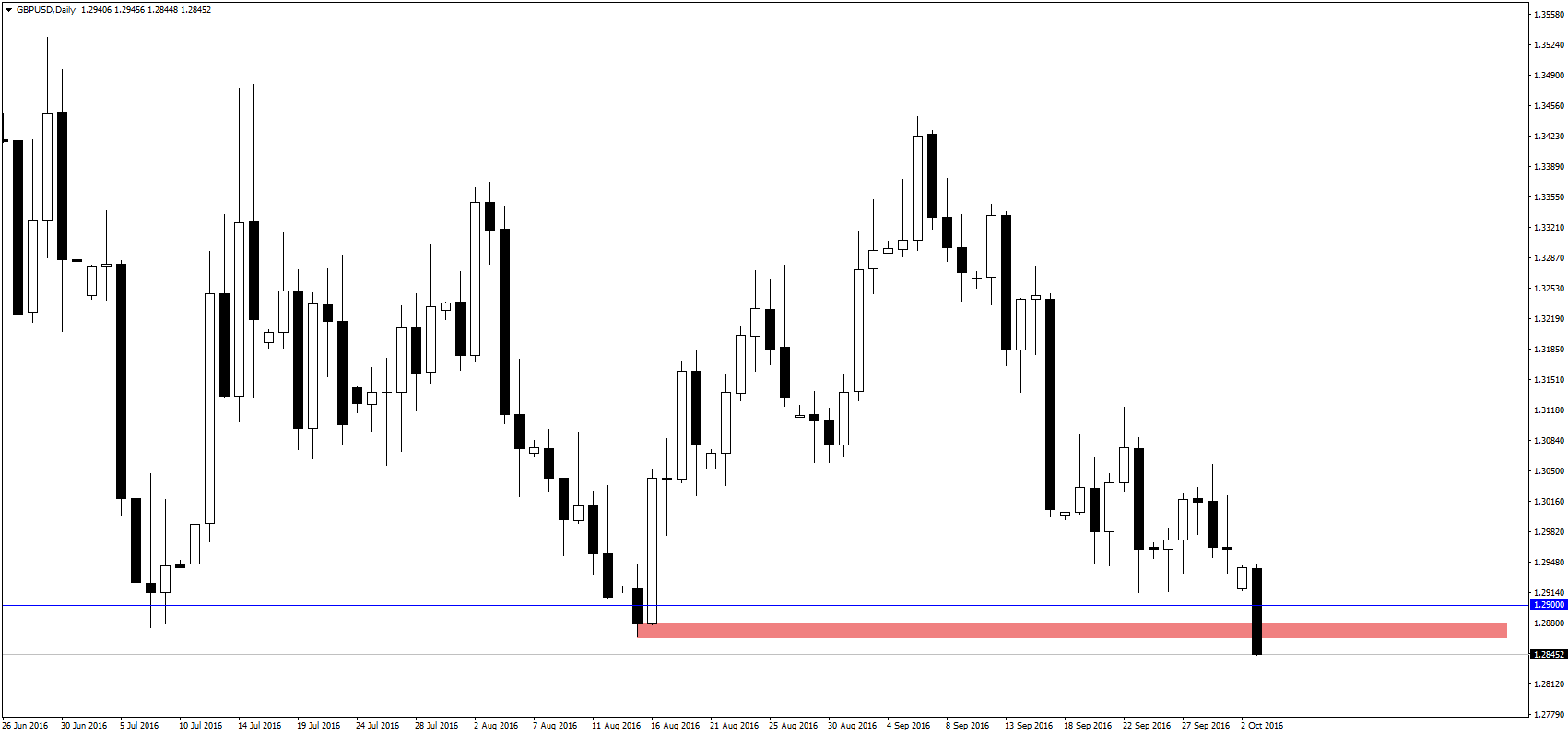

Pound from early morning is under selling pressure – GBPUSD once again falls below the level of 1.2900 and dangerously close to the multiannual minimum set in July of this year:

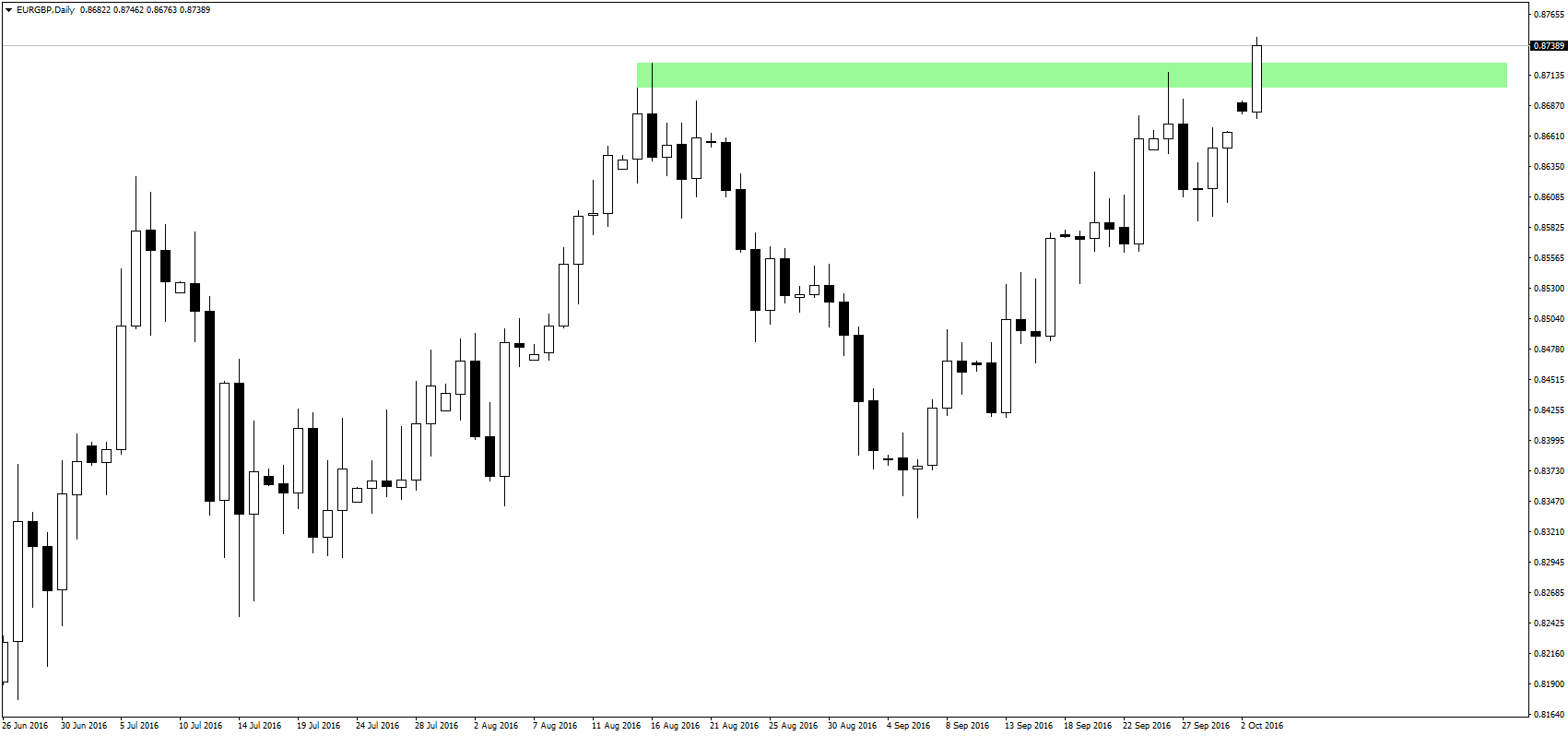

EURGBP creates another high: