Just after midnight (GMT) Reserve Bank of Australia shared with minutes of November’s monetary policy meeting. Bank members suggested again that too strong AUD will make rebound of local economy harder. Tuesday’s session is also full of important data- more details below!

Balanced RBA minutes

You can read full report here. Below we present the most important highlights:

- Inflation should come back to normal levels in the future

- Inflation expectations risk is “balanced”

- Economy can slow down in nearest months before further dynamic gains

- AUD gain will make another economic changes harder

- Unemployment rate should fall

- More stable situation on China limits bearish risk according global economic forecasts

Part of the analytics thins that Australia is too optimistic – we have to remember that inflation is bouncing off historical lows and further rates cuts are still possible . If there will be a plan of further loosening, it will probably happen in the next year.

At the same time we have to notice that Philip Lowe (RBA) will speak in Melbourne this morning. He will probably speak about low interest rates policy and inflation expectation – it can influence AUD.

After publication of minutes AUDUSD was stronger for some time however on D1 chart we cannot see many changes. More volatility there was in last week when pair decreased dynamiccaly to the levels from August and April. Currently 61.8% retracement of April-May decrease is tested from below.

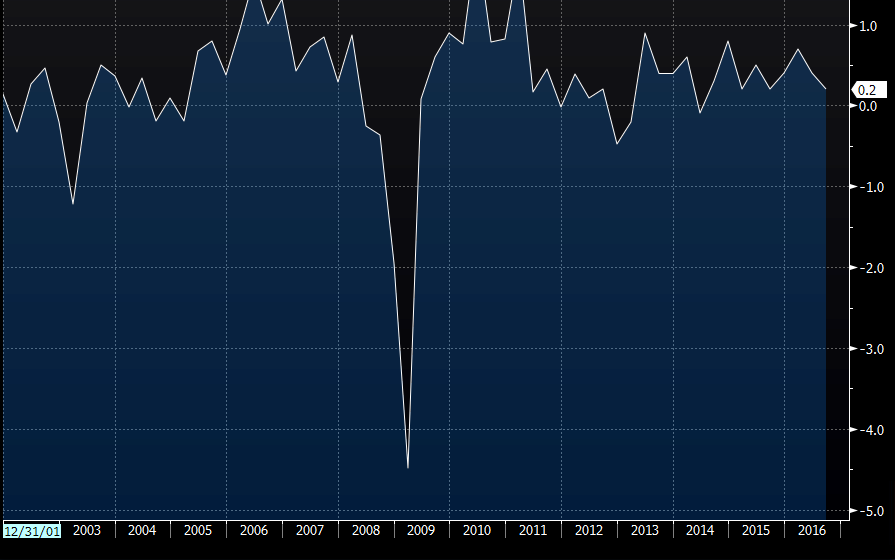

German GDP expectation a little lower than expected

In the morning markets got to know German GDP forecast for third quarter. It was a little worse than expected – 0.2% vs 0.3% exp, prior 0.4%.

What are we still waiting for?

- 10:00 (GMT) – ZEW Survey for Germany and Eurozone

- 10:00 – Eurozone GDP and trade balance

- 1:30 PM – US retail sales and import/export price indices

- 6:30 PM – New Zealand’s retail sales