Losing money is an “occupational hazard” of trading in financial markets. “Using” the experience is a useful lesson on becoming a better trader.

The key is obviously to make more win trades than loss trades.

Using a stop loss to limit losses as a vital action.

In theory a stop loss should be placed above or below (depending on your long or short position) an event which negates the reason the position was taken in the first place. The closer the stop is to the opening rate the less money is being risked but the more likely it is to be triggered.

Stop loss for breaking out of consolidation. There are two places to set the stop loss when the price breaks out of a consolidation. The position should be opened with pending orders Buy Stop or Sell Stop and SL should be either in the middle of earlier consolidation or on the other end of it.

A buy stop is an order where you buy above the market. This is as if you are short and closing a position but is in fact buying a breakout. The opposite is true of a sell stop.

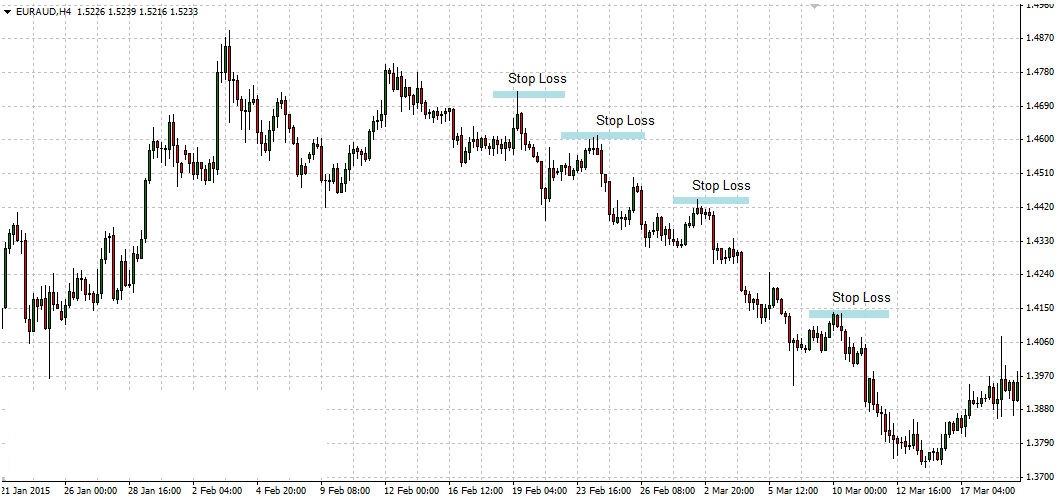

Stop loss for transaction consistent with trend. This type of trading is also called swing trading. Positions are opened during corrections and SL should be set above high of last correction (in case of bearish trend) or below last low (in case of bullish trend). Then we should move SL according to developing trend as you can see on the chart below.

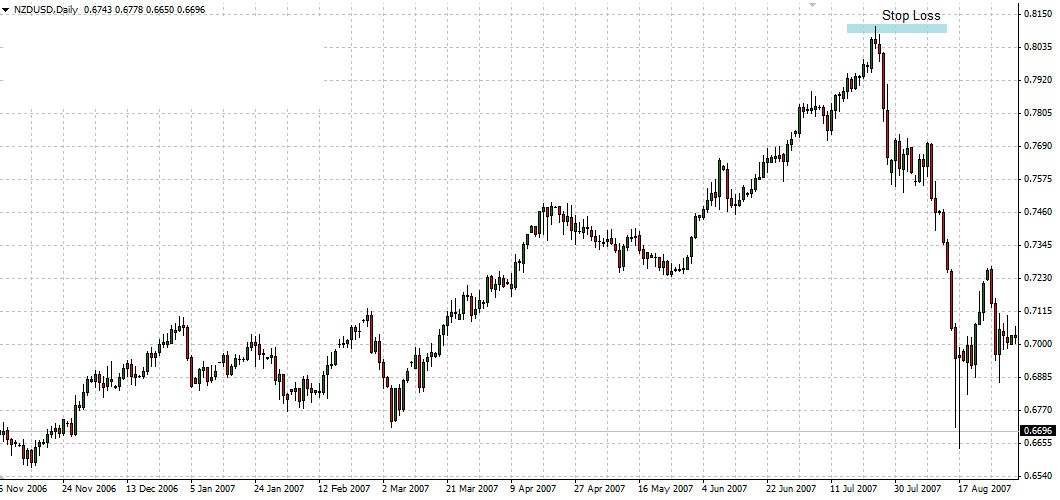

Stop loss for position opposite to the trend. Most of the times there should be clear pattern; double top, H&S etc. In the example below it would be pretty hard to open profitable position when betting on losses. If it would happen (maybe because of macro data), SL should be placed just above the top.

Subscribe to Elliott Waves International to get report for 2017!

More sophisticated ways to control losses:

- ATR (average true range). SL is 2x or 3x larger than ATR. That is to say that you set a stop at two or three times the average range that is seen during the period of observation.

- Margin Call. On the account you put only the money you are ready to lose. It should be 2-3% of all capital. In this case you should ensure that broker will not charge you additional debt.

![How to install MetaTrader 4 / 5 on MacOS Catalina? Simple way. [VIDEO]](https://comparic.com/wp-content/uploads/2020/07/mt4-os-218x150.jpg)